Can Chainlink (LINK) price secure $12 as a support floor?

The price of Chainlink (LINK) could decline as the veil of optimism is lifted by investors.

The emerging bear market could lead to a decline as the network’s activity has been minimal compared to its valuation.

Concerns about Chainlink

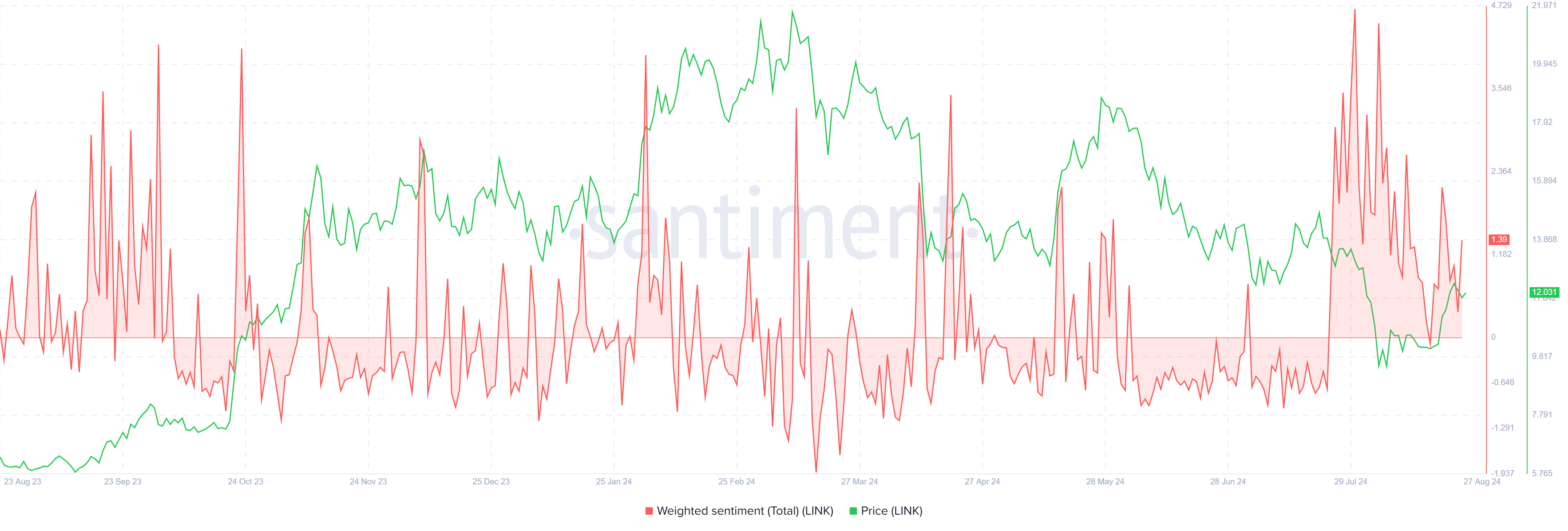

The fact that Chainlink’s price is struggling to break through and close above a key resistance level has a lot to do with investors. Since late July, LINK holders have shown an intense bullish bias despite the crash. This prevented the altcoin from losing significantly and drove the altcoin’s price higher in mid-August. However, this strong optimism is now starting to fade.

Despite the recent price increase, the weighted sentiment for LINK is continuously declining. It is currently above the zero line, indicating that there is still some positive sentiment among holders. However, this optimism is gradually fading.

