Why you should add AES to your portfolio now

The AES Corporation AES is a global energy company. Its strategic investments in expanding its clean energy production capacity and building new generation, transmission and distribution projects are likely to enhance its performance. Given its growth opportunities, AES is a solid investment option in the utility sector.

The company currently has a Zacks Rank #2 (Buy). Let’s look at the factors driving the stock.

Growth forecasts and surprising history of AES

The Zacks Consensus Estimate for earnings per share (EPS) for 2024 and 2025 is $1.91 and $2.08, respectively, representing year-over-year growth of 8.5% and 8.8%, respectively.

The consensus estimate for revenue in 2024 and 2025 is $13.32 billion and $13.77 billion, respectively, representing year-over-year growth of 5.1% and 3.4%, respectively.

AES delivered an average earnings surprise of 19.18% over the last four quarters.

Dividend yield of AES shares

AES regularly pays dividends to shareholders. The current dividend yield is 3.82%, which is better than the industry average of 3.44%.

AES return on equity

AES’s current return on equity (ROE) is 32.74%, which is higher than the industry average of 10.34%. ROE, a profitable measure, reflects how effectively a company uses its shareholders’ funds in its operations to generate profits.

AES investments

AES is leading the transition of the utility industry to clean energy by investing in sustainable growth and innovative solutions. Notably, the company completed the construction and acquisition of 976 megawatts (MW) of wind, solar and energy storage assets in the second quarter of 2024. It signed long-term contracts for 1 gigawatt (GW) of new renewable energy.

AES signed contracts to support 1.2 GW of new data center load at U.S. utilities. In addition, the company signed 15-year power purchase agreements for 727 MW of wind and solar power to support data center growth in Texas and a 310 MW retail supply agreement to support data centers across Ohio.

This should help the company add 3.6 GW of new renewable energy projects to its portfolio in 2024 and add 14-17 GW of renewable energy capacity to its project portfolio over the 2023-2025 period.

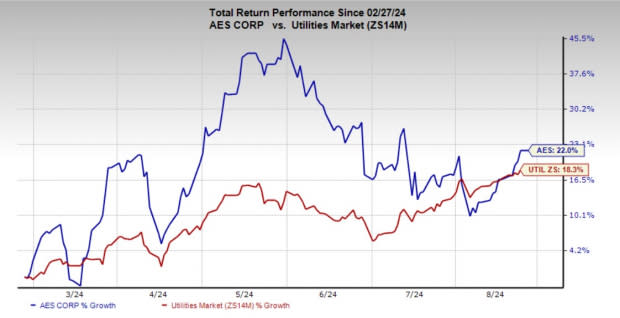

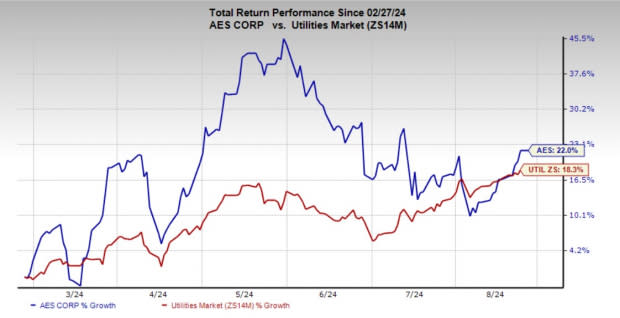

AES share price development

AES shares have gained 22 percent over the past six months, compared to the sector’s growth of 18.3 percent.

Image source: Zacks Investment Research

Other stocks to consider

Some other high-ranking stocks in the industry are American Electric Power Company, Inc. AEP, PPL Corporation PPL and NiSource Inc. NI. Each of these stocks currently has a Zacks Rank of 2. You can see the complete list of Zacks Rank #1 (Strong Buy) stocks here.

American Electric Power’s long-term (three to five years) earnings growth rate is 6.20%. The Zacks Consensus Estimate for revenue in 2024 suggests year-over-year growth of 5.7%.

PPL Corporation’s long-term earnings growth rate is 6.80%. The consensus estimate for 2024 earnings is for year-over-year growth of 7.5%.

NiSource delivered an average earnings surprise of 20.64% over the last four quarters. The Zacks Consensus Estimate for 2024 earnings suggests year-over-year growth of 7.5%.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

PPL Corporation (PPL): Free Stock Analysis Report

NiSource, Inc (NI): Free Stock Analysis Report

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research