Rental costs in New Hampshire continued to rise in early 2024, impacting renters’ household budgets

DOWNLOAD THIS BLOG PDF

New data collected earlier this year shows that rental costs in New Hampshire continue to rise, putting pressure on the overall housing supply and finances of renters in the Granite State. The median price for a rental apartment in New Hampshire reached a record high of $1,691 in 2024. In addition, the median price for a single-family home in the state rose to $530,000 in July 2024, the highest level ever. Rising housing costs and limited supply can create barriers to safe and affordable housing for Granite State families and individuals, and add further challenges related to transportation and access to services. Rising costs for both renters and homeowners have contributed to the difficulties faced by households across the state, particularly among low- and moderate-income renters. To make matters worse, renters may struggle to pay the rising cost of living and may be less likely to enter the housing market to purchase a home.

Higher costs across the state

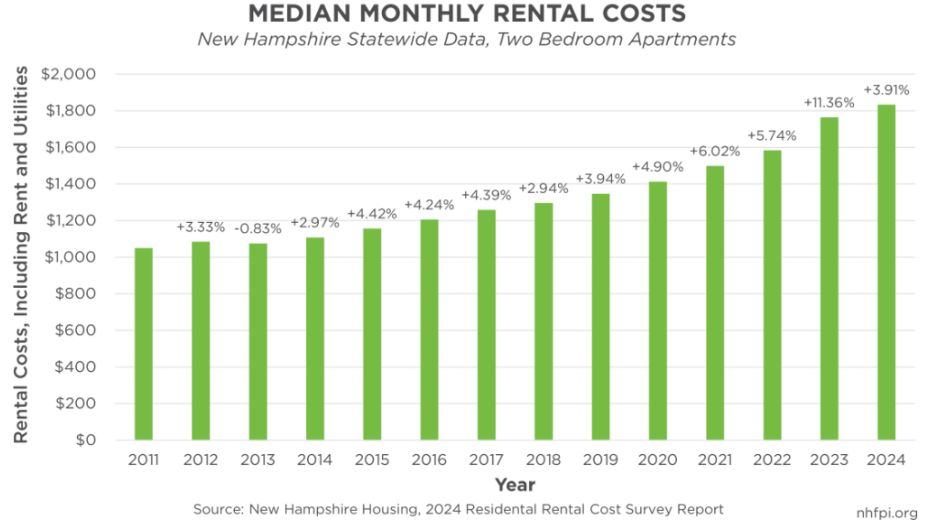

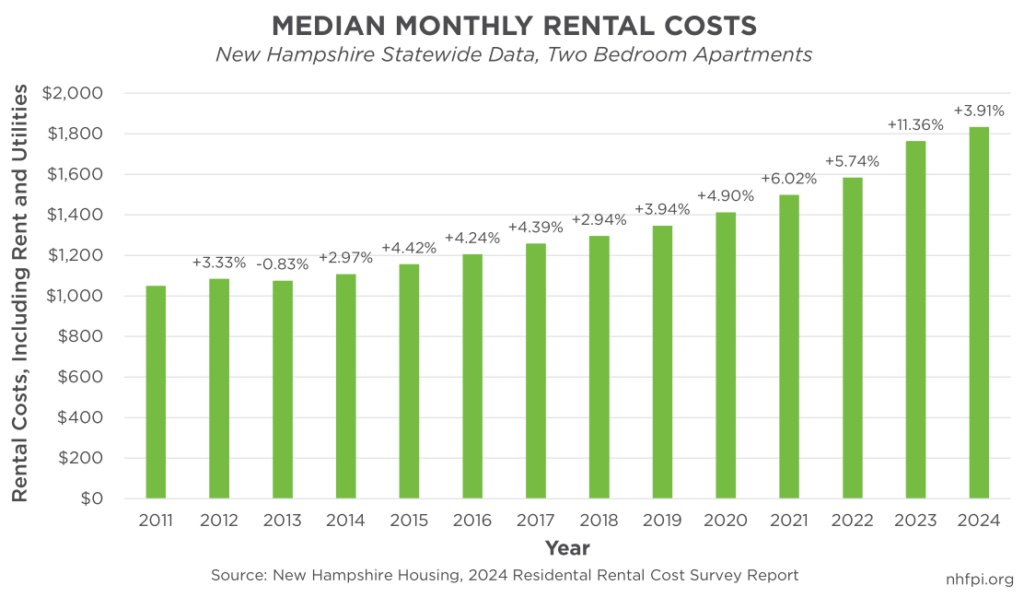

According to the 2024 Residential Rental Cost Survey Report, based on data collected between March and May 2024 and released by New Hampshire Housing, the state’s housing finance agency, the median monthly rent for all rental units in the Granite State, including utilities, was $1,691. For a two-bedroom unit, the median cost was $1,833 per month, representing an annual increase of about 3.9 percent starting in 2023 and slightly higher than the average annual inflation of 3.3 percent faced by New England consumers overall during that period.

While rental prices have been rising since 2014, the increase in costs slowed between 2023 and 2024 compared to the year-on-year change in the previous year. From 2022 to 2023, the median monthly rent for a two-bedroom apartment increased by about 11.4 percent, partly due to increased utility costs. In 2024, the median utility cost for a two-bedroom apartment where the renter pays for heat was $266 per month, a decrease of about 15.6 percent from the median cost of $315 in 2023. The decreased utility costs in 2024 may explain the smaller increase in total monthly rental costs relative to the change in total costs from 2022 to 2023.

