Vedant Fashions (NSE:MANYAVAR) pays less dividends than last year

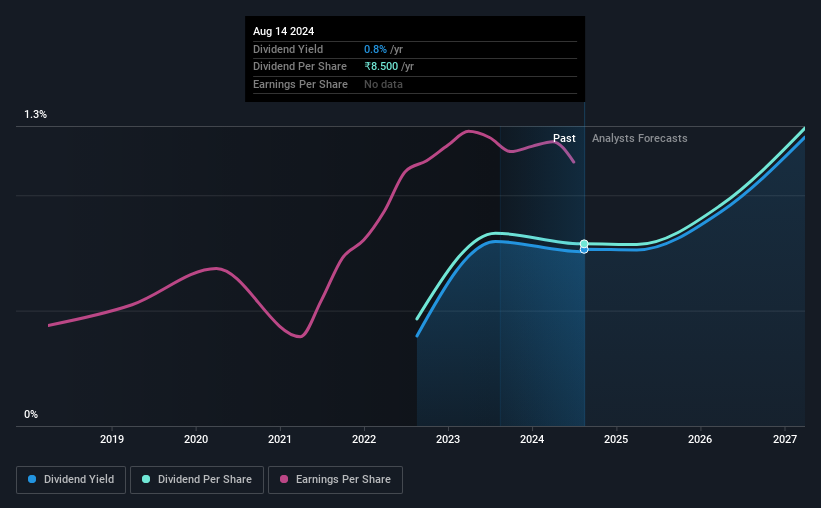

Vedant Fashions Limited (NSE:MANYAVAR) has announced that it will pay a dividend of ₹8.50 per cent on September 29, a reduction from the comparable dividend paid last year. However, the dividend yield of 0.8% is still a decent boost to shareholder returns.

Check out our latest analysis for Vedant Fashions

Vedant Fashions’ payment shows solid earnings coverage

We like to see solid dividend yields, but that doesn’t matter if the payment isn’t sustainable. Based on the last payment, Vedant Fashions earned comfortably enough to cover the dividend. That suggests a fairly large portion of the profits are being reinvested into the business.

Next year, EPS is expected to grow by 66.1%. If the dividend stays on this path, the payout ratio could be 42% next year, which we believe can be quite sustainable going forward.

Vedant Fashions does not have a long payment history

The company has been paying a consistent dividend for a few years, but we’d like to see a longer track record before relying on it. As of 2022, the annual payment was ₹5.00 then, compared to the last full-year payment of ₹8.50. That means payouts have grown 30% annually during that time. Vedant Fashions has been increasing its dividend quite quickly, which is exciting. However, the short payment history makes us doubt whether this performance will continue over a full market cycle.

The dividend is likely to increase

Investors in the company will be happy to see dividends being paid out for some time. Vedant Fashions has impressed us with EPS growth of 17% per year over the past five years. Shareholders are getting a lot of the profits back, which combined with the strong growth makes this quite attractive.

We are really excited about Vedant Fashions’ dividend

Generally speaking, we don’t like to see dividend cuts, especially when the company has as much potential as Vedant Fashions. Cutting the dividend takes pressure off the balance sheet, which could help keep the dividend consistent going forward. All in all, this ticks many of the boxes we look for when selecting a dividend stock.

Market movements show how much a consistent dividend policy is valued compared to a more unpredictable one. However, investors need to consider a number of other factors besides dividend payments when analyzing a company. For example, we have picked out the following: 1 warning sign for Vedant Fashions investors should consider. Is Vedant Fashions not quite the opportunity you have been looking for? Check out our Selection of the highest dividend stocks.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.