Floor & Decor Holdings (NYSE:FND) stock has outperformed underlying earnings growth over the past five years

The most you can lose on a stock (assuming you don’t use leverage) is 100% of your money. But the good news is that if you buy shares of a high-quality company at the right price, you can gain well over 100%. A good example is Floor & Decor Holdings, Inc. (NYSE:FND), whose stock price has risen 132% in five years. In about a month, it has risen 15%. We note that Floor & Decor Holdings recently released its financial results. Fortunately, you can read the latest sales and earnings numbers in our company report.

With it being a strong week for Floor & Decor Holdings shareholders, let’s take a look at how the longer-term fundamentals are performing.

Check out our latest analysis for Floor & Decor Holdings

In his essay The super investors of Graham and Doddsville Warren Buffett described how stock prices do not always rationally reflect the value of a company. By comparing earnings per share (EPS) and stock price changes over time, we can get a sense of how investors’ attitudes toward a company have changed over time.

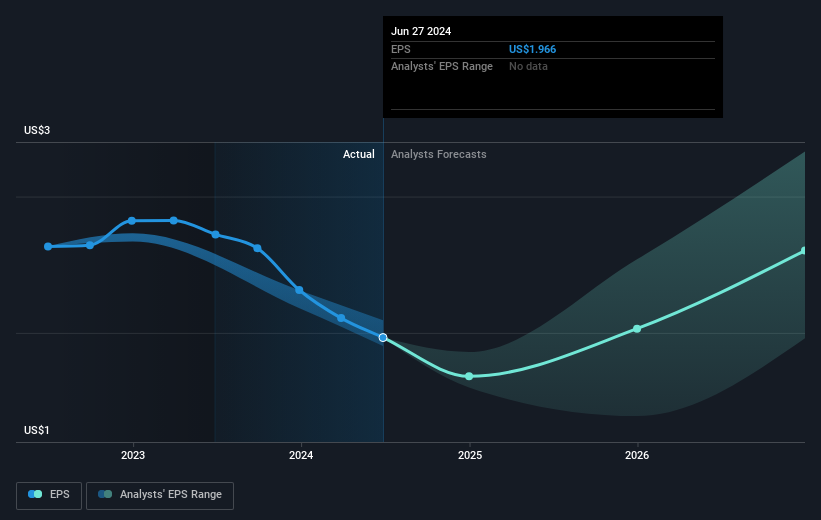

Over half a decade, Floor & Decor Holdings managed to grow its earnings per share by 10% per year. This EPS growth is lower than the average annual share price increase of 18%. This suggests that market participants have a higher opinion of the company these days. And that’s hardly surprising given its growth track record. This optimism is reflected in its rather high P/E ratio of 56.68.

The company’s earnings per share (over time) is shown in the image below (click to see the exact numbers).

The free Floor & Decor Holdings’ interactive earnings, revenue and cash flow report is a good place to start if you want to investigate the stock further.

A different perspective

Floor & Decor Holdings generated a TSR of 11% over the last twelve months. However, this return is below market value. If we look back at the last five years, the returns are even better, at 18% per year over five years. It is quite possible that the company will continue to perform well even if the share price gains slow down. Before you look more closely at Floor & Decor Holdings, you should click here to see if insiders have been buying or selling shares.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.