Hirakawa Hewtech’s (TSE:5821) upcoming dividend will be higher than last year

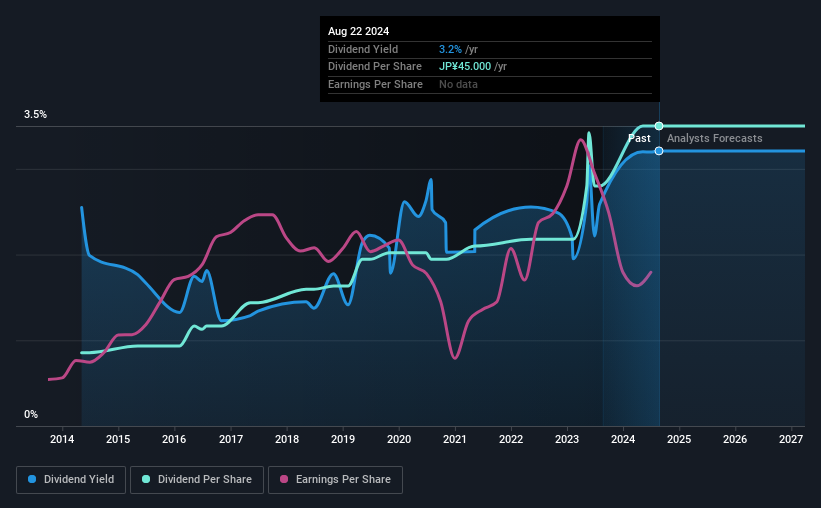

The (TSE:5821) The dividend will increase to ¥22.00 from the payment made during the same period last year on December 9. This brings the annual payment to 3.2% of the share price, higher than what most companies in the industry pay.

Check out our latest analysis for Hirakawa Hewtech

Hirakawa Hewtech’s profits easily cover the distributions

If the payments are not sustainable, a high yield over a few years is not so important. Before this announcement, Hirakawa Hewtech was easily earning enough to cover the dividend, so a large portion of the earnings were reinvested in the company.

Next year, earnings per share are expected to grow by 11.3%. If the dividend follows recent trends, we estimate the payout ratio will be 36%, a range that makes us comfortable with the sustainability of the dividend.

Hirakawa Hewtech has a solid track record

The company has a long history of paying dividends, and they have been quite stable, which gives us confidence in its future dividend potential. The dividend has increased from an annual total of ¥11.00 in 2014 to the most recent annual total payout of ¥45.00. This means that the company has increased its payouts by about 15% annually over this period. We can see that the payments have shown very nice upward momentum without faltering, which gives us some confidence that future payments will also be reliable.

Hirakawa Hewtech may have a hard time increasing its dividend

Investors in the company will be happy to have been receiving dividends for some time. However, things are not looking so rosy. Over the past five years, Hirakawa Hewtech’s earnings per share have declined by about 2.5% annually. If earnings fall, this will inevitably lead the company to pay a smaller dividend in line with lower earnings. However, next year things are actually looking better and earnings will rise. We would just wait for this to become a pattern before getting too excited.

Our thoughts on Hirakawa Hewtech’s dividend

In summary, it’s great to see the company can increase the dividend and keep it within a sustainable range. While payments currently appear sustainable, earnings have been declining, so the dividend could come under pressure in the future. Taking all this into account, the dividend looks sustainable going forward, but investors should be aware that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements show how much a consistent dividend policy is valued compared to a more unpredictable one. Despite the importance of dividend payments, however, they are not the only factors our readers should know when evaluating a company. For example, we have selected the following companies: 1 warning sign for Hirakawa Hewtech investors should know before investing capital in this stock. Is Hirakawa Hewtech not quite the opportunity you have been looking for? Check out our Selection of the highest dividend stocks.

Valuation is complex, but we are here to simplify it.

Find out if Hirakawa Hewtech could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.