Shareholders of China Mobile (HKG:941) will receive a higher dividend than last year

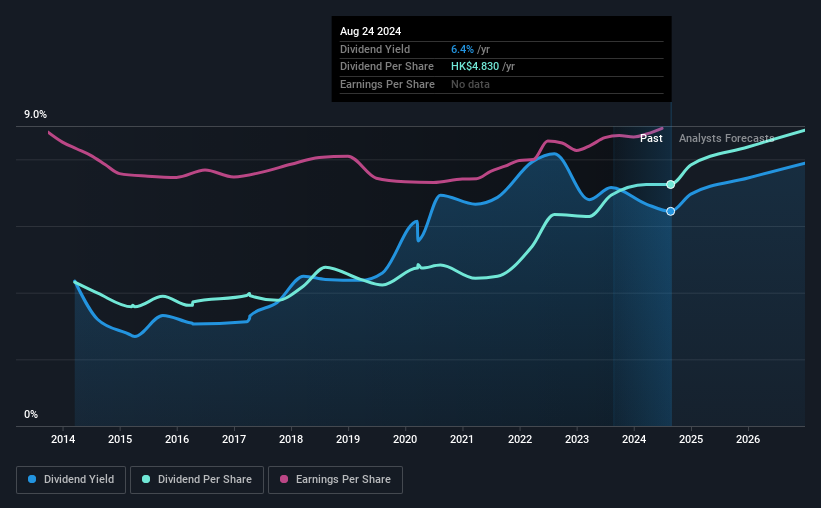

China Mobile Limited (HKG:941) announced that it will increase its dividend on September 24 to CN¥2.60 from last year’s payout, bringing the dividend yield to 6.4%, which is above the industry average.

Check out our latest analysis for China Mobile

China Mobile’s dividend is well covered by profit

If payments aren’t sustainable, a high yield won’t matter that much over a few years. Before this announcement, China Mobile’s dividend represented a very large proportion of profits, and perhaps more worryingly, it represented 95% of cash flow. Paying out such a high proportion of cash flow certainly exposes the company to a dividend cut if cash flow falls.

Next year, EPS is expected to grow by 11.0%. If the dividend follows recent trends, we believe the payout ratio could reach 76%, which is quite high but still doable.

China Mobile has a solid track record

Even over a long dividend history, the company’s payouts have been remarkably stable. Since 2014, the dividend has increased from a total of CNY2.63 per annum to CNY4.41 per annum. This means that the company has increased its payouts by about 5.3% per annum over this period. Dividends have grown at a reasonable pace over this period, and without any major cuts in payments over time, we think this is an attractive combination as it significantly enhances shareholder returns.

It may be difficult for China Mobile to increase its dividend

Investors in the company will be happy to have been receiving dividend income for some time. Earnings have grown 3.7% per year over the past five years, which is admittedly a bit slow. There are exceptions, but limited earnings growth and a high payout ratio can be a sign that a company has reached maturity. If a company prefers to pay out cash to shareholders rather than reinvest it, this can often say a lot about the company’s dividend prospects.

In summary

In summary, while it’s always good to see a dividend increase, we don’t think China Mobile’s payments are rock solid. Given the lack of cash flows, it’s hard to imagine the company being able to sustain a dividend payment. We’d be a little cautious about relying primarily on dividend income for this stock.

Market movements show how much a consistent dividend policy is valued compared to a more erratic one. At the same time, there are other factors that our readers should be aware of before putting capital into a stock. For example, we have selected the following: 1 warning signal for China Mobile investors should consider. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.