Flash crashes are getting faster

I’m a clean freak, so I occasionally clean and reorganize my office.

Earlier this week, I came across an old Life magazine that a reader had sent me a few years ago.

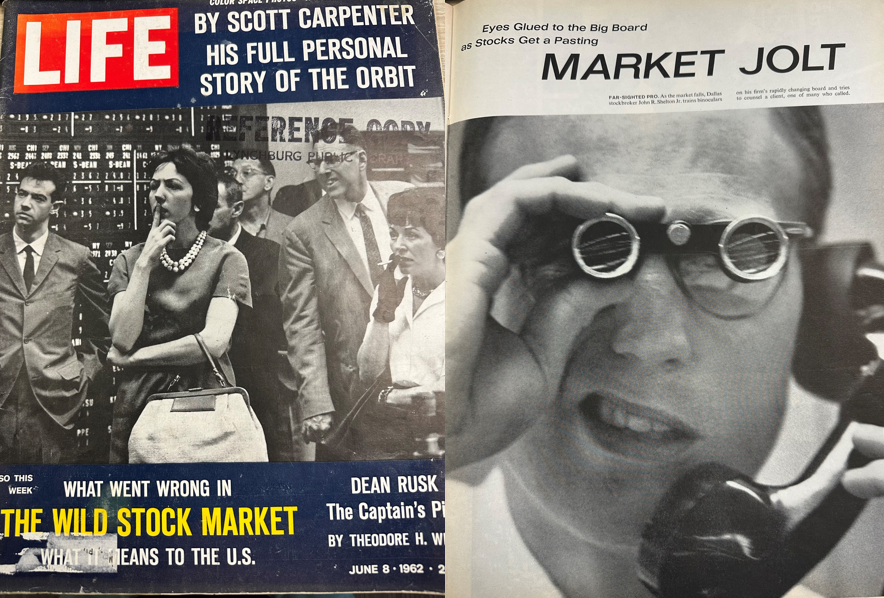

It is from June 1962 and the cover story was about the stock market:

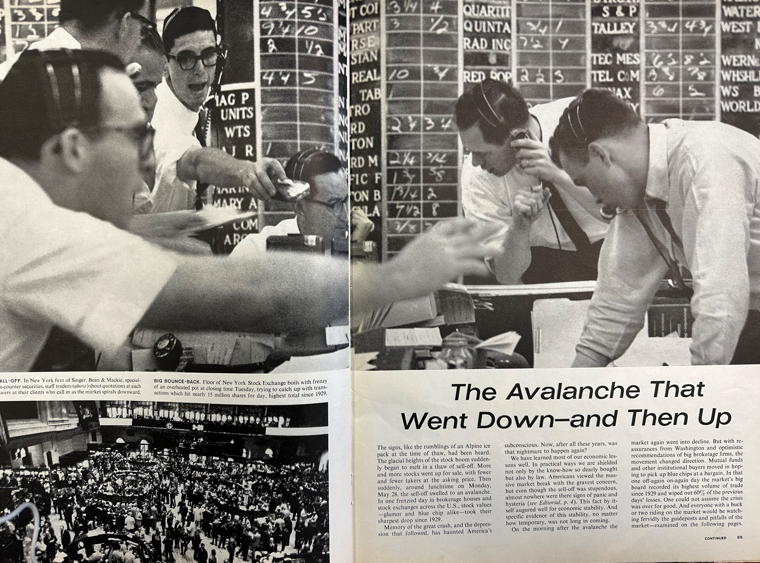

The pictures are fantastic.

This is how the story began:

The signs were clear, like the rumble of an Alpine block of ice at the time of the thaw. The icy heights of the stock market boom suddenly began to melt, and thawing waves of selling ensued. More and more shares were offered for sale, but fewer and fewer people were willing to offer them at the asking price. Then suddenly, around noon on Monday, May 28, the sell-off swelled into an avalanche. In a single hectic day in brokerage houses and stock exchanges across the United States, stock prices – both glam and blue chip – experienced their biggest drop since 1929.

By the spring of 1962, the stock market was already in the midst of a double-digit correction. Then, on May 28, a flash crash occurred, sending stocks down nearly 7% in a single day. It was the biggest one-day sell-off since the Great Depression.

Why did it happen?

