Why you should include Regency Centers (REG) in your portfolio

Regency Centers Corporation REG is one of the leading retail real estate investment trusts (REIT) in the United States. The company’s portfolio consists primarily of grocery stores and neighborhood centers that provide reliable customer traffic.

Last month, Regency Centers reported second-quarter 2024 NAREIT funds from operations (FFO) per share of $1.06, beating the Zacks Consensus Estimate of $1.02. The results reflected healthy leasing activity and year-over-year base rent improvement. The company also raised its 2024 guidance.

Analysts seem optimistic about this Zacks Rank #2 (Buy) company, with the Zacks Consensus Estimate for 2024 FFO per share being raised marginally to $4.22 last month.

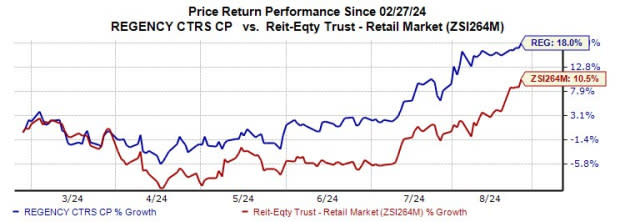

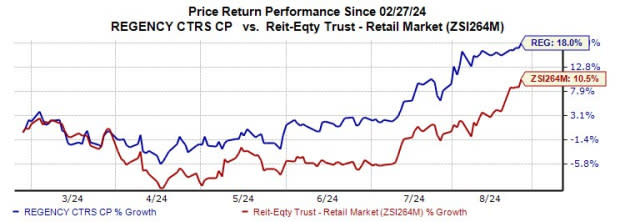

Over the past six months, shares of this retail REIT have risen 18 percent, compared to industry growth of 10.5 percent.

Image source: Zacks Investment Research

Factors that make Regency Centers a solid choice

Healthy leasing activity and improvement in base rent: Regency Centers’ premium shopping centers are located in affluent suburbs and close to urban commercial areas where consumers have high purchasing power, allowing them to attract the best grocers and retailers. The company’s focus on convenience, service, convenience and value retailers that meet the basic needs of communities gives it a strategic advantage.

Specifically, anchor tenants (tenants leasing space greater than or equal to 10,000 square feet) accounted for 42.5% (based on prorated ABR) of its portfolio as of June 30, 2024. Regency Centers signed approximately 2.2 million square feet of comparable new leases and renewals in the second quarter.

Regency Centers’ integrated rent increases were also an important factor in rental growth. In the second quarter, like-for-like base rents contributed 2.9% to like-for-like net operating income (NOI) growth.

Solid tenant base: In uncertain times, the grocery component has benefited retail REITs, and Regency Centers has numerous industry-leading grocers such as Publix, Kroger, Albertsons Company ACID, TJX Companies TJX, Inc. and Amazon/Whole Foods as tenants. The company has a high-quality portfolio of open-air shopping centers, with more than 80% of the stores focused on grocery stores. Six of the top 10 tenants are successful grocers.

Expansion efforts: To expand its portfolio, REG has undertaken acquisitions and development activities. Thanks to its prudent financial management, the company is well positioned to capitalize on growth opportunities.

In May 2024, the company acquired Compo Shopping Centers in the heart of Westport, Connecticut. The acquisition of this 7,000 square foot retail location is part of the company’s expansion efforts in the Northeast.

During the second quarter, REG launched approximately $40 million in new development and redevelopment projects, bringing the total number of project starts year-to-date through August 1, 2024 to $120 million. As of June 30, 2024, the estimated net project costs of Regency Centers’ ongoing development and redevelopment projects were $578 million.

Balance sheet strength: Regency Centers enjoys financial flexibility and is focused on continuing to strengthen its balance sheet position. This retail REIT had nearly $1.2 billion of capacity under its revolving credit facility and approximately $79.2 million in cash and equivalents as of June 30, 2024. As of the same date, its net debt and preferred stock to operating EBITDAre ratio was 5.3x, while its fixed cost coverage ratio was 4.4x. The company has a well-staggered debt maturity schedule and aims to have less than just under 15% of total debt maturing in any given year.

The Company also maintains a large pool of unencumbered assets, allowing it easy access to the secured and unsecured credit markets. As of June 30, 2024, 88.1% of its wholly owned real estate assets were unencumbered.

Stable dividend payments: Solid dividend payouts are the biggest attraction for REIT investors and Regency Centers is committed to increasing shareholder wealth. Over the past five years, the company has increased its dividend four times and its dividend has recorded a compound annual growth rate of 3.24%. Therefore, given its solid operating platform, growth potential and strong financial position relative to the industry, this dividend rate is expected to be sustainable over the long term.

Other stocks to consider

Other top stocks from the retail REIT sector are Brixmor Real Estate Group (BRX) and Phillips Edison & Company (PECO), all of which currently have a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brixmor Property Group’s FFO per share in 2024 has moved marginally higher over the past month to $2.13.

The Zacks Consensus Estimate for Phillips Edison & Company’s FFO per share in 2024 has increased marginally within the past month to $2.42.

Note: All earnings figures presented in this article represent FFO, a widely used metric to assess the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

The TJX Companies, Inc. (TJX): Free Stock Analysis Report

Albertsons Companies, Inc. (ACI): Free Stock Analysis Report

Regency Centers Corporation (REG): Free Stock Analysis Report

Brixmor Property Group Inc. (BRX): Free Stock Analysis Report

Phillips Edison & Company, Inc. (PECO): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research