An overview of cost-burdened households in the United States and Virginia

Housing affordability has become a pressing issue as a significant number of Americans struggle with the unstoppable rise in housing costs. Both homeowners and renters are in financial distress due to the current economic climate. When households spend more than 30% of their gross monthly income on housing, they are considered cost-burdened, and when this figure exceeds 50%, the household is considered severely burdened. We provide housing cost ratio analysis in different regions and examine the impact on your local market.

Typically, homeowners have to pay higher housing costs each month than renters, but statistically they also have a higher household income.

As a homeowner, you are responsible for:

As a tenant you are responsible for:

The housing cost ratio is calculated from these factors.

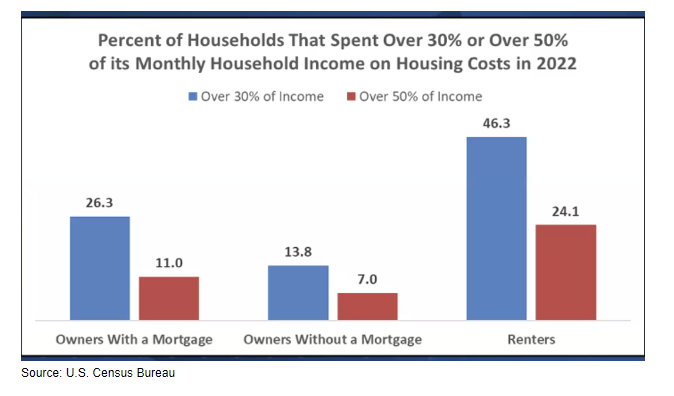

According to the latest data from the US Census Bureau ACS (American Consumer Survey), 58 million US households face high costs. About 39 million US households spend over 30% of their monthly income on housing costs, and about 19 million households spend over 50%. Average housing cost ratios across the country were 20.9% for homeowners with a mortgage, 11.3% for homeowners without a mortgage, and 31% for renters.

Renter

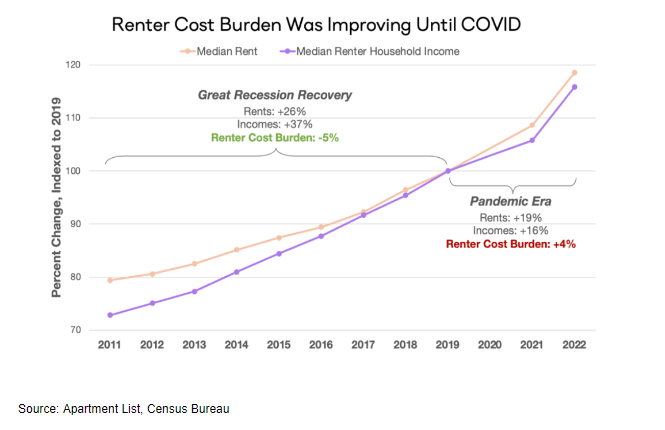

The pandemic has undone progress made to ease cost burdens on renter households. Recent data shows that the number of American renters burdened by housing costs has reached a new high since 2012. Renters are more likely to be burdened by housing costs than homeowners due to a lack of affordable rental housing and lower household incomes.

Homeowners

In the U.S., about 18 million homeowners struggle with the financial burden of homeownership, with 44% of this group considered severely cost-burdened, according to recent data. In 2019, about 27% of homeowners (with a mortgage) spent a significant portion of their monthly income on their home. In 2022, that number has risen to about 28%, indicating further financial stress among homeowners.

Owning a home is becoming more expensive. According to a study by Bank interestHomeowners in the United States pay an average of $18,118 per year for property taxes, home insurance, maintenance, energy and other housing costs. That’s 26 percent more than the cost of maintaining a home four years ago, which was $3,689 more. Even though the principal and interest on a mortgage usually stay the same, these rising phantom costs can weigh on many homeowners.

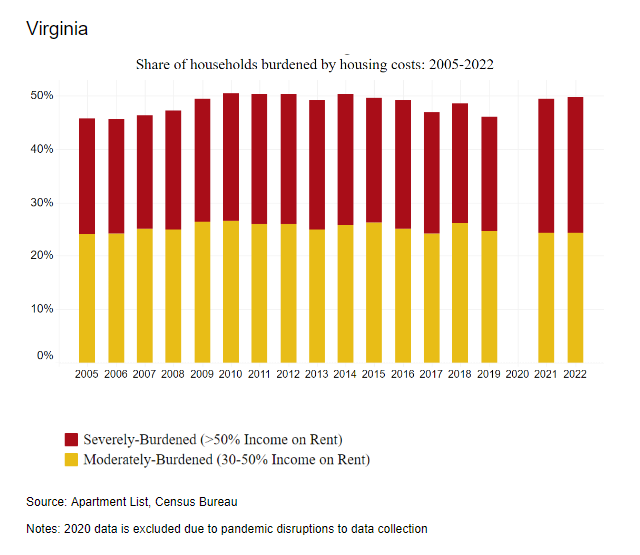

According to recent census data, nearly 50% of renters and 20% of homeowners in Virginia were considered housing cost burdened. The metropolitan areas with a large pool of renters who were highly cost burdened were Richmond, with a cost burden rate of 53.7%, and Virginia Beach, with 55.7%. Hispanic and black households in the state struggle the most with high housing costs.

As mentioned above, the rising phantom costs of homeownership are weighing on households. On average, homeowners in Virginia spend $17,647 on hidden costs such as property taxes, home insurance, maintenance, energy and other housing costs, an increase of $3,241 from 2020 (+23%).

Households should ideally have some financial breathing room after paying their monthly housing costs, but that can be challenging in the current market. It’s important for prospective homebuyers to get a full picture of the hidden costs of homeownership to avoid being surprised by housing costs. This knowledge will enable them to make informed decisions and plan their finances effectively.

For more information on housing, population and economic trends in Virginia, visit the Virginia REALTORS® website. Economic insights blogs.