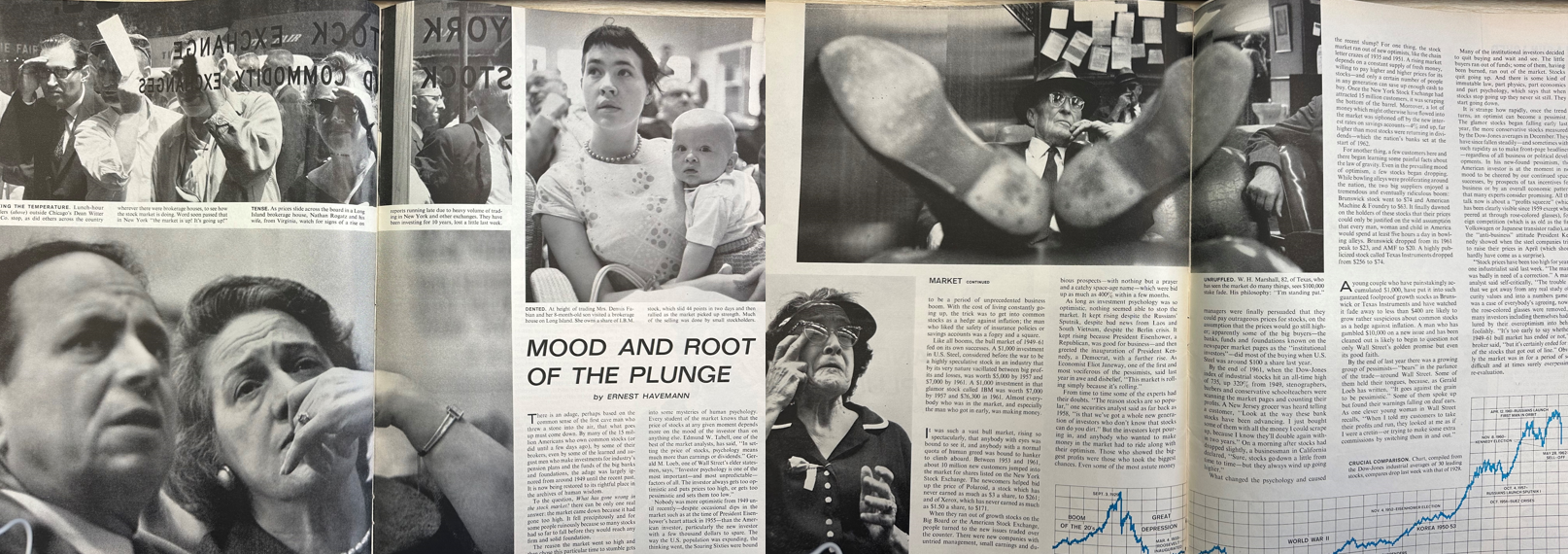

Here is the explanation from the article:

There can only be one correct answer to this: the market collapsed because it had risen too high.

The reason the market shot up so high and then stumbled at this precise moment is a mystery of human psychology. Anyone who follows the market knows that the price of a stock at any given time depends more on the mood of the investor than on anything else.

Sometimes the reason stock prices fall is because they have previously risen too much. There was a massive bull market in the 1950s. Investors were probably complacent and needed a just punishment.

The stock market can behave like a madman in the short term because human emotions are fickle.

It is becoming clearer by the day that last Monday’s stock market crash was also a flash crash. On August 5, the S&P 500 was down more than 6% for the month. It is now up in August.

I don’t rule out that there will be more volatility in the future, but this mini-crash looks like an investor panic moment. There are all sorts of macroeconomic reasons one could cite for this panic moment – a slowing labor market, interest rate hikes in Japan, the unwinding of the carry trade, a possible Fed misstep in monetary policy, etc.

However, the most logical reason for the turbulence on the stock markets last Monday is that prices collapsed because everything was too quiet. The stock markets cannot remain quiet forever.

Flash crashes occurred in the 1920s, in the 1960s and even today.

The biggest difference between then and now is the interconnectedness of global markets. There is computer and algorithmic trading. Information flows at the speed of light. Every single economic data is combed through in real time with a fine-tooth comb.

Overreactions can happen much more quickly today.

