Harris releases economic plan to lower housing costs and end price gouging

Vice President Kamala Harris unveiled her economic plans in Raleigh, North Carolina, on Friday, the first time she has released a major policy initiative since President Biden dropped out of the race last month.

North Carolina is a key swing state in November, and Harris is trying to convince voters there and across the country that her policies can lower costs and provide economic opportunity for Americans. Harris noted it was her 16th visit to the state since becoming vice president – and President Biden’s first stop after the fateful debate performance that ultimately led to his exit from the race.

Harris said she would release more details on her economic plan in the coming weeks, but on Friday she focused on reducing the cost of living.

“If elected president, I will make it my top priority to lower costs and increase economic security for all Americans,” Harris said at Wake Tech Community College in Raleigh. “As president, I will address the high costs that matter most to most Americans, like the cost of food. We all know that prices went up during the pandemic when supply chains shut down and failed. But our supply chains have since improved. And prices are still too high.”

Harris also criticized former President Donald Trump for his economic policies. She said Trump would “effectively implement a national sales tax,” referring to Trump’s recent comments that he wanted to increase tariffs on goods imported into the United States by 10 to 20 percent.

New housing

Harris is calling for the construction of three million new housing units in the first four years of her term. The Biden administration had previously called for the construction of two million new homes.

She wants to encourage these new housing units by offering tax breaks to developers who build homes for first-time buyers. She also proposes a $40 billion fund to help local governments find solutions to the housing shortage.

“There is a serious housing shortage. In many places, it is too difficult to build housing, and that is driving up prices,” Harris said. “As president, I will work in partnership with industry to create the housing we need, both to rent and to buy. We will break down barriers and cut red tape, including at the state and local levels. And by the end of my first term, we will end America’s housing shortage by building three million new homes and rentals that are affordable to the middle class.”

Campaign officials said Harris will ask Congress to pass the Preventing Algorithmic Promotion of Rental Housing Cartels Act, which would prevent landlords from using price-fixing algorithms to raise rents. She also wants lawmakers to pass the Preventing Predatory Investing Act, a bill that would limit tax breaks for large investors and private equity firms that purchase single-family homes in bulk.

“Some corporate owners are buying dozens, if not hundreds, of homes and apartments,” Harris said. “Then they rent them out at extremely high prices. And that can make it impossible for regular people to buy a home or even rent one.”

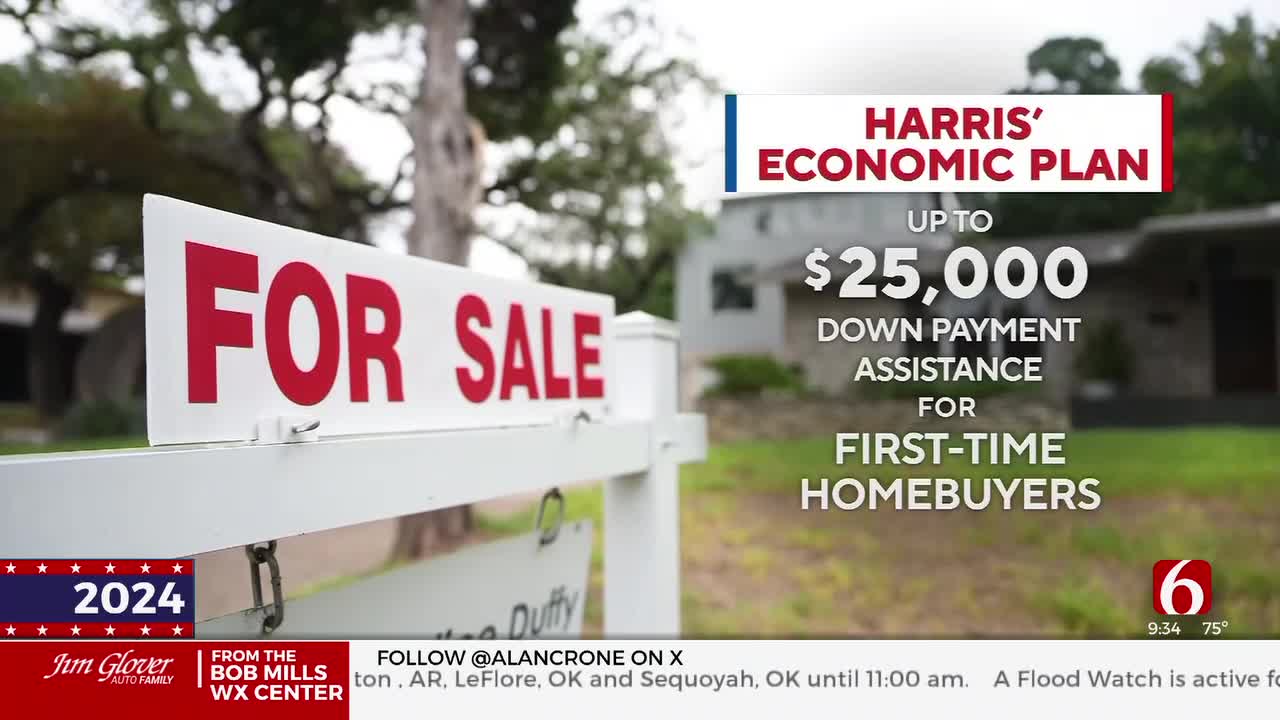

Harris will also propose providing up to $25,000 in down payment assistance to Americans who have paid their rent on time for two years, and more support for first-generation homeowners.

