Shareholders of SBS Holdings (TSE:2384) will receive a higher dividend than last year

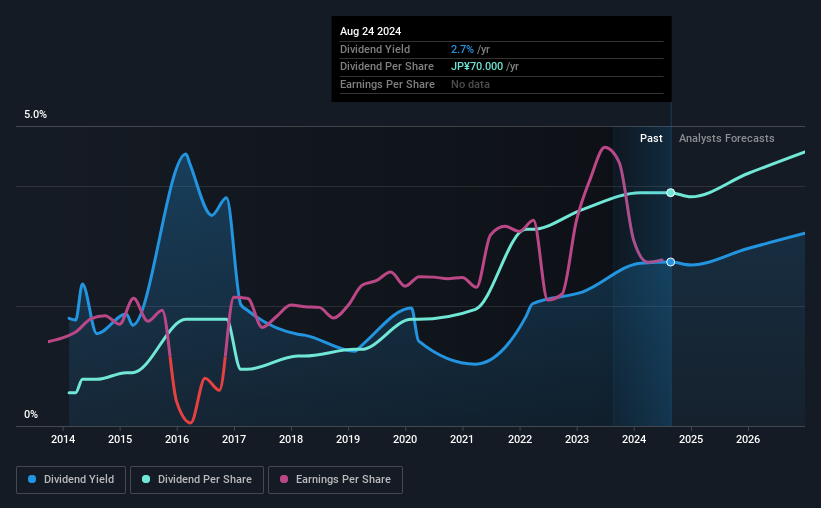

SBS Holdings, Inc. (TSE:2384) The dividend will increase to ¥70.00 compared to the payment made in the same period last year on March 11. This puts the dividend yield at about the industry average of 2.7%.

Check out our latest analysis for SBS Holdings

SBS Holdings’ dividend is well covered by earnings

We are not particularly impressed with dividend yields unless they can be sustained over time. Based on the last payment, SBS Holdings earned enough to cover the dividend, but free cash flows were not positive. Since the company is not earning any money, paying out to shareholders will become difficult at some point.

Next year, earnings per share are expected to grow by 14.9%. Assuming the dividend stays the same, we believe the payout ratio next year could be 34%, which is in a fairly sustainable range.

Dividend volatility

The company has a long dividend history, but it doesn’t look good due to past cuts. Since 2014, the dividend has increased from a total of ¥10.00 per year to ¥70.00 per year. This represents a compound annual growth rate (CAGR) of approximately 21% per year over that period. Despite rapid dividend growth in recent years, payments have also declined in the past, which makes us cautious.

Dividend growth could be difficult to achieve

With a relatively unstable dividend, it is even more important to assess whether earnings per share are growing, which could indicate a rising dividend in the future. However, SBS Holdings has only grown its earnings per share by 4.9% per year over the past five years. Even though growth is rather low, SBS Holdings could always pay out a higher proportion of its earnings to increase shareholder returns.

Our thoughts on SBS Holdings’ dividend

Overall, this is probably not a great dividend stock, even if the dividend is currently being increased. Given the lack of cash flows, it is hard to imagine the company being able to maintain a dividend payment. This company is not in the top category of dividend stocks.

Market movements show how much a consistent dividend policy is valued compared to a more unpredictable one. However, there are other things that investors need to consider when analyzing stock performance. A typical example: We have 3 warning signs for SBS Holdings (1 of which makes us a little uncomfortable!) that you should know about. Looking for more high-yield dividend ideas? Try our Collection of strong dividend payers.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.