Read more: How to buy Chainlink (LINK) and everything you need to know

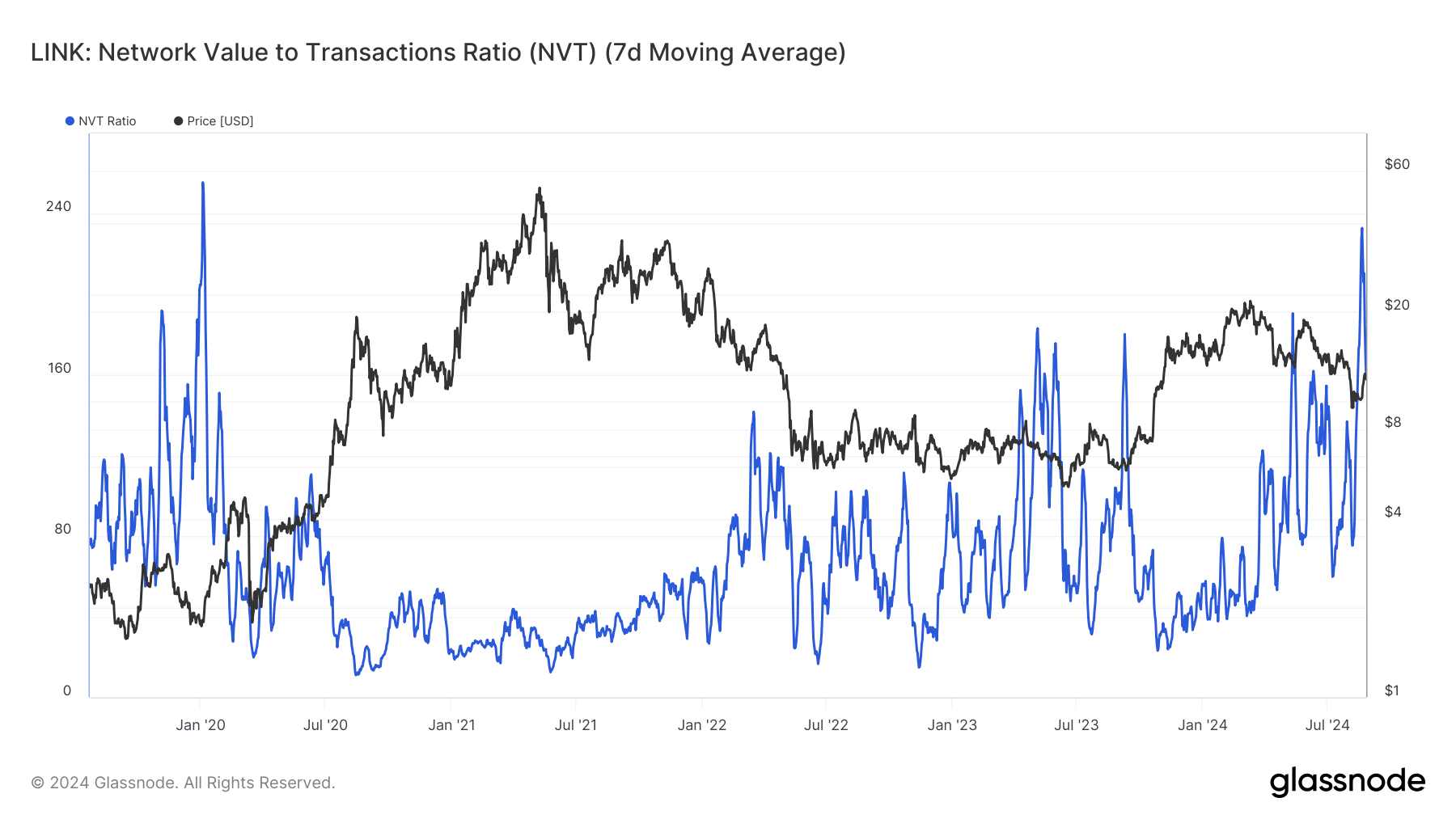

A key indicator of this change in sentiment is the Network Value to Transactions (NVT) ratio. This ratio is currently at a four-year and eight-month high and was last seen at this level in January 2020. The NVT ratio is a metric used to assess the valuation of an asset relative to its transaction activity.

The elevated NVT ratio suggests that LINK is highly overvalued compared to its actual network activity. This could indicate that the price is too far ahead of the underlying fundamentals.

As the bullish sentiment fades and the NVT ratio remains high, LINK investors may need to brace for possible price corrections.

LINK Price Prediction: Major Barrier Ahead

The Chainlink price at $12.00 seems to be turning the $12.35 resistance into a support level. This level has been tested multiple times as a rebound point, so a recovery above it will be crucial for LINK.

However, the mixed signals from the network and from LINK holders suggest a different path. Chainlink price could see a drop to $10.79, the local support floor. While a drop below this level is unlikely, unfortunate conditions could take the altcoin to $10.00. This would wipe out the 22% recovery from mid-August.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if the altcoin manages to sustain its rise and bounce off the support at $10.79, it could break the $12.35 mark. This would push the Chainlink price above $13.00 and invalidate the bearish thesis.

Disclaimer

Per the Trust Project’s guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions can change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.