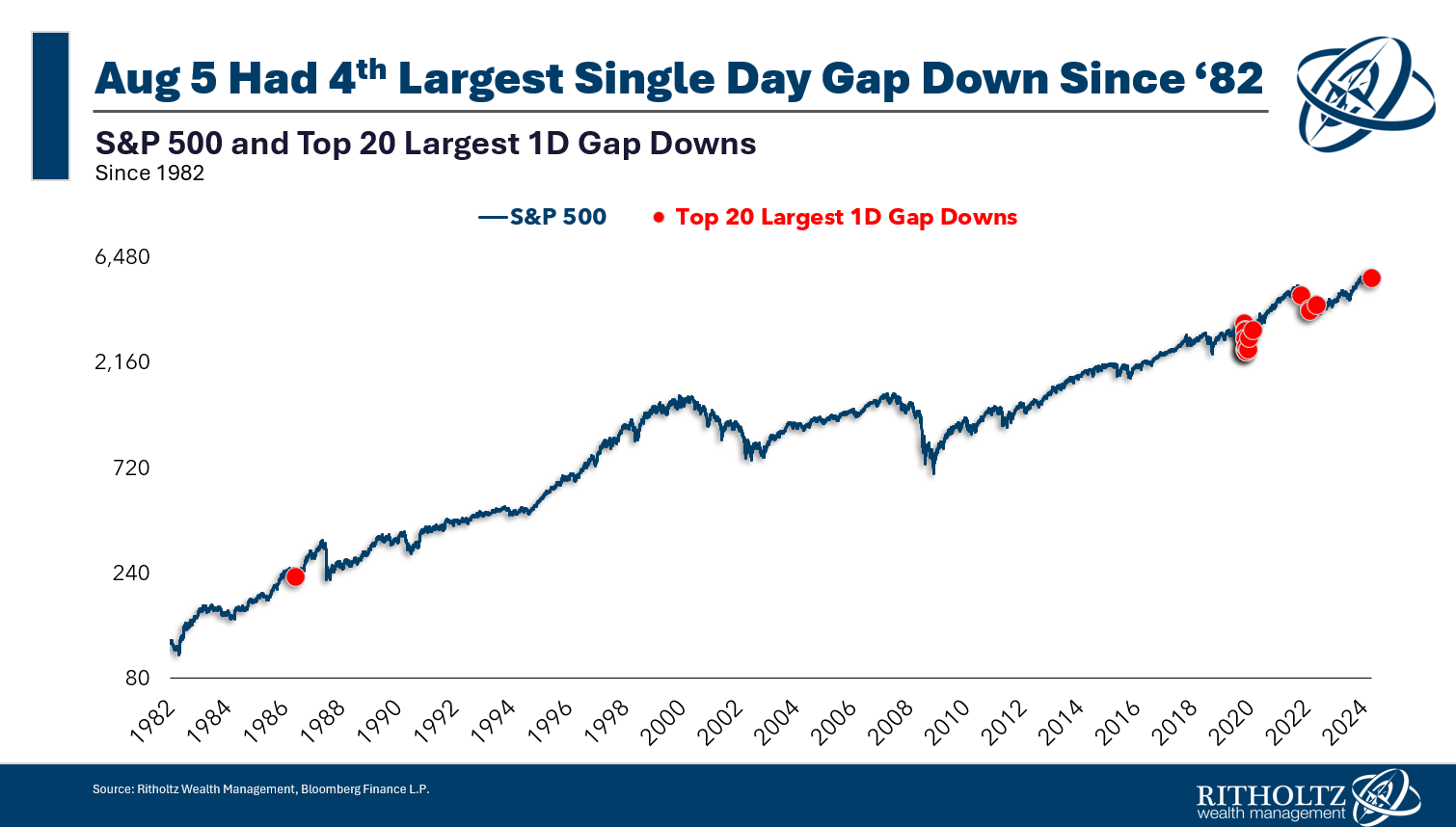

Just look at the biggest price gaps of the last 40 years:

This chart shows the largest differences between the stock market’s opening price and the previous day’s closing price. Except for the 1987 crash, they all occurred in this decade.

