Excel Industries (NSE:EXCELINDUS) will pay a lower dividend than last year

The (NSE:EXCELINDUS) Dividend will be reduced to ₹5.50 as compared to last year’s payment for the same period on October 19. This payment increases the dividend yield to 0.4%, which adds only a marginal amount to the total return.

While dividend yield is important for income investors, it is also important to consider large price swings, as these generally exceed any gains from distributions. Investors will be pleased to see that Excel Industries’ share price is up 47% over the past 3 months, which is good for shareholders and may also explain a decline in the dividend yield.

Check out our latest analysis for Excel Industries

Excel Industries’ profits easily cover the distributions

While a higher yield would be nice, we should also consider whether higher dividend payments would be sustainable. The last dividend was easily covered by Excel Industries’ earnings, suggesting that a fairly large portion of the profits are being reinvested in the company.

If the company fails to turn things around, earnings per share could fall 21.5% next year. If the dividend stays at current levels, we estimate the payout ratio could be 22%, which is quite doable.

Dividend volatility

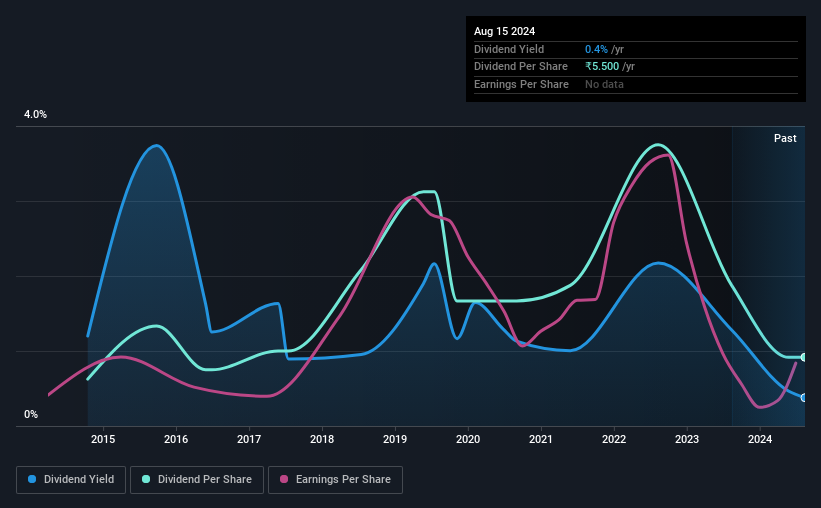

The company’s dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has increased from ₹3.75 per cent annually to ₹5.50 per cent. This means that payouts have grown at an annual rate of 3.9% during this time. The dividend has seen some fluctuations in the past, so while the dividend has been increased this year, we should not forget that it has been cut in the past.

The dividend has limited growth potential

With a relatively unstable dividend, it’s even more important to see if earnings per share are growing. Earnings per share have fallen 22% over the past five years. This sharp decline may indicate that the company is going through a difficult time, which could limit its ability to pay a higher dividend each year in the future.

In summary

Overall, it’s not great that the dividend has been cut, but that might be because the payments were a bit high previously. In the past, payments have been unstable, but in the short term, the dividend could be reliable as the company generates enough cash to cover it. This company is not in the top tier of income-producing stocks.

Market movements show how much a consistent dividend policy is valued compared to a more erratic one. At the same time, there are other factors that our readers should be aware of before putting capital into a stock. Just as an example: We are on 2 warning signs for Excel Industries You should be aware of these, and one of them is worrying. If you are a dividend investor, you should also check out our curated list of high dividend stocks.

Valuation is complex, but we are here to simplify it.

Find out if Excel Industries could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.