San Jose leads the nation in the cost of buying versus renting

Given the long-term costs of buying or renting a home in San Jose, it is far less expensive to pay the landlord.

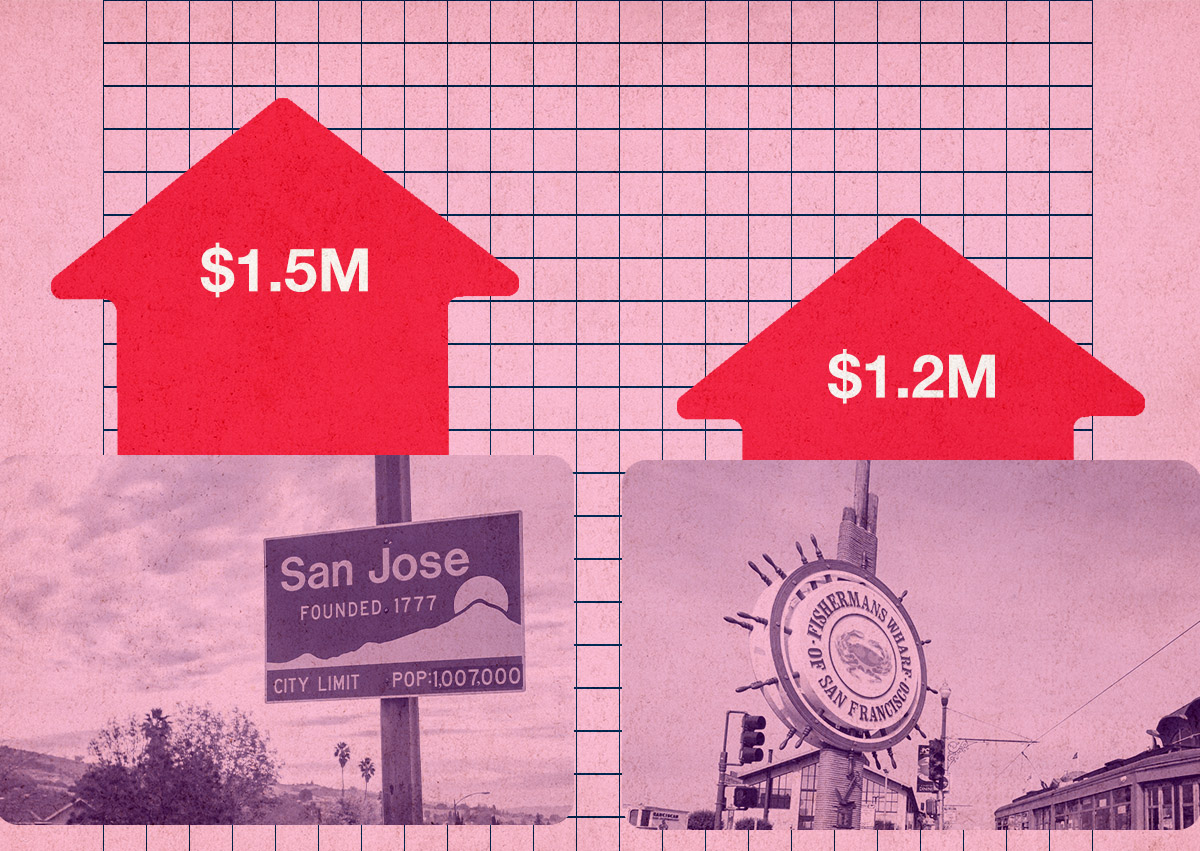

In the South Bay City, the median home price in June was $1.5 million – more than double the typical rental cost of $715,000 for 20 years, the San Francisco Chronicle reported, citing figures from Zillow and Apartment List.

The price-to-rent ratio was 2.2, the highest among the 100 most populous metropolitan areas in the United States. The price-to-rent ratio in San Jose was 1.6 in June 2019.

In the greater San Francisco area, the median home price was $1.2 million in June — nearly double the typical rental cost of $609,000 over two decades. In 2019, the ratio was 1.3.

Across the country, the median home price in June was roughly equivalent to the median price of renting a property for 20 years, or $352,000 to buy versus $338,000 to rent.

The difference between home prices and long-term rents across the Bay Area helps explain why many first-time home buyers are flocking to inland metropolitan areas like Fresno and Stockton, where the ratio was just 1.3 in June.

Even to afford a mortgage for an “affordable” home in California, an income of over $140,000 is required, according to the Legislative Analyst’s Office.

Across the state, Los Angeles and San Diego also had some of the highest price-to-rent ratios in the country.

In the greater Los Angeles area, the median home price was $945,000 in June, nearly double the typical rental cost of $528,000 over two decades (a ratio of 1.8).

In the greater San Diego area, the typical home price was $889,000, compared to $552,000 for a long-term rental, a ratio of 1.6.

According to the Chronicle, California’s home prices, which hit record levels this year, have risen faster than other parts of the country in decades. The ratio of home prices to rental costs jumped during the pandemic as housing prices hit record highs.

In addition, during the pandemic, renters were much more likely to move out of the Bay Area and take advantage of remote work options, Patrick Carlisle, chief market analyst at Compass, told the newspaper.

However, homeowners were more likely to stay where they were, while those who moved usually found a buyer for their home.

This, and low interest rates that led to bidding wars between buyers, drove up property prices while driving down rents – “which completely unbalanced the relationship between property prices and rents,” said Carlisle.

In some parts of the country, buying is still cheaper than renting.

In the Chicago area, the median home price in June was $311,000, while the cost of renting for a 20-year lease was $391,000.

— Dana Bartholomew

Read more

Reside

San Francisco

Bay Area residents pay the highest premium when buying a home compared to renting

Reside

San Francisco

Bay Area has the worst home affordability score in the country

Reside

San Francisco

The typical home price in Silicon Valley exceeds $2 million