Expansion of the child tax allowance

Harris is also proposing an expansion of the child tax credit to give families with newborns a $6,000 tax break. Republican vice presidential candidate and Ohio Senator JD Vance has proposed a similar but more general $5,000 expansion of the child tax credit. The Committee for a Responsible Federal Budget pointed out that Vance’s proposal, which is 150 percent higher than the current $2,000 tax credit, could mean trillions of dollars in debt. “We could easily be talking about $2 trillion to $3 trillion in additional debt over the next decade,” Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, told CBS MoneyWatch about Vance’s proposal.

Vance has indicated that his tax credit would have no income limits, while Harris’ proposal would apply to low- and middle-income families.

Brian Hughes, a senior adviser to Trump’s campaign, said there has been “a lot of criticism from the Harris campaign of Senator Vance and his campaign for advocating policies that are family-friendly and supportive of those who are raising children. So it’s a little ironic that Vice President Harris is suddenly pursuing a policy that she didn’t seem to have implemented a few weeks ago.”

Harris also wants to return the child tax credit to the level of the pandemic-era American Rescue Plan, which would give working- and middle-class families with children up to $3,600 per child.

She also proposes a $1,500 earned income tax credit for people in low-paying jobs who are not raising children. During the campaign, Harris also stressed that she would ensure that “no one who earns less than $400,000 a year will have to pay more taxes.”

Both Vance’s and Harris’ proposals would require congressional approval.

Combating inflation

In North Carolina, Harris also talked about how much higher prices for certain goods, such as bread, are than before the pandemic, something Mr Biden does not normally do.

According to a campaign factsheet, Harris plans to lower food prices in her first 100 days in office. To do this, she will work with Congress to ban price gouging on food and other goods nationwide and give the Federal Trade Commission and state attorneys general new powers to impose penalties on companies that break the law.

“Look, the bills add up,” Harris said Friday. “Groceries, rent, gas, school uniforms, prescription drugs – after all of that, there’s not much left at the end of the month for many families.”

Extreme consolidation in the food industry has led to higher prices, which account for a large portion of higher grocery bills. Harris plans to crack down on unfair mergers and acquisitions that give big food companies the power to drive up prices on groceries and grocery stores and undermine the competition that keeps prices low for consumers. And her plan aims to support smaller businesses like grocery stores, meat processors, farmers and ranchers so those industries can become more competitive.

According to the latest CBS News poll, only 9% of registered voters rated the state of the national economy as “very good,” with the economy and inflation consistently ranking as the biggest concern in all 2024 polls. Inflation has cooled since its peak in June 2022, but many voters are still feeling financial strains. Prices overall are still 20% higher than they were before the COVID-19 pandemic.

In a statement, the Trump campaign accused Harris of trying to impose price controls, which it said have been “tried—and failed—over and over again throughout history, as they inevitably lead to food lines, shortages, and skyrocketing inequality.” The Trump campaign also blamed the problem on Harris and Biden’s economic policies, “aided and abetted by Harris’s decisive votes on trillions of inflationary spending.” However, economists have said that pandemic-related federal spending by both Trump and Biden has fueled high inflation.

In swing states, voters often tell CBS News on their way to the polling booth that the economy remains a top issue.

“Workforce development, job creation, making sure everyone can advance in different career fields,” Abraham Camejo said in Las Vegas ahead of Harris’ rally on Saturday when asked about economic priorities. “The policies that benefit big corporations and the middle class are different.”

According to a recent CBS News poll, Harris trailed Trump when asked about measures to improve people’s financial situation: 45 percent of registered voters said they would be better off financially under the former president, compared to 25 percent for Harris.

Abolition of taxes on tips

Harris’ economic policy remarks followed her promise at a rally in Las Vegas last Saturday to eliminate the tip tax and raise the minimum wage.

“When I’m president, we will continue our fight for working families. That includes raising the minimum wage and eliminating the tip tax for service and restaurant workers,” Harris said recently at a rally attended by members of the Nevada Culinary Union.

A Harris-Walz campaign official pointed out that her promise would need to be enshrined in law.

This was the first time Harris proposed eliminating the tax on service employee tips, a similar idea Trump first put forward in June at a rally in Las Vegas.

In 2025, lawmakers will have a great chance to pass new tax legislation as some tax changes made during Trump’s presidency in 2017 expire. The majority in Congress is likely to be a major factor on the issue, as Republicans held the House, Senate and White House when Trump’s 2017 tax cuts went into effect.

Aaron Navarro contributed to this report.