Redfin is up 50% so far in August – but here are 4 reasons why it could still be a good stock to buy now

Real estate technology company Redfin (NASDAQ: RDF) has taken investors on quite a rollercoaster ride. After losing more than 95% of its highs following the housing market slowdown in 2022, the stock has more than tripled from the lows and is up more than 50% in recent weeks.

However, since Redfin still trades at a relatively small market cap ($1.3 billion) and there are several big catalysts that could help the business over the next few years, it could still be a great stock to buy and hold for the long term.

1. Management is fully focused on profit

As Redfin’s management has correctly noted, the real estate market has been terrible over the past few years. But the company has positioned itself well for future success by focusing on efficiency and profitability.

To name just a few recent stats, Redfin’s trailing-12-month adjusted EBITDA loss narrowed from $145 million in the first quarter of 2023 to $33 million last quarter. Gross margin improved 70 basis points over the past year. And while the core real estate services business is not currently profitable (which is understandable in a weak market), the rental and mortgage businesses both are.

2. Tailwind from interest rates

Falling interest rates should be a large Catalyst for Redfin’s business for several reasons. In fact, it was the recent shift in expectations about the pace and timing of the Federal Reserve’s rate cuts that drove the stock price higher in recent weeks.

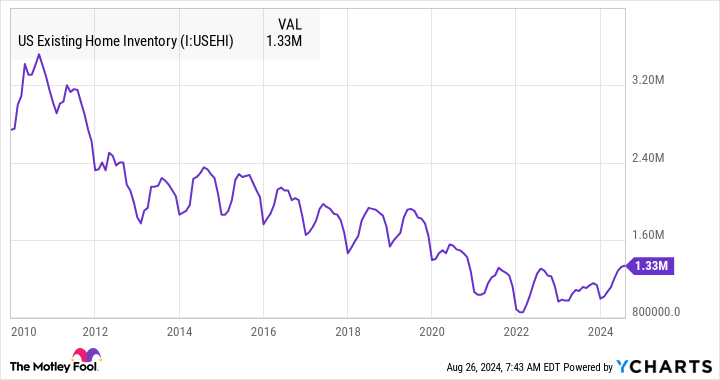

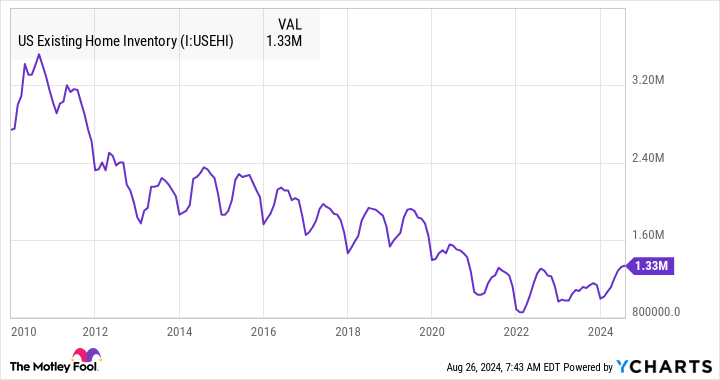

The main reason (I’ll get to others later) is that falling interest rates could thaw the housing market in the U.S. Existing home inventories are near generational lows as homeowners are hesitant to sell their homes with low mortgage rates. If mortgage rates were to fall to 5%, that could change.

While Redfin agents certainly handle both sides of home sales transactions, the company positions itself as the most cost-effective way to sell a home. If existing home sales pick up, that could be a big tailwind for Redfin’s business.

3. NAR processing

The National Association of Realtors and several leading brokerage firms have reached an agreement that recently went into effect. In short, it brings big changes to how real estate agents are paid and the level of price transparency required.

This could be a big deal for traditional agents. Sellers have traditionally covered commissions for both the buyer’s and seller’s agents, but now buyer’s agent commissions must be negotiated directly between homebuyers and their agents. And on both sides, the settlement makes buyers and sellers much more fee-conscious than ever before.

While this could hurt traditional real estate agents, it could be a net positive for Redfin. Since Redfin is the only major broker looking to disrupt the traditional pricing structure, price-conscious consumers could flock to Redfin’s platform in this environment.

4. Pent-up housing demand

Increased mortgage rates not only deter potential sellers from purchasing their homes. They also deter potential buyers from purchasing a home.

I would argue that a drop in mortgage rates from current levels in the 6.5% range to around 5% would have a far greater impact on the market than a price drop of, say, 10%.

Think of it this way: If you want to buy a $500,000 home with a 6.5% mortgage rate and a 20% down payment, you’ll pay $2,528 per month in principal and interest. If the interest rate stayed the same but the home price dropped 10% to $450,000, your payment would drop to $2,275. On the other hand, if the price stayed the same but your interest rate dropped to 5%, the monthly payment would be $2,147.

In short, if interest rates fall, this could large Impact on home affordability and could lead to an influx of buyers into the market.

No low-risk stock

On the one hand, there are some good reasons why investors should still consider Redfin even after the recent rally. On the other hand, it’s important to point out that Redfin is still a rather speculative stock. The company is not yet a profitable business and a lot still needs to go right to achieve consistent profitability – especially to a degree that would justify a significantly higher valuation.

Of course, I own Redfin stock and am convinced that the company’s best days are still ahead of it. But that’s by no means a certainty, and even if things go well, I expect there to be quite a bit of volatility.

Should you invest $1,000 in Redfin now?

Before you buy Redfin stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors looking to buy now… and Redfin wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $774,894!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Matt Frankel has a position in Redfin. The Motley Fool has a position in Redfin and recommends it. The Motley Fool recommends the following options: short August 2024 $11 calls on Redfin. The Motley Fool has a disclosure policy.

Redfin is up 50% so far in August — but here are 4 reasons it could still be a good stock to buy now. Originally published by The Motley Fool