A shift away from China in the procurement of important minerals would increase costs and delay the energy transition, warns Wood Mackenzie

A shift away from China in the procurement of important minerals would increase costs and delay the energy transition, warns Wood Mackenzie

Replacing Chinese copper supply chains requires $85 billion for new smelting and refining facilities

SINGAPORE/LONDON/HOUSTON/ August 15, 2024 – As the world’s major economies seek to realign their supply chains for critical minerals outside of China, the resulting inefficiencies could increase the cost of finished products and delay the energy transition. The world cannot achieve decarbonization without copper, a critical component of electrification. Currently, China dominates copper mining, further processing (smelting and refining), and semi-finished production. According to a new report from Wood Mackenzie, demand for copper is expected to grow 75% to 56 million tonnes (Mt) by 2050, requiring significant investment.

The shift away from China will require massive investment in new copper processing and manufacturing facilities. Wood Mackenzie’s August Horizons report, “Securing Copper Supply: No China, No Energy Transition,” says that replacing China’s smelting and refining capacity alone to meet the rest of the world’s needs would cost nearly $85 billion.

“A scenario without China in the copper supply chain would require a significant increase in processing capacity to meet energy transition goals,” said Nick Pickens, head of global mining research at Wood Mackenzie.

“We forecast that there will be an additional 8.6 million tonnes of copper demand outside China over the next decade. This demand represents 70% of smelting capacity and 55% of manufacturing capacity in the rest of the world. As governments and manufacturers seek to diversify away from China, it is critical to consider the entire supply chain, not just mining.”

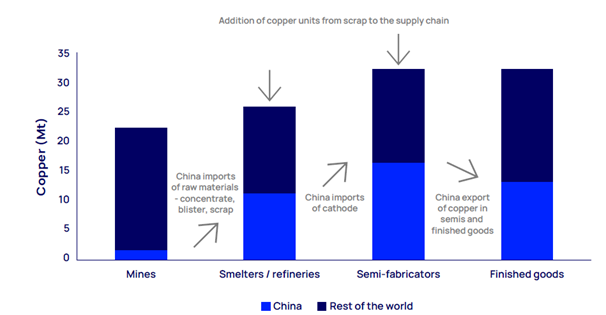

China’s role in the copper supply chain, 2023

Source: Wood Mackenzie

The global copper supply chain is a complex system consisting of four main stages: mining, smelting and refining, semi-finished goods manufacturing and finished goods manufacturing. Copper flows from raw material extraction in the Americas and Africa to further processing and manufacturing, predominantly in China. The country’s significant investments in further processing and semi-finished goods manufacturing pose significant challenges to global copper supply security.

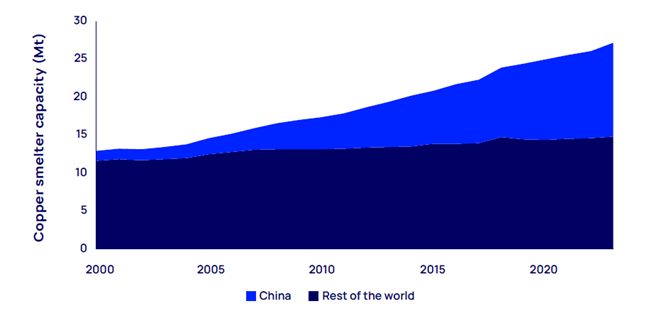

The report says China has accounted for 75% of global smelting capacity growth since 2000 and currently controls 97% of global smelting and refining capacity, representing over 3 Mt of production and nearly $25 billion in investment. The country has also added nearly 11 Mt of copper and alloy capacity since 2019, accounting for about 80% of global gains. About two-thirds of these plants produce wire rod, giving China over half of global manufacturing capacity, and further expansion is underway.

Global copper smelting capacity growth is dominated by China

Source: Wood Mackenzie Lens Metals & Mining*

“China’s copper smelting industry has undergone significant development,” said Zhifei Liu, senior copper markets consultant at Wood Mackenzie. “In the 2000s, the pursuit of stricter environmental and efficiency standards led to the modernization of smelting facilities.

“Today, Chinese smelting furnaces are cost-effective and meet high environmental standards, especially in sulfur dioxide removal, making them extremely competitive.”

Pickens added that semi-finished products producers outside China, particularly in Europe, face challenges due to lower capacity utilization and higher operating costs. Carbon emissions regulations, such as the European Union’s Carbon Border Adjustment Mechanism, could reduce competitiveness by imposing higher taxes on the European copper industry without providing equivalent benefits. In addition, U.S. government incentives such as the Inflation Reduction Act may not ensure the long-term sustainability of the industry.

The report also highlights significant changes in the global copper smelting landscape, with new plants set to come online outside China this year. India is bringing a dedicated smelter online, Indonesia is adding two integrated smelters and a new smelter in the Democratic Republic of Congo is set to be completed by 2025, largely due to Chinese investment. According to Wood Mackenzie, these expansions will increase global smelting capacity by 1.6 million tonnes, the largest increase outside China in decades.

However, there are no plans for new primary smelting capacity in North America or Europe. Instead, the US is concentrating on the secondary market and copper scrap and plans to build its first secondary smelter for complex materials in Georgia, among other places.

“While copper supply risks can be mitigated and some restructuring has already begun in some countries, a complete replacement is not feasible given China’s dominance of the supply chain,” said Pickens. “The introduction of new processing and manufacturing facilities may lead to higher costs and delays in the energy transition.”

“Funding these investments presents additional hurdles, as resistance to new smelting projects is particularly strong in Europe for environmental and social reasons. Pragmatism and a willingness to compromise will be essential to achieve net-zero targets without imposing excessive costs on taxpayers. Easing global trade restrictions could be a necessary concession.”

END

Editor’s note:

The global transition to clean energy and decarbonization depends significantly on copper. With demand for copper increasing, efforts to secure critical minerals and reduce dependence on China’s supply are challenging. While the need to invest in new mines is obvious, the impact on further processing and semi-finished production is often overlooked. Our latest Horizons report addresses these issues. You can read it Here.

Wood Mackenzie Lens Metals and Mining is an integrated, cross-commodity data analytics platform for key mined commodities. It provides a comprehensive picture of how markets and assets in the energy and natural resources value chain are evolving under Wood Mackenzie’s energy transition scenarios.

- China’s role in the copper supply chain, 2023

- Global copper smelting capacity growth is dominated by China