Fuel giant Ampol says grid connection delays are slowing the rollout of fast chargers for electric vehicles

Fuel giant Ampol says grid connection delays continue to delay the expansion of its fast-charging network for electric vehicles, with the target of 300 charging stations not being reached until 2025.

The company had already addressed the problem in last year’s annual report, when it fell far short of its target of 180 electric vehicle charging stations by the end of 2023. And just weeks after it signed a new financing agreement with the federal government through the Clean Energy Finance Corporation (CEFC), the problem still appears to be unresolved.

“Progress in building out the electric vehicle fast-charging network is slower than expected given the challenges of connecting to the electricity grid, particularly in Australia,” Ampol CEO Matt Halliday told investors in a conference call to discuss interim results for calendar year 2024.

“We have a pipeline of about 100 sites either waiting to be connected to the grid or under construction,” he said. “That gives some insight into the challenges of providing the infrastructure to support the transition.”

Ampol is not the only company building out fast-charging networks for electric vehicles that has complained about grid connections. For example, some ultra-fast chargers are limited to the capacity they can provide and others like NRMA are installing integrated battery systems to take pressure off the grid.

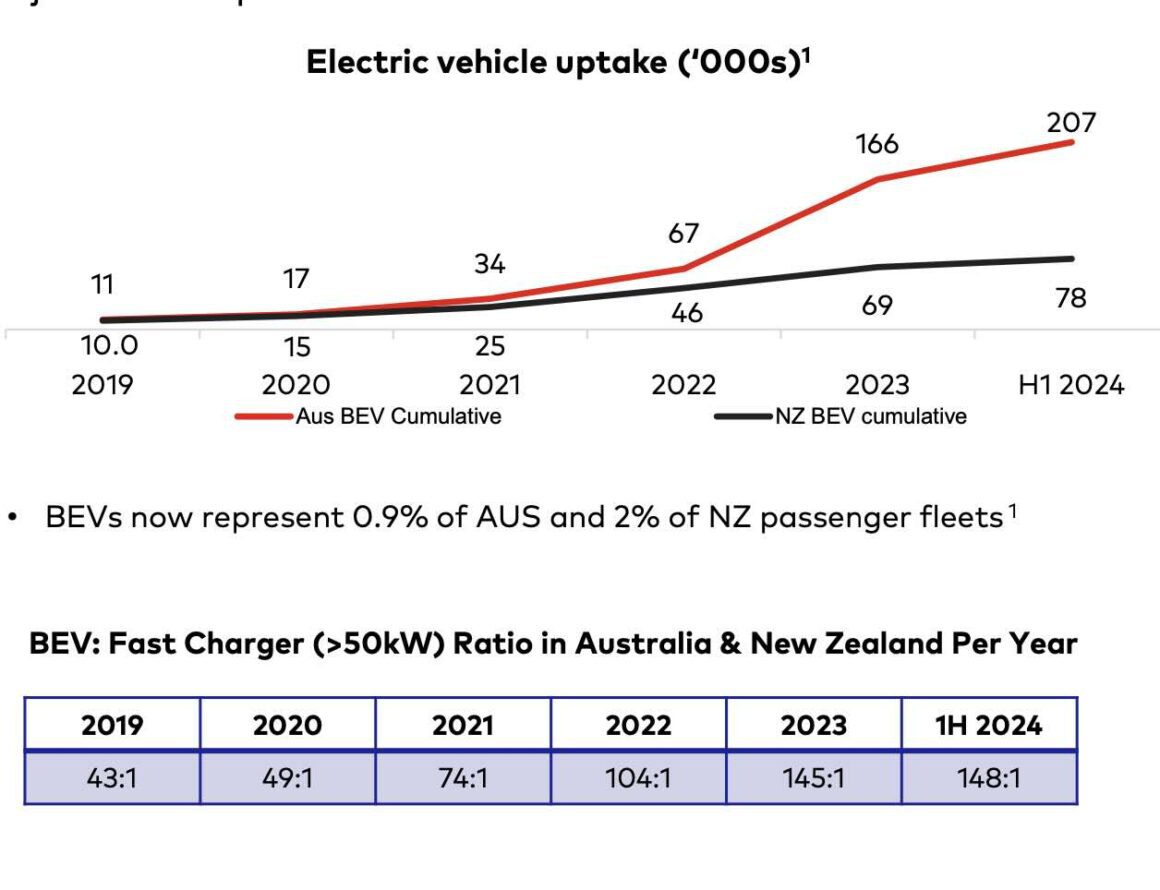

Halliday pointed out that electric vehicles still accounted for just 0.9 percent of the passenger car fleet in Australia – just over two percent in New Zealand – and that sales growth had slowed, which could impact the speed at which the company redesigned its retail stores.

