For this reason, the compensation of the CEO of Far East Hotels and Entertainment Limited (HKG:37) appears appropriate

Key findings

- Far East Hotels and Entertainment will hold its Annual General Meeting on September 2nd

- CEO Derek Chiu’s total compensation includes a salary of HK$706.9 thousand

- Total compensation is 64% below the industry average

- Far East Hotels and Entertainment’s total shareholder return over the past three years was 300%, while earnings per share declined 76% over the past three years.

Shareholders may be wondering what CEO Derek Chiu intends to do to reverse the less than stellar performance of Far East Hotels and Entertainment Limited (HKG:37) recently. They will have the opportunity to exercise their voting rights to influence the future direction of the company at the next AGM on September 2nd. Setting appropriate executive compensation in line with shareholders’ interests can also be a way to influence the company’s performance in the long term. We’ve put together some analysis below to show that CEO compensation appears appropriate.

Check out our latest analysis for Far East Hotels & Entertainment

How does Derek Chiu’s total compensation compare to other companies in the industry?

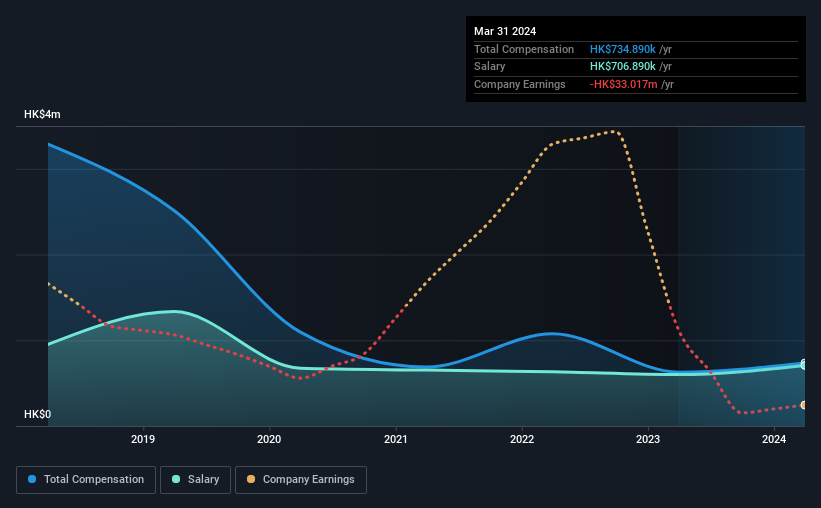

At the time of writing, our data shows that Far East Hotels and Entertainment Limited has a market capitalization of HK$391 million and reported total annual CEO compensation of HK$735k for the year to March 2024. That’s a notable year-over-year increase of 17%. We note that the salary portion of HK$706,900 makes up the largest portion of the CEO’s total compensation.

For comparison, other companies in the hotel industry in Hong Kong with a market capitalization of less than HK$1.6 billion reported an average total CEO compensation of HK$2.0 million. In other words, Far East Hotels and Entertainment pays its CEO less than the industry average. In addition, Derek Chiu directly owns HK$95 million worth of shares in the company, meaning he is heavily invested in the company’s success.

| component | 2024 | 2023 | Share (2024) |

| Salary | HK$707,000 | HK$600,000 | 96% |

| Other | HK$28,000 | HK$28,000 | 4% |

| Total compensation | HK$735,000 | HK$628,000 | 100% |

At an industry level, total compensation is approximately 87% salary and 13% other compensation. Far East Hotels and Entertainment has taken a largely traditional route, paying Derek Chiu a high salary that prioritizes him over non-salary benefits. If total compensation leans more toward salary, it suggests that the variable portion – which is generally tied to performance – is lower.

A look at the growth figures of Far East Hotels and Entertainment Limited

Over the past three years, Far East Hotels and Entertainment Limited’s earnings per share have declined 76% annually. Revenue fell 20% last year.

The decline in earnings per share is a little concerning. To make matters worse, revenue actually fell year-on-year. So, given this relatively weak performance, shareholders probably wouldn’t want to see high compensation for the CEO. We don’t have analyst forecasts, but you can get a better picture of growth by looking at this more detailed historical graph of earnings, revenue and cash flow.

Was Far East Hotels and Entertainment Limited a good investment?

Most shareholders would probably be happy if Far East Hotels and Entertainment Limited delivered a total return of 300% over three years, so some may believe the CEO should be earning more than is typical for companies of a similar size.

In summary…

Far East Hotels and Entertainment pays its CEO the majority of his compensation as a salary. Despite the strong returns on shareholder investments, we are skeptical that the stock will maintain its current momentum given that earnings have not grown. Shareholders should question the board about these concerns and reconsider their investment thesis for the company.

A CEO’s compensation can have a massive impact on performance, but it is only one element. We have researched and found 2 warning signs for Far East Hotels and Entertainment which investors should deal with in the future.

Important NOTE: Far East Hotels and Entertainment is an exciting stock, but we understand that investors are looking for an unencumbered balance sheet and high yields. You may find something better in this list of interesting companies with high return on equity and low debt.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.