Shareholders of Resona Holdings (TSE:8308) will receive a higher dividend than last year

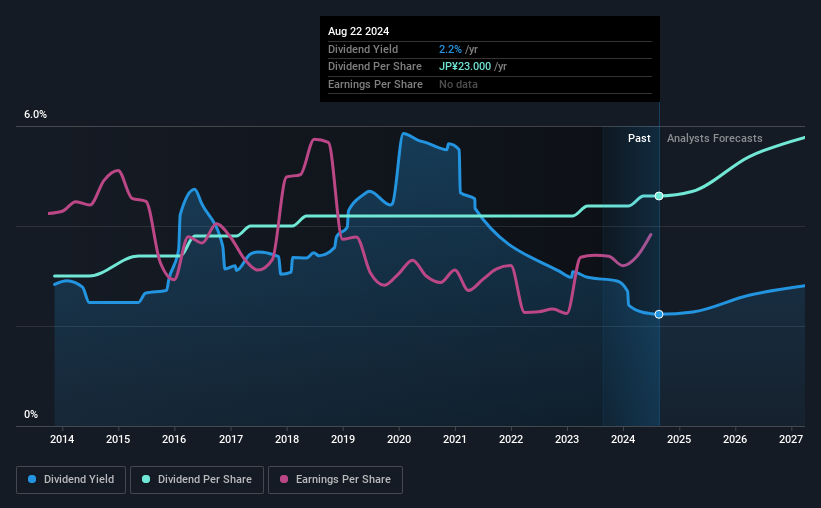

The Board of Resona Holdings, Inc. (TSE:8308) has announced that it will pay its dividend of 11.50 yen on December 9. This is a higher payment than the comparable dividend paid last year. Although the dividend is now higher, the yield is only 2.2%, which is below the industry average.

Check out our latest analysis for Resona Holdings

Resona Holdings’ payment is expected to provide solid profit coverage

A higher yield would be desirable, but we should also consider whether a higher dividend payout would be sustainable.

Resona Holdings has paid dividends for at least 10 years, giving it a long history of returning a portion of its profits to shareholders. The company’s payout ratio comes from its last earnings report at 29%, meaning Resona Holdings could pay its last dividend without putting pressure on its balance sheet.

Earnings per share are expected to grow at 9.0% next year. If the dividend follows recent trends, we estimate the future payout ratio will be 27%, a range that makes us comfortable with the sustainability of the dividend.

Resona Holdings has a solid track record

The company has a long history of paying stable dividends. The annual payment over the past 10 years was ¥15.00 in 2014 and the payment in the most recent fiscal year was ¥23.00. This represents a compound annual growth rate (CAGR) of approximately 4.4% per year over that period. While the consistency of dividend payments is impressive, we find the relatively slow growth rate less attractive.

Dividend growth could be difficult to achieve

Investors who have held shares in the company over the past few years will be pleased with the dividends they have received. However, Resona Holdings has only grown its earnings per share at 4.8% per year over the past five years. If Resona Holdings struggles to find profitable investments, the company still has the option to increase its payout ratio to pay out more to shareholders.

Resona Holdings looks like a great dividend stock

In summary, a dividend increase is always positive and we are particularly pleased with its overall sustainability. The company easily earns enough to cover its dividend payments and it is great to see those profits being translated into cash flow. All in all, this ticks many of the boxes we look for when selecting a dividend stock.

Market movements show how highly a consistent dividend policy is valued compared to a more erratic one. However, there are other things investors need to consider when analyzing stock performance. As an example, we found: 1 warning signal for Resona Holdings that you should consider before investing. If you are a dividend investor, you should also check out our curated list of high dividend stocks.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.