FAR International Holdings Group Company Limited (HKG:2516) share price rises 119% as investors are less pessimistic than expected

Despite an already strong run, FAR International Holdings Group Company Limited (HKG:2516) shares have been on a tear, gaining 119% over the past 30 days. Long-term shareholders will be grateful for the recovery in the share price, as it is now virtually flat for the year following the recent upswing.

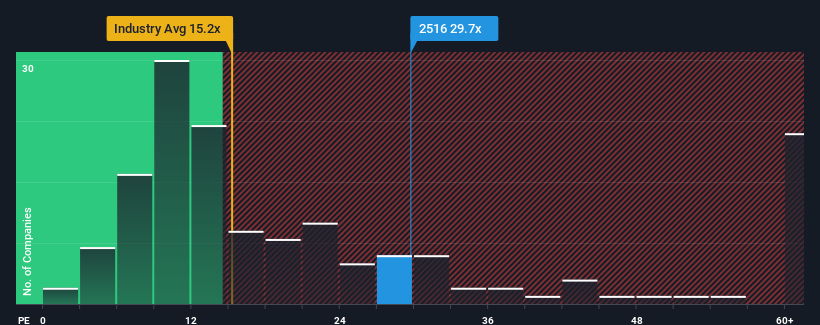

With the price rising sharply and nearly half of Hong Kong companies having a price-to-earnings (P/E) ratio of under 8x, you might want to consider FAR International Holdings Group, with its P/E ratio of 29.7x, a stock to avoid altogether. Still, we would have to dig a little deeper to determine if there is a rational basis for the sharply elevated P/E ratio.

The recent period has been quite beneficial for FAR International Holdings Group as its earnings have grown very strongly. The P/E ratio is probably so high because investors believe this strong earnings growth will be enough to outperform the broader market in the near future. If not, existing shareholders may be a little nervous about the profitability of the share price.

Check out our latest analysis for FAR International Holdings Group

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free FAR International Holdings Group earnings, revenue and cash flow report.

How is the FAR International Holdings Group growing?

To justify its P/E ratio, FAR International Holdings Group would have to deliver outstanding growth that significantly outperformed the market.

If we look at the earnings growth over the last year, the company saw a fantastic increase of 33%. However, this was not enough as the last three-year period as a whole saw a very unpleasant 99% decline in earnings per share. Therefore, it is fair to say that earnings growth has been undesirable for the company lately.

If you compare this medium-term earnings trend with the broader market’s one-year forecast of 21% growth, it’s not a pretty prospect.

Given this information, we find it concerning that FAR International Holdings Group is trading at a higher P/E than the market. It appears that many investors in the company are much more optimistic than its recent history would suggest, and are unwilling to offload their shares at any price. There is a very good chance that existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent negative growth rates.

The conclusion on the P/E ratio of the FAR International Holdings Group

The sharp rise in share price has also pushed FAR International Holdings Group’s P/E ratio to great heights. It is argued that the price-to-earnings ratio is a poor indicator of value in certain industries, but can be a strong indicator of business sentiment.

Our research into FAR International Holdings Group found that declining earnings over the medium term is not affecting the high P/E nearly as much as we would have expected given the market’s likely growth. When we see earnings declining and falling short of market forecasts, we suspect the share price could decline and the high P/E could fall. Unless medium-term conditions improve significantly, it is very difficult to accept these prices as reasonable.

Please note, however, FAR International Holdings Group shows 3 warning signals in our investment analysis, and two of them are somewhat worrying.

Naturally, You may also be able to find a better stock than FAR International Holdings Group. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.