Enterprise Financial Services (NASDAQ:EFSC) will pay a higher dividend than last year at $0.27

The Board of Enterprise Financial Services Corp (NASDAQ:EFSC) announced that it will pay its dividend of $0.27 on September 30, a higher payment than last year’s comparable dividend. Despite this increase, the dividend yield of 2.2% is only a modest increase in shareholder returns.

Check out our latest analysis for Enterprise Financial Services

Enterprise Financial Services’ payment should provide solid revenue coverage

A higher yield would be desirable, but we should also consider whether a higher dividend payout would be sustainable.

Enterprise Financial Services has established itself as a dividend-paying company and has a history of over 10 years of distributing profits to shareholders. Although past data is no guarantee of future performance, Enterprise Financial Services’ latest earnings report puts the payout ratio at 22%, which shows that the company has no problem paying its dividends.

Earnings per share are expected to decline by 0.4% over the next 12 months. But assuming the dividend stays as it has in recent years, we believe the future payout ratio could be 26%. We are quite comfortable with that and think it would be doable on an earnings basis.

Enterprise Financial Services has a solid track record

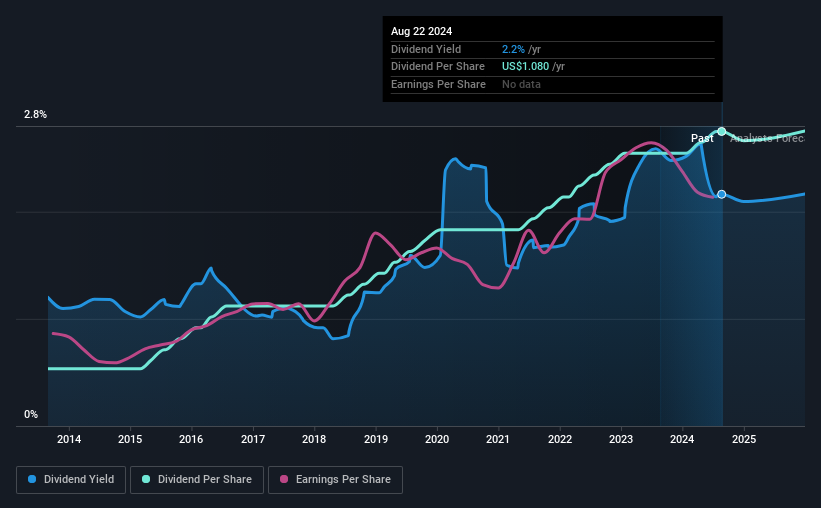

The company has a long history of paying dividends and these have been relatively stable, giving us confidence in its future dividend potential. The dividend has grown from an annual total of $0.21 in 2014 to the most recent annual total payout of $1.08. This means that the company has increased its payouts by about 18% annually over this period. Fast-growing dividends over the long term are a very valuable trait for a dividend stock.

We could see a dividend increase at Enterprise Financial Services

Investors in the company will be happy to see that it has been receiving dividend income for some time. It is encouraging to see that Enterprise Financial Services has grown earnings per share at 6.6% per year over the past five years. Enterprise Financial Services definitely has the potential to grow its dividend in the future, as earnings are on an upward trend and the payout ratio is low.

Enterprise Financial Services seems to be a great dividend stock

Overall, we think this could be an attractive dividend stock, and it will get even better by paying a higher dividend this year. Earnings easily cover the company’s distributions, and the company generates plenty of cash. If earnings do indeed decline over the next 12 months, the dividend could suffer a bit, but we don’t think this should be too much of a problem in the long term. Taking all of this into account, it looks like this could be a good dividend opportunity.

Market movements show how much a consistent dividend policy is valued compared to a more unpredictable one. However, there are other things that investors need to consider when analyzing stock performance. A typical example: We have 2 warning signs for Enterprise Financial Services (of which 1 is significant!) that you should know about. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

Valuation is complex, but we are here to simplify it.

Discover whether Enterprise Financial Services could be under- or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.