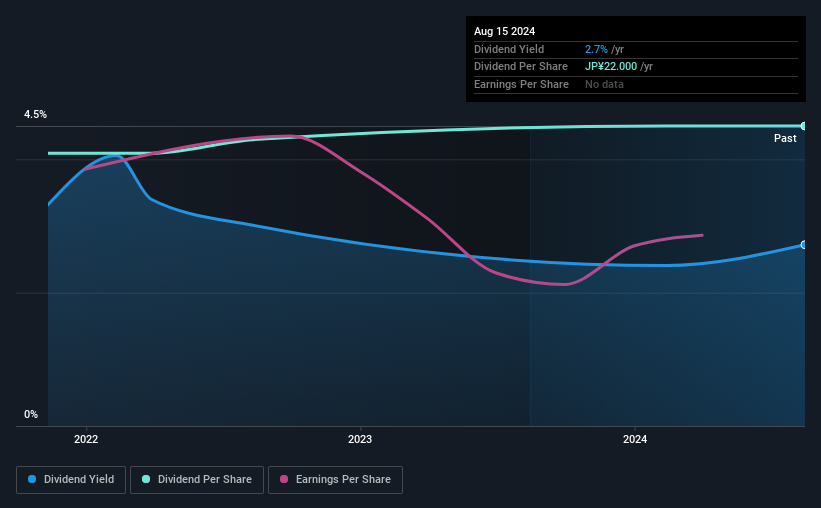

Mercuria Holdings (TSE:7347) will pay a higher dividend than last year at ¥22.00

Mercuria Holdings Co., Ltd. (TSE:7347) The dividend will increase to ¥22.00 compared to the payment in the same period last year on March 26. This puts the dividend yield approximately in line with the industry average of 2.7%.

Check out our latest analysis for Mercuria Holdings

Mercuria Holdings’ dividend is well covered by earnings

We want the dividend to remain consistent over the long term, so it’s important to check whether it’s sustainable. However, Mercuria Holdings’ profits easily cover the dividend, meaning that the majority of profits are retained to grow the business.

If the company cannot reverse the trend of the past few years, earnings per share could decline by 5.7% going forward. Assuming the dividend continues to follow recent trends, we believe the payout ratio could be as high as 41%. We are quite happy with that and think it is doable on an earnings basis.

Mercuria Holdings does not have a long payment history

The company has paid a consistent dividend for a number of years, but we’d like to see a longer track record before relying on it. The annual payment over the past three years was ¥20.00 in 2021, and the most recent fiscal year’s payment was ¥22.00. This means the company has grown its payouts by about 3.2% annually over that time. Mercuria Holdings hasn’t been paying a dividend for very long, so we wouldn’t get too excited about its growth track record just yet.

Dividend growth is questionable

Investors in the company will be happy to have been receiving dividends for some time. Unfortunately, things are not going as well as they seem. Over the past five years, Mercuria Holdings’ earnings per share have shrunk by about 5.7% per year. If earnings decline, this will inevitably lead to the company paying a lower dividend in line with lower earnings.

Our thoughts on Mercuria Holdings’ dividend

Overall, we always like to see dividend increases, but we don’t think Mercuria Holdings will be a good dividend stock. Payments have been unstable in the past, but in the short term the dividend could be reliable as the company generates enough cash to cover it. We would probably look elsewhere for a dividend investment.

Investors generally prefer companies with a consistent, stable dividend policy over companies with an irregular dividend policy. However, investors must consider a number of other factors besides dividend payments when analyzing a company. To this end, Mercuria Holdings has 2 warning signs (and 1 that is potentially serious) that we think you should know about. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.