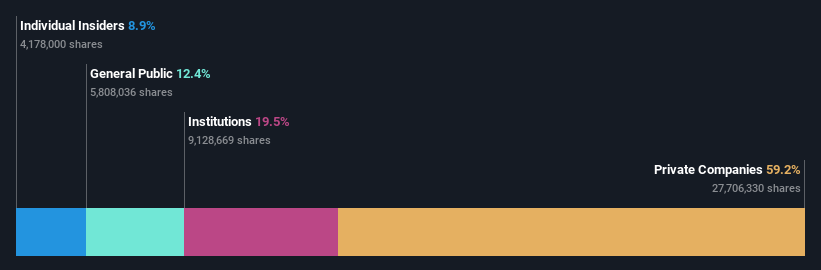

The 11% loss in Hiper Global Ltd. (TLV:HIPR) last week hit both retail investors, who own 59%, and institutions

Key findings

- The significant control of Hiper Global by private companies means that the public has more influence on management and governance-related decisions

- 59% of the company is held by a single shareholder (Mercury Emet 2021 Ltd.).

- The institutional share in Hiper Global is 19%

A look at the shareholders of Hiper Global Ltd. (TLV:HIPR) tells us which group is the most powerful. We see that private companies own the lion’s share of the company at 59%. In other words, the group stands to gain (or lose) the most from their investment in the company.

While private company holdings took a hit following last week’s 11 percent drop in share prices, institutions with their 19 percent holdings also suffered.

Let’s dive deeper into each of Hiper Global’s ownership types, starting with the table below.

Check out our latest analysis for Hiper Global

What does institutional ownership tell us about Hiper Global?

Many institutions measure their performance against an index that is similar to the local market, so they tend to pay more attention to companies listed in major indices.

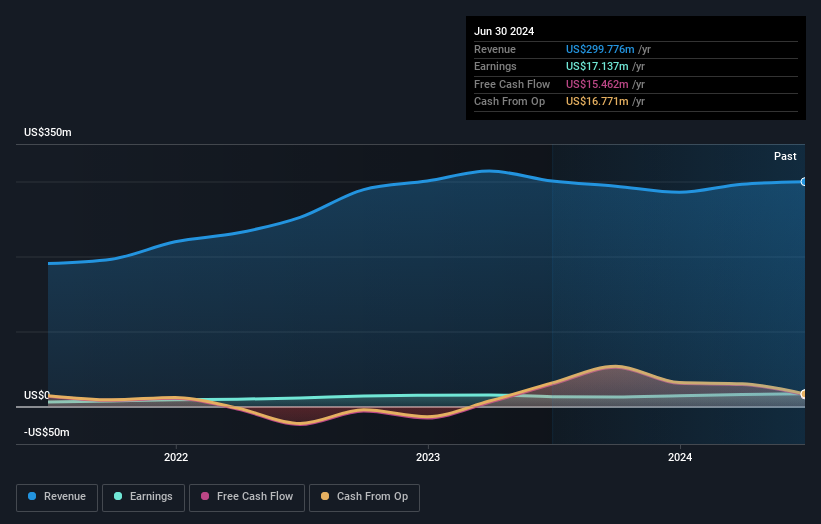

As you can see, institutional investors own a sizable portion of Hiper Global. This may indicate that the company enjoys a certain level of trust in the investment community. However, one should be wary of relying on the supposed validation that institutional investors bring. Even they are sometimes wrong. When multiple institutions own a stock, there is always a risk that they are involved in a “crowd trade.” If such a trade goes wrong, multiple parties may be competing to sell the stock quickly. This risk is higher with a company without a history of growth. You can see Hiper Global’s historical earnings and revenue below, but remember, there’s always more to the story.

Hiper Global is not owned by hedge funds. Our data shows that Mercury Emet 2021 Ltd. is the largest shareholder with 59% of the outstanding shares. This means they have majority control over the future of the company. In comparison, the second and third largest shareholders hold about 12% and 8.9% of the shares, respectively.

While it makes sense to study a company’s institutional ownership data, it also makes sense to study analyst sentiments to know which way the wind is blowing. According to our information, there are no analyst coverage of the stock, so it is likely little known.

Insider ownership of Hiper Global

The definition of an insider may vary slightly from country to country, but it always includes members of the board of directors. Company management runs the business, but the CEO is responsible to the board, even if he or she is a member of the board.

Most people consider insider ownership to be a positive because it can indicate that the board is well aligned with other shareholders. However, sometimes too much power is concentrated in this group.

We can see that insiders own shares in Hiper Global Ltd. The company has a market capitalization of just ₪770m and insiders own ₪69m worth of shares in their own names. Some would say this shows an alignment of interests between shareholders and the board, but it might be worth checking to see if these insiders have been selling.

Public property

The general public – including retail investors – owns 12% of the company’s shares and therefore cannot be easily ignored. While this size of ownership is significant, it may not be enough to change company policy if the decision does not coincide with that of other major shareholders.

Private company ownership

Our data shows that private companies hold 59% of the company’s shares. Private companies can be related parties. Sometimes insiders have an interest in a publicly traded company through an ownership interest in a private company, rather than in their own capacity as an individual. While it is difficult to draw any general conclusions, this is an area for further investigation.

Next Steps:

While it is worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take a detailed look at a company’s past performance. You can access these detailed graphics of previous earnings, sales and cash flows.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of interesting companies.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

Valuation is complex, but we are here to simplify it.

Find out if Hiper Global could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.