Peninsula Energy Limited (ASX:PEN) may have moved too quickly with its recent 26% share price drop

Peninsula Energy Limited (ASX:PEN) shareholders who had been waiting for something to happen were hit hard with a 26% share price drop over the past month. The fall over the past 30 days capped off a tough year for shareholders, with the share price falling 33% in that time.

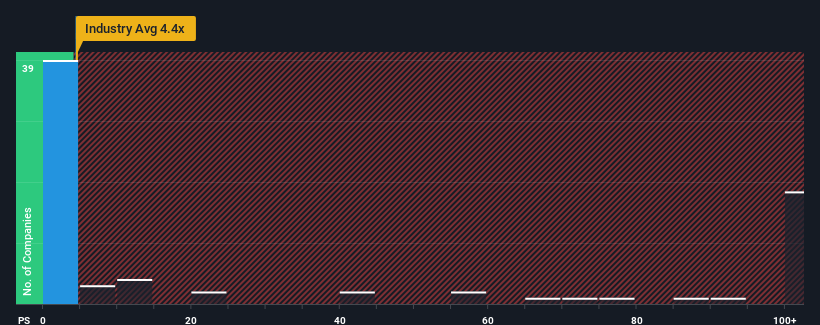

Even after such a large price drop, not many would think Peninsula Energy’s price-to-sales (or “P/S”) ratio of 4.4 is worth mentioning when it’s essentially in line with the median P/S in Australia’s oil and gas industry. While that may not surprise anyone, if the P/S ratio isn’t justified, investors could be missing out on a potential opportunity or ignoring a looming disappointment.

Check out our latest analysis for Peninsula Energy

How has Peninsula Energy performed recently?

Peninsula Energy has undoubtedly done well recently, as revenue growth has been positive while most other companies have seen revenue declines. Perhaps the market is expecting the company’s current strong performance to fade in line with the rest of the industry, which has kept its price-to-earnings ratio in check. If not, existing shareholders have reason to be optimistic about the future direction of the share price.

If you want to know what analysts are predicting for the future, you should check out our free Report on Peninsula Energy.

Is Peninsula Energy forecast to grow revenue?

Peninsula Energy’s price-to-sales ratio would be typical of a company that is expected to deliver only moderate growth and, importantly, perform in line with the industry.

First, if we look back, we see that the company has grown its revenue by an impressive 87% over the last year. Spectacularly, the revenue growth has increased several folds over the last three years, partly due to the revenue growth over the last 12 months. Therefore, it is fair to say that the company’s revenue growth has been outstanding recently.

Looking ahead, the four analysts covering the company expect revenue to grow 49% annually over the next three years, while the rest of the industry is forecast to grow 135% annually, which is much more attractive.

Given this information, we find it interesting that Peninsula Energy trades at a fairly similar price-to-earnings ratio compared to the industry. Apparently, many investors in the company are less pessimistic than analysts indicate and are not willing to offload their shares at this time. Maintaining these prices will be difficult, as this revenue growth will likely weigh on the shares at some point.

What can we learn from Peninsula Energy’s P/S?

Peninsula Energy’s declining share price has brought the price-to-sales ratio back into a similar region to the rest of the industry. We would argue that the price-to-sales ratio is not primarily used as a valuation tool, but rather to gauge current investor sentiment and future expectations.

Our look at analyst forecasts for Peninsula Energy’s revenue outlook has shown that the weaker revenue outlook is not having as much of a negative impact on the price-to-sales ratio as we would have expected. When we see companies with relatively weaker revenue outlooks compared to the industry, we suspect the share price could decline, driving the modest price-to-sales ratio down. A positive change is needed to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we have 1 warning sign for Peninsula Energy You should know about this.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.