TeraWulf Inc. (NASDAQ:WULF) released its earnings last week and analysts raised their price target to $6.57

TeraWulf Inc. (NASDAQ:WULF) shareholders are likely a little disappointed as shares fell 7.2% to $3.60 in the week following the release of its latest quarterly results. Overall, it was a pretty poor result; while revenues were in line with expectations at $36 million, statutory losses ballooned to $0.03 per share. Analysts typically update their forecasts with each earnings report, and we can judge from their estimates whether their opinion of the company has changed or if there are any new concerns to be aware of. Readers will be pleased to know that we have rounded up the latest statutory forecasts to see if analysts have changed their minds on TeraWulf following the latest results.

Check out our latest analysis for TeraWulf

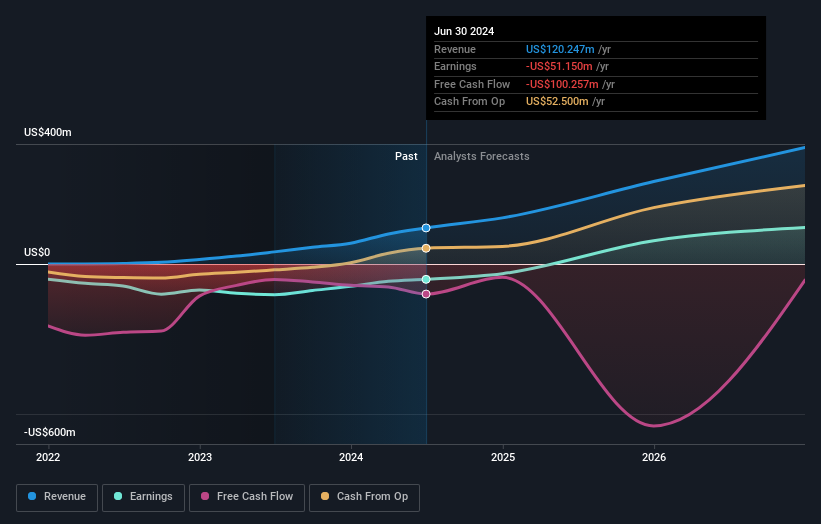

Following the latest results, TeraWulf’s six analysts are now forecasting revenues of $153.7 million in 2024. This would be a substantial 28% increase in revenues compared to the last 12 months. Loss per share is expected to narrow significantly in the near term, falling 30% to $0.094. Prior to this earnings announcement, analysts had been modeling revenues of $157.9 million and a loss of $0.072 per share in 2024. So it’s pretty clear that analysts have mixed opinions on TeraWulf following this update; revenues have been downgraded and losses per share are expected to increase.

The average price target rose 7.8% to $6.57, clearly suggesting that the weaker revenue and earnings outlook is not expected to weigh on the stock in the long term. However, fixating on a single price target can be unwise since the consensus target is actually the average of analysts’ price targets. Therefore, some investors like to look at the range of estimates to see if there are any differing opinions on the company’s valuation. There are some differing views on TeraWulf, with the most optimistic analyst valuing it at $10.00 and the most pessimistic at $3.00 per share. As you can see, the range of estimates is wide, with the lowest valuation being less than half of the most optimistic estimate, suggesting that there are some widely divergent views on how the analysts view this company’s performance. With this in mind, we would not rely too heavily on the consensus price target as it is only an average and analysts obviously have very different views on the company.

One way to put these forecasts into a larger context is to look at them in comparison to past performance and to the performance of other companies in the same industry. We’d like to highlight that TeraWulf’s revenue growth is expected to slow down. The forecast annual growth rate of 63% through the end of 2024 is well below the historical growth of 197% over the last year. Compare this to the other companies in the industry covered by analysts, whose revenues (in total) are expected to grow at 12% per year. So it’s pretty clear that while TeraWulf’s revenue growth is expected to slow down, it will still grow faster than the industry itself.

The conclusion

Most importantly, the analysts have raised their loss per share estimates for next year. Unfortunately, they have also lowered their revenue estimates, but the latest forecasts still suggest that the company will grow faster than the wider industry. There was also a nice increase in the price target, as the analysts clearly feel that the intrinsic value of the company is increasing.

However, the long-term trajectory of company earnings is much more important than the next year. At Simply Wall St, we have a full range of analyst estimates for TeraWulf out to 2026, and you can see them free on our platform here.

You still have to consider risks, for example – TeraWulf has 4 warning signs (and 3 that are a little worrying) that we think you should know about.

Valuation is complex, but we are here to simplify it.

Find out if TeraWulf could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.