Futian Holdings Limited (HKG:8196) may have moved too quickly with its recent 46% share price slump

To the annoyance of some shareholders Futian Holdings Limited (HKG:8196) shares have fallen a whopping 46% over the past month, continuing the company’s terrible slide. The latest decline caps a disastrous 12 months for shareholders, who are sitting on a 94% loss during that time.

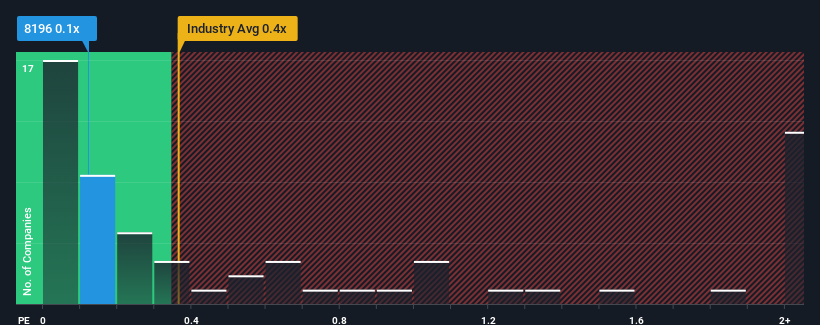

Despite the sharp drop in price, there won’t be many who find Futian Holdings’ price-to-sales (or “P/S”) ratio of 0.1 worth mentioning when the median P/S in Hong Kong’s retail distribution industry is similar at around 0.4. While this may not be surprising, if the P/S ratio is not justified, investors could miss a potential opportunity or ignore a looming disappointment.

Check out our latest analysis for Futian Holdings

What does Futian Holdings’ P/S mean for shareholders?

For example, Futian Holdings’ revenues have declined over the past year, which is far from ideal. One possibility is that the P/S ratio is modest because investors believe the company could still do enough to keep up with the broader industry in the near future. If you like the company, you at least hope that’s the case so you can potentially buy some shares while it’s not that popular yet.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Futian Holdings will help you shed light on the company’s historical performance.

What do the sales growth metrics tell us about the P/S?

There is a general assumption that a company should be in line with the industry average for P/S ratios like Futian Holdings to be considered reasonable.

Looking back, last year saw a frustrating 58% drop in sales. However, despite the unsatisfactory short-term performance, the company has recorded an excellent overall increase in sales of 41% over the last three years. So, first of all, we can say that the company has done a very good job of increasing sales overall during this time, even if there have been some setbacks along the way.

Compared to the industry, growth of 34 percent is forecast for the next twelve months. Based on the latest medium-term annual sales figures, the company’s momentum is weaker.

Given this information, we find it interesting that Futian Holdings trades at a fairly similar price-to-earnings ratio compared to the industry. It seems that most investors are ignoring the fairly low growth rates of late and are willing to pay more to own the stock. Maintaining these prices will be difficult, as a continuation of recent revenue trends will likely weigh on shares at some point.

The last word

After the Futian Holdings share price plunge, the price-to-sales ratio is just about holding on to the industry average. It is not useful to use the price-to-sales ratio alone to determine whether you should sell your shares, but it can be a handy guide to the company’s future prospects.

Our research into Futian Holdings found that the poor three-year revenue trends are not translating into a lower P/S as we expected, as they look worse than the current industry outlook. At the moment, we are unhappy with the P/S as this revenue trend is unlikely to support more positive sentiment for long. If the recent medium-term revenue trends continue, the likelihood of a share price decline becomes quite high, putting shareholders at risk.

Please note, however, Futian Holdings shows 5 warning signals in our investment analysis, and two of them cannot be ignored.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.