Rent prices in the Granite State have risen rapidly since the COVID-19 pandemic began. In 2019, a two-bedroom apartment cost $1,347 a month, which has increased by about 31 percent through 2024. Declining rental availability just before the pandemic began is likely a major factor influencing price increases in recent years. After rising to 1.8 percent in 2020, the vacancy rate for two-bedroom rentals fell to 0.6 percent in 2021. Although the rate has fluctuated every year since then, the vacancy rate for a two-bedroom apartment in 2023 (0.6 percent) remained lower than the pre-pandemic level in 2019 (0.8 percent). According to New Hampshire Housing, the vacancy rate needed for a balanced rental market is 5 percent, which was last reached for rentals statewide in 2010.

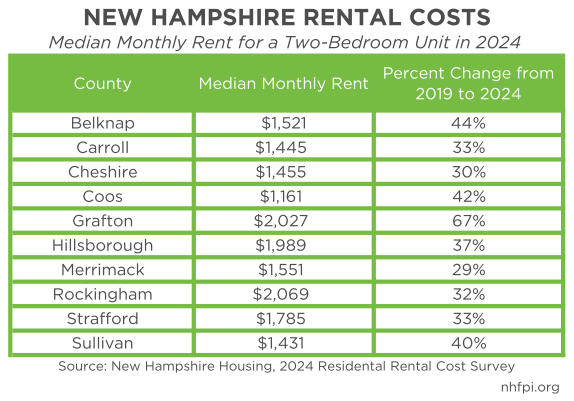

Regional differences in housing supply and demand affect the average monthly rental cost. The median price for a two-bedroom apartment in 2024 ranged from the highest price of $2,069 per month in Rockingham County to $1,161 per month in Coos County. In Coos, Carroll, Cheshire and Sullivan counties, the average rental cost for a two-bedroom apartment was under $1,500 per month, and the state’s remaining six counties all had higher prices. While rental costs have increased in all 10 counties, the increases have been unevenly distributed across the state. From 2019 to 2024, the median price for a two-bedroom apartment in Grafton County rose about 67 percent, the largest percentage increase of any county. According to New Hampshire Housing, rising costs in Grafton County were driven by rents in the Lebanon and Plymouth areas. In comparison, Merrimack County saw the smallest percentage increase of about 29 percent during that time period. Rising rental costs in certain parts of the state can impact the housing situation of families, which in turn impacts the availability of necessary resources such as child care and healthcare. In addition, higher housing costs can discourage individuals and families from moving to certain areas to find jobs, leading to labor shortages.

Impact of the current rental market

Rising housing costs increased the financial burden on low- and middle-income Granite Staters. In 2022, the median household income of homeowners in the state was nearly double that of renters, at about $108,000 and about $56,000, respectively. According to New Hampshire Housing, in 2024, only about 24 percent of rental housing was affordable to those earning the median renter household income of $56,814. Based on wage data analyzed by New Hampshire Housing, of 11 selected high-demand occupations, only nurses had a median wage sufficient to afford the rent and utilities for a two-bedroom apartment in the state. In addition, public school teachers and electricians were the only occupations that could afford a one-bedroom apartment based on the median wage, while all other high-demand occupations, such as nursing assistants and construction workers, earned a median monthly wage below the median price of a one-bedroom apartment. Renters are also more likely to pay more than 30 percent of their income on housing costs. This amount is defined by the U.S. Department of Housing and Urban Development as the housing cost burden and serves as a simple but reliable measure of affordability. According to U.S. Census Bureau data from 2018 to 2022, nearly half of renters in the Granite State were housing price burdened. Among those with household incomes of less than $35,000, about three-quarters paid more than 30 percent of their income on rent.

The increased housing costs may be linked to the increase in eviction filings across the state, as more low-income families in New Hampshire may struggle to pay their rent. According to Princeton University’s Eviction Lab, about 4.3 eviction filings were filed for every 100 renter households in the Granite State in 2018. That rate was more than double that of neighboring Vermont (2.1) and also higher than Maine (2.8) and Massachusetts (3.5) that year. The total number of eviction filings in New Hampshire increased about 66 percent from 3,742 filings in 2020, which included a temporary eviction moratorium in New Hampshire followed by state-funded rental assistance, to 6,221 in 2023. The 2023 total was similar to pre-pandemic numbers in 2019 (6,514 filings). The increase in evictions may have contributed to the rise in homelessness. From January 2022 to January 2023, the number of homeless people in New Hampshire increased by about 52 percent, according to estimates by the U.S. Department of Housing and Urban Development.

The increase in prices across the rental market is not unrelated to the challenges the housing market is experiencing overall. According to the New Hampshire Association of Realtors, the median price for a single-family home in New Hampshire was $530,000 in July 2024, a 76.7 percent increase from the median price of $300,000 in July 2019. According to Harvard University’s Joint Center for Housing Studies, a family purchasing a home in Hillsborough County would need to have an annual income of about $156,000 to afford a median-priced home. A median-income family that could have afforded a home in 2019 may struggle to buy one in 2024. In addition, due to the limited availability of single-family homes, households that can afford a home may have to stay in rentals longer, potentially resulting in fewer rental homes available for families and individuals who cannot afford to purchase a home. As the average price of single-family homes continues to rise, low- and middle-income renters in the Granite State will likely struggle to keep up with rising housing costs.

– Jessica Williams, political analyst