Investors in Heineken Holding (AMS:HEIO) have unfortunately lost 16% in the last five years

For many, the primary reason for investing is to achieve higher returns than the overall market. But the main goal is to find enough winners to more than offset the losers. At this point, some shareholders may stop investing in Heineken Holding NV (AMS:HEIO) as the share price has fallen 23% over the last five years. It has been even worse for shareholders recently as the share price has fallen 14% over the last 90 days. Note that the company only recently announced its results and the market is not happy. You can read the latest numbers in our company report.

Let’s now take a look at the company’s fundamentals and see if the long-term return to shareholders matches the performance of the underlying business.

Check out our latest analysis for Heineken Holding

While the efficient markets hypothesis is still taught by some, it is well established that markets are over-reactive dynamic systems and investors do not always act rationally. A flawed but useful way to assess how sentiment toward a company has changed is to compare earnings per share (EPS) to the share price.

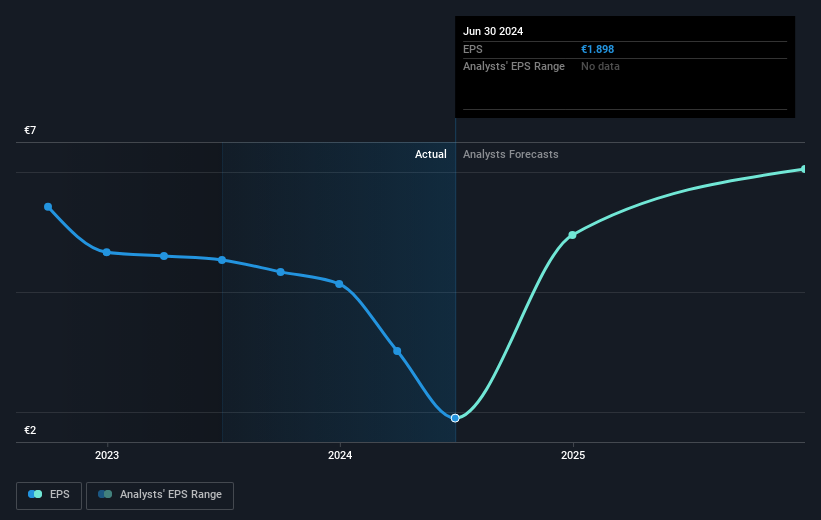

During the five years that the share price fell, Heineken Holding’s earnings per share (EPS) fell by 11% each year. The 5% drop in share price per year is not as bad as the drop in EPS, so investors might be expecting EPS to recover – or they may have already anticipated the EPS drop.

The image below shows how EPS has evolved over time (if you click on the image you can see greater detail).

It might be worth taking a look at our free Report on earnings, sales and cash flow of Heineken Holding.

What about dividends?

In addition to measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that takes into account the value of cash dividends (assuming that all dividends received were reinvested) and the calculated value of any discounted capital raisings and spin-offs. The TSR arguably gives a more comprehensive picture of the return generated by a stock. In the case of Heineken Holding, the TSR over the last 5 years is -16%. This exceeds the share price return we mentioned earlier. The dividends paid by the company have therefore in total shareholder return.

A different perspective

Heineken Holding shareholders are down 6.3% for the year (even including dividends), but the market itself is up 22%. Keep in mind, however, that even the best stocks sometimes underperform the market over a trailing twelve month period. Unfortunately, last year’s performance may indicate unresolved issues, as it was worse than the 3% annualised loss over the last five years. Generally speaking, long-term share price weakness can be a bad sign, although contrarian investors may want to research the stock in the hope of a turnaround. It’s always interesting to follow share price movements over a longer period of time. But to better understand Heineken Holding, we need to consider many other factors. Consider, for example, the ever-present specter of investment risk. We have identified 4 warning signs with Heineken Holding, and understanding them should be part of your investment process.

If you like buying stocks along with management, you might like this free List of companies. (Note: many of them go unnoticed AND have an attractive valuation).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that are currently traded on Dutch stock exchanges.

Valuation is complex, but we are here to simplify it.

Find out if Heineken Holding could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.