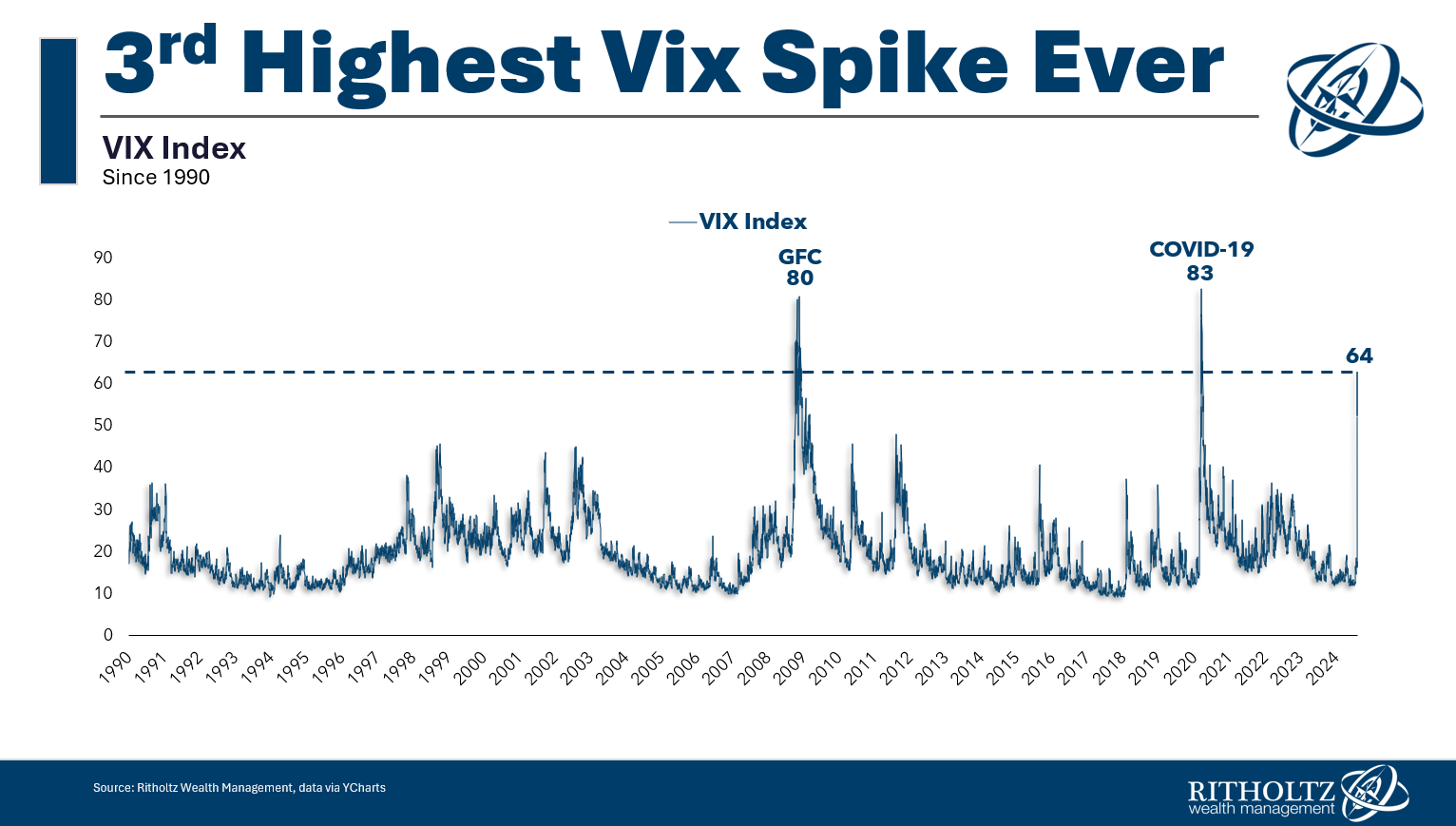

During a 9% correction, we had the third largest VIX increase of all time:

This was a financial crisis-level volatility outbreak and we didn’t even reach double digits on the decline.

I cannot predict the future, but I would not be surprised if such events become more common in the future.

Human nature is the only constant in all market environments, but we no longer trade with handwritten trading slips and blackboards.

The information age has added a Barry Bonds amount of HGH to human nature in the markets.

Due to the combination of increased leverage in the system, globalized markets, and computer trading, we are likely to see more such flash crashes in the future.

The difficult thing for investors is that they can more easily lose control during such market events. You no longer have to call your broker to make a trade. You can change your entire portfolio with the touch of a button on your phone.

Just because markets are getting faster doesn’t mean your decisions need to be made faster.

In a world that is moving faster every day, it is more important than ever to take it slow with your investments.

Michael and I talked about flash crashes and more in this week’s Animal Spirits video:

Subscribe to The Compound so you don’t miss an episode.

Further information:

The Minsky Market

Here’s what I’ve been reading lately:

Books: