GBA Holdings Limited (HKG:261) may have run too fast with the recent 34% share price drop

GBA Holdings Limited (HKG:261) Shareholders will not be happy to hear that the share price has had a very bad month, falling 34% and erasing the positive performance of the previous period. Looking at the bigger picture, even after that bad month, the stock is up 55% over the last year.

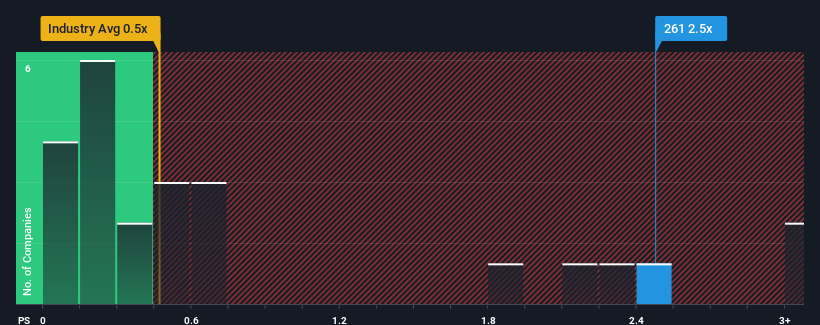

Although the price has dropped significantly, and almost half of the companies in Hong Kong’s communications industry have a price-to-sales ratio (or “P/S”) of less than 0.5x, you can still consider GBA Holdings, with its P/S ratio of 2.5x, as a stock not worth investigating. However, it is not advisable to simply take the P/S at face value, as there may be an explanation as to why it is so high.

Check out our latest analysis for GBA Holdings

What does GBA Holdings’ P/S mean for shareholders?

The recent period has been quite favorable for GBA Holdings as its revenue has grown very strongly. The P/S ratio is probably so high because investors believe that this strong revenue growth will be enough to outperform the entire industry in the near future. However, if this does not happen, investors could find themselves in a situation where they are overpaying for the stock.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on GBA Holdings will help you shed light on its historical performance.

Is sufficient sales growth forecast for GBA Holdings?

GBA Holdings’ price-to-sales ratio would be typical of a company expected to deliver very strong growth and, importantly, significantly outperform the industry.

First, if we look back, we see that the company managed to grow its revenue by an impressive 41% last year. However, this was not enough, as the company suffered an overall revenue decline of 80% over the last three-year period. Accordingly, shareholders were sobered about medium-term revenue growth rates.

In contrast to the company, the rest of the industry is expected to grow by 38% next year, which puts the company’s recent medium-term sales decline into perspective.

Given this information, we find it concerning that GBA Holdings is trading at a higher price-to-earnings ratio than the industry. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. Only the bravest would assume that these prices are sustainable, as a continuation of recent revenue trends will likely ultimately weigh heavily on the share price.

What can we learn from GBA Holdings’ P/S?

While GBA Holdings shares have suffered, its price-to-sales ratio remains high. Generally, we prefer to use the price-to-sales ratio only to determine what the market thinks about the overall health of a company.

Our research into GBA Holdings found that declining revenues over the medium term are not leading to a P/S ratio as low as we expected, as the industry is geared towards growth. When we see revenues declining and falling short of industry forecasts, we think a decline in the share price is very likely, bringing the P/S ratio back into the realm of reasonableness. Unless the circumstances of the recent medium-term performance improve, it would not be wrong to expect a difficult time for the company’s shareholders.

Before you take the next step, you should know about the 5 warning signs for GBA Holdings (3 are a bit unpleasant!) that we uncovered.

If you uncertain about the strength of GBA Holdings’ businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.