Institutional investors in Cancom SE (ETR:COK) lost 6.0% last week, but benefited from longer-term growth

Key findings

- The significant holdings of institutions in Cancom imply that they have significant influence on the company’s share price

- The 11 largest shareholders own 50% of the company

- Owner research together with analyst forecasts help to understand the opportunities of a stock

Every investor in Cancom SE (ETR:COK) should know who the most powerful shareholder groups are. Institutions own the most shares in the company, with 57% of the shares. This means that this group benefits the most when the stock rises (or loses the most when it goes down).

No shareholder likes to lose money on their investments, especially institutional investors, whose shares fell 6.0% in value last week. However, the one-year return of 23% may have helped mitigate their overall losses. However, we expect them to be on the lookout for weakness in the future.

In the following graphic we zoom in on the different ownership groups of Cancom.

Check out our latest analysis for Cancom

What does institutional ownership tell us about Cancom?

Many institutions measure their performance against an index that is similar to the local market, so they tend to pay more attention to companies listed in major indices.

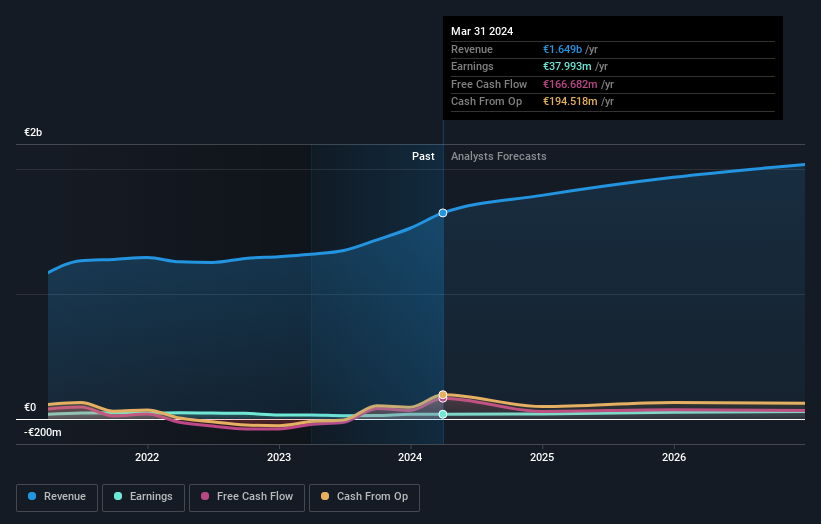

As you can see, institutional investors own a significant amount of Cancom. This may indicate that the company enjoys a certain level of trust in the investment community. However, one should be wary of relying on the supposed validation that institutional investors bring. They too are sometimes wrong. If multiple institutions change their minds on a stock at the same time, the share price can fall quickly. It is therefore worth taking a look at Cancom’s earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together they can probably strongly influence the board’s decisions. Hedge funds do not own many shares in Cancom. Allianz Asset Management GmbH is currently the company’s largest shareholder with 9.2% of outstanding shares. By comparison, the second and third largest shareholders hold about 6.6% and 5.6% of the shares, respectively.

A closer look at our ownership figures suggests that the top 11 shareholders together own 50%, meaning no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be done by studying analyst opinions. Quite a few analysts cover the stock, so you can look at the forecasted growth quite easily.

Insider ownership of Cancom

While the exact definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management is accountable to the board, which should represent the interests of shareholders. Notably, sometimes top executives are themselves on the board.

I think insider ownership is generally a good thing. However, in some cases it makes it harder for other shareholders to hold the board accountable for decisions.

We note that our data does not show any board member personally owning shares. Not all jurisdictions have the same rules for disclosing insider ownership and it’s possible we missed something here. Click here to learn more about the CEO.

Public property

The general public – including retail investors – owns 30% of the company’s shares and therefore cannot be ignored. While this group does not necessarily call the shots, it can have a real influence on how the company is run.

Private company ownership

It appears that private companies own 12% of Cancom shares. This may be worth investigating further. If related parties, such as insiders, have an interest in one of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important. To that end, you should be aware of the following: 1 warning sign We discovered it at Cancom.

If you’re like me, you might want to think about whether this company will grow or shrink. Luckily, you can check out this free report showing analyst forecasts for the future.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.