Reasons to add The Cooper Companies (COO) to your portfolio now

The Cooper Companies, Inc. COO is well positioned for growth, supported by strong prospects in the CooperVision (CVI) and CooperSurgical (CSI) businesses. Acquisitions are strengthening the company’s portfolio and providing cause for optimism. However, adverse currency fluctuations and rising costs continue to weigh on revenue and margins.

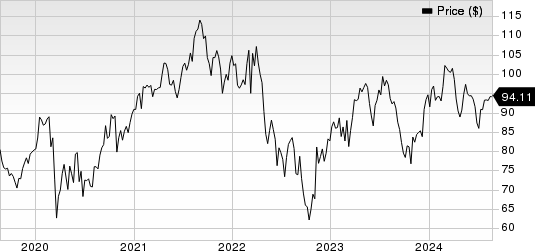

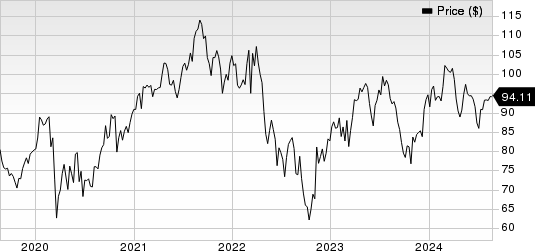

Shares of this Zacks Rank #2 (Buy) company have lost 0.5% year-to-date versus industry growth of 0.8%. The S&P 500 Index has gained 17.9% during the period.

The Cooper Companies is a global specialty medical device company with a market capitalization of $18.65 billion.

The company’s bottom line is expected to improve by 11.3% over the next five years. Earnings exceeded expectations in two of the last four quarters and even exceeded expectations in the other two quarters, giving the company an average surprise of 2.50%.

Image source: Zacks Investment Research

What drives COO performance?

The Cooper Companies is a leader in the specialty lens market thanks to innovative product portfolios, market-leading flexibility and strength with major accounts. Its flagship silicone hydrogel lenses, including MyDay and Clarity, are expected to drive strong sales in the coming quarters. In addition, its silicone hydrogel FRP lenses, Biofinity and Avaira, are expected to drive sales growth.

The lens business is likely to be driven by continued strong growth in CVI’s toric, multifocal and disposable ball lens sub-units. Robust growth across all geographies is also encouraging. In addition, the robust performance of the COO’s myopia management portfolio, mainly driven by strong demand for MiSight, is also encouraging. The myopia management business is likely to improve in the coming quarters due to the back-to-school promotional campaigns.

The CVI segment delivered solid performance in the second quarter, with revenue increasing 10% at constant exchange rates to $635.9 million. Management said strong demand for silicone hydrogel lenses contributed to the segment’s upturn.

In August, COO acquired obp Surgical, a US-based medical device company known for its innovative single-use surgical products. obp Surgical’s unique ONETRAC portfolio complements CooperSurgical’s existing offerings, including INSORB, Lone Star and the Doppler blood flow monitor.

CVI revenues are expected to be in the range of $2.591 billion to $2.613 billion in fiscal 2024 (organic growth of 8.5%-9.5%).

The Cooper Companies is also well positioned to benefit from CSI’s growing product portfolio. In the second fiscal quarter, CSI reported constant currency sales growth in two focus areas – fertility and office and surgical products. Office and surgical products sales are expected to continue to improve due to robust growth in PARAGARD as well as increasing demand for stem cell storage. Although the Company’s U.S. distribution center for medical devices and fertility products will likely continue to experience supply disruptions in the coming quarter (following a system upgrade in the second fiscal quarter), the impact is expected to lessen.

Fertility revenues increased 2% year over year to $123.8 million, indicating continued solid performance. Office and Surgical revenues increased 12% to $182.9 million.

For fiscal year 2024, CSI revenues are expected to be in the range of $1.272 billion to $1.293 billion, representing organic growth of 5-7%.

What is weighing on the stock?

The Cooper Companies generate a significant portion of their revenue in foreign currencies. Exchange rate fluctuations can have a significant impact on foreign revenue.

Estimated trend

The Zacks Consensus Estimate for the company’s fiscal 2024 revenue is $3.88 billion, representing year-over-year growth of 8%. The consensus mark for adjusted earnings per share is $3.57, representing year-over-year improvement of 11.6%.

Over the past 60 days, the COO’s fiscal 2024 earnings forecast has improved 2% to $3.57 per share.

The Cooper Companies, Inc. Course

The Cooper Companies, Inc. Price | The Cooper Companies, Inc. Offer

Important tips

Some better-valued stocks in the broader medical space that have announced quarterly results are DaVita DVA, Aspen Technology AZPN and Universal health services UHS, all with a Zacks Rank #1 (Strong Buy) currently. See the complete list of today’s Zacks #1 Rank stocks here.

DaVita has an estimated long-term growth rate of 17.5%. DVA’s earnings beat estimates in each of the last four quarters, with the average surprise being 24.2%.

DaVita shares have risen 43.4% year-to-date, compared to industry growth of 14.3%.

Aspen Technology has an estimated long-term growth rate of 13.1%. AZPN’s earnings beat estimates in two of the last four quarters and fell short of them twice. The average surprise was 4.24%.

Aspen Technology shares have lost 4.2% since the beginning of the year, while the industry has grown 13.5%.

Universal Health Services has an estimated long-term growth rate of 19%. UHS’s earnings beat estimates in each of the last four quarters, with the average surprise being 14.58%.

The company’s shares have risen 48.6% year-to-date, compared to industry growth of 39.7%.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Universal Health Services, Inc. (UHS): Free Stock Analysis Report

DaVita Inc. (DVA): Free Stock Analysis Report

The Cooper Companies, Inc. (COO): Free Stock Analysis Report

Aspen Technology, Inc. (AZPN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research