This weight loss stock is up 74% so far this year and is about to crash

Weight loss drugs such as Ozempic, Wegovy, Mounjaro and Zepbound are conquering the pharmaceutical industry. While Eli Lilly And Novo Nordisk are major players in diabetes and obesity treatment thanks to their glucagon-like peptide-1 (GLP-1) agonists, but many companies are striving to outdo the industry giants.

Most competitors are investing considerable sums in research and development to bring their own GLP-1 drugs onto the market.

A company that recently entered the weight loss space without a novel drug of its own telemedicine company Health for you and him (NYSE:HIMS)Rather than producing an alternative to existing treatments, Hims & Hers entered the weight loss race through the back door by offering patients compounded versions of Ozempic and its sister treatments.

I consider this strategy not only controversial, but also one that could bring major disadvantages for the company.

What are compounded weight loss medications?

Have you ever been in a big city where vendors on the sidewalks sell fake designer handbags and clothing that look exactly like the items sold in the store?

The difference between these lower-cost alternatives and what’s sold in a branded store is that these reproductions are likely made from lower-quality materials and may not last as long as the original. There is no major company behind the products with its deep pockets and shiny brand name.

The concept of compounded drugs is similar.

The main ingredient in Ozempic and Wegovy is called semaglutide. Novo Nordisk owns a lot of intellectual property (IP) around the specific chemical composition of semaglutide. This makes it almost impossible to copy the drug at the molecular level.

In weight loss drugs, semaglutide blend may contain ingredients that are tested in research but never make it into the final FDA-approved version of a drug – possibly for safety reasons.

The FDA points out: “Compound drugs are not approved by the FDA. This means that the FDA does not review the safety, effectiveness, or quality of compounded drugs before they are marketed.”

Why does Hims & Hers do this?

Ozempic, Mounjaro and their sister drugs are expensive – there’s no doubt about that. Common GLP-1 agonists can cost you nearly $1,000 a month if your insurance doesn’t cover the cost.

According to Hims & Hers’ website, the company’s rationale for offering compounded GLP-1 injections is to provide customers with access to “medications containing the same active ingredient as Ozempic® and Wegovy® without the shortages and costs that currently limit access to the brand-name drugs.”

It’s no secret that people do unusual things to lose weight, yet I believe Him & Hers is trying to bolster its business by capitalizing on a theme known as “body politics” rather than providing top-notch healthcare.

Saying that their compounded semaglutide contains the same active ingredient as Ozempic and Wegovy is like wearing two different shoes but saying they are the same because they both have laces. Taking a compounded semaglutide is nowhere near the equivalent of Ozempic or Wegovy and is a largely unregulated product.

And the shortages that are driving people to compounded GLP-1 agonists may not last forever. Earlier this year, Novo spent $16.5 billion to build several manufacturing facilities of CatalantThe sole reason for this deal was to expand existing manufacturing capacity and increase production for Ozempic and Wegovy.

Lilly followed this pattern with an acquisition of its own. In April, Lilly acquired an injectable drug manufacturing facility from Nexus Pharmaceuticals to increase supply of Mounjaro and Zepbound.

I caution investors against buying into the idea that Hims & Hers will save the day because Eli Lilly and Novo Nordisk are failing to meet supply and demand dynamics.

Why I predict a downward spiral

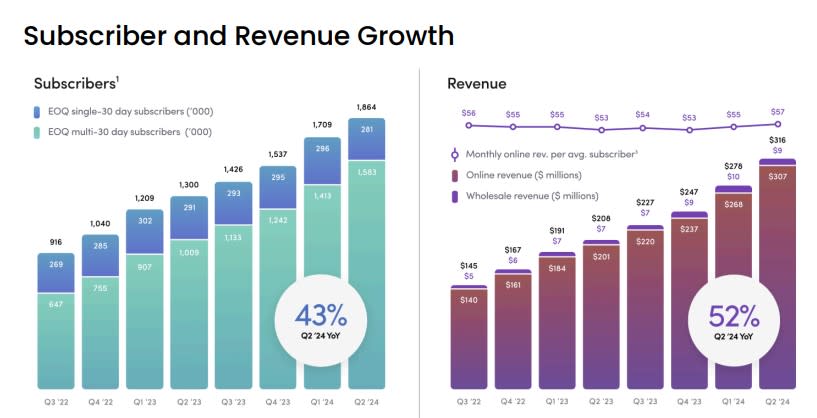

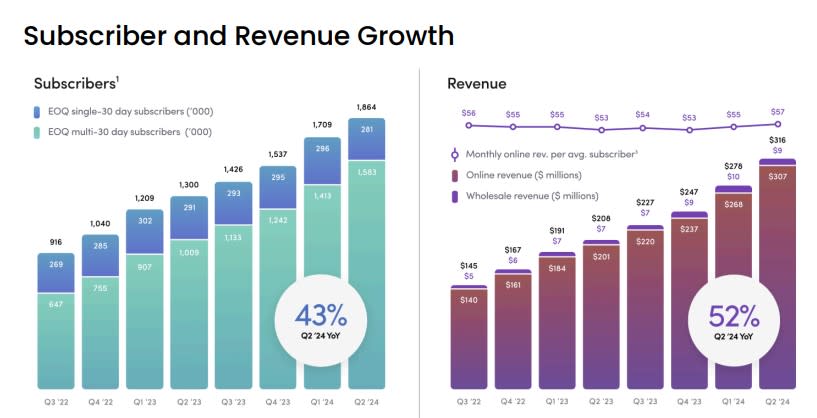

So far in 2024, Hims & Hers stock has risen 74%, exceeding the S&P500 And Nasdaq-Composite. I think these gains are largely due to the impressive growth of the company’s subscription business.

While the trends in the charts above indicate that Hims & Hers has been successful in attracting and retaining subscribers, I believe the company’s entry into the compounded semaglutide space will backfire.

The FDA warns that a major risk associated with compounded GLP-1 preparations is dosing errors “because patients measure and self-administer incorrect doses of the drug or because healthcare professionals incorrectly calculate the dose of the drug.”

If patients taking Hims & Hers’ semaglutide were to experience significant health problems, the company could find itself at the center of a public relations nightmare and could very well face lawsuits or even fines from the Department of Justice.

Although Lilly and Novo’s share prices have risen significantly over the past year, both companies appear to have a robust long-term roadmap ahead of them – suggesting that further gains are in the offing for patient investors.

More daring investors might want to look at a number of alternatives to Lilly and Novo that actually invest a lot of time and capital into drug development. But right now, I see too many risks with Hims & Hers and think the company has simply taken on too much at the expense of potential near-term growth.

Investors looking to gain exposure to the weight loss space should best consider positions in larger players with established presences and avoid speculative opportunities like Hims & Hers.

Should you invest $1,000 in Hims & Hers Health now?

Before you buy Hims & Hers Health stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and Hims & Hers Health wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $723,545!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Prediction: This weight-loss stock is up 74% so far this year and is about to crash. Originally published by The Motley Fool