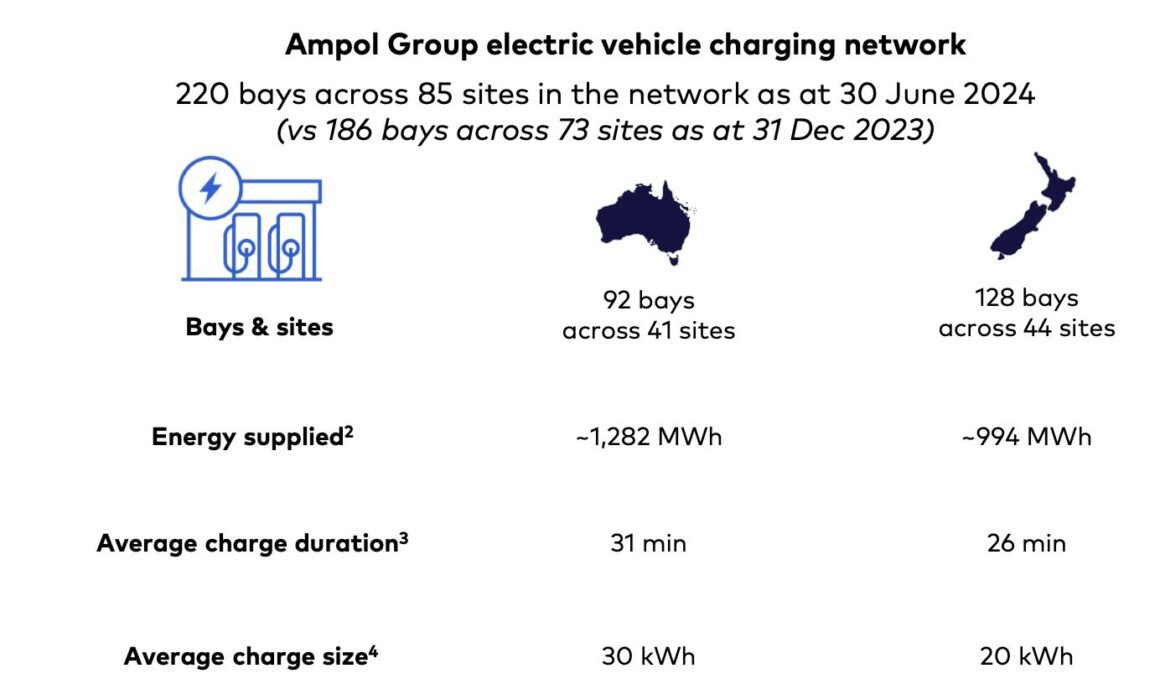

The graph above shows the growth in the number of electric vehicles per fast charger in Australia – currently there are 148 electric vehicles per fast charger. Ampol has only added 34 stations in Australia and New Zealand in the first half of 2024.

Still, longer charging times for electric vehicles, which the data shows are averaging 31 minutes, are opening up new opportunities for convenience stores that have traditionally relied on tobacco sales. Halliday says tobacco has now fallen to 25 percent of total sales and margins are low, reflecting the growth of illegal resellers.

Halliday says its fast-charging stations are at 98 to 99 percent capacity, but cited unspecified issues with certain chargers and in certain regions.

In terms of utilization, Ampol reported a figure of 7 percent across its entire network. “That is actually significantly higher than what we currently expected,” Halliday said.

“I think that’s a bit of an incentive for us. I think some international models and experience show that at 10% utilization, there’s a return on the electrons, and even up to 15% if you take into account the benefits of convenience retail, where the EV customer spends on average about 30% more.

“That’s pretty much in line with what we’re seeing. So we think it’s an interesting opportunity. Of course, there aren’t many vehicles in the country yet, less than 1% of the fleet, but at 7%, that’s above what we would have expected at this point.”

Giles Parkinson is founder and editor of The Driven and editor and founder of the websites Renew Economy and One Step Off The Grid. He is a journalist for nearly 40 years, a former business editor and deputy editor of the Australian Financial Review, and owns a Tesla Model 3.