Boxship orders exceed previous year and reach third highest level in the last 20 years

The appetite for new container ships remains high, reports BIMCO in its latest market analysis. The trade group emphasizes that after a brief pause, orders will rise sharply again at the end of 2023 and volumes are at their third highest level since 2008.

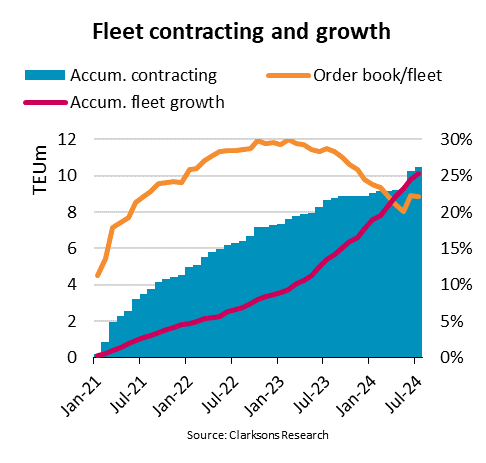

Contracts signed this year already exceed the total for the full year 2023, as Niels Rasmussen, Chief Shipping Analyst at BIMCO, points out. They estimate that the sector has contracted for 10.47 million TEU of new capacity since the beginning of 2021. Compared to the fleet size at the beginning of 2021, the contracted capacity will give the industry 44 percent of new capacity, according to BIMCO.

The first part of the wave began in late 2023 and has accelerated through 2024 with the arrival of the latest ultra-large vessels reaching new capacities. Yesterday, for example, Orient Overseas Container Line (OOCL) celebrated the christening of the company’s twelfth 24,188 TEU newbuild at a ceremony at Nantong COSCO KHI Ship Engineering Co. The new vessel, named OOCL Portugalis the last ship in the company’s new megaship series and was followed today by the christening of Maersk’s fourth 18,000 TEU methanol-powered container ship, Alette Maerskat a ceremony held jointly with Nike at the Port of Los Angeles.

The 1.59 million TEU capacity contracted so far for 2024 is the third highest since 2008 and is only surpassed by the first seven months of 2021 and 2022, says Rasmussen. Combined with the 8.86 million TEU contracted between 2021 and 2023, BIMCO highlights that the current wave has already surpassed the previous four-year contract record of 8.31 million TEU ordered between 2004 and 2007, and that there are still months left until 2024.

The pace is not expected to slow down. Maersk recently announced that it is working to finalize orders and charters for a total of 50 to 60 new dual-fuel vessels with a capacity of 800,000 TEU as part of a fleet renewal program. The company expects to deliver 160,000 TEU annually to ensure a steady flow of needed capacity for its network from 2026 to 2030. MSC also recently signed a new partnership agreement with China’s Hengli Heavy Industry, leading to speculation of further orders from the largest carrier. MSC already has over 6 million TEU of capacity and has ordered another 1.8 million TEU.

“The fleet is expected to grow by at least 12 percent through the end of the decade, representing a compound annual growth rate of 2.4 percent,” says Rasmussen. “Although cargo volume growth could match this pace, if fleet growth ends at a higher level and the Red Sea crisis ends, we could see a pronounced oversupply, causing demand for vessels to fall significantly.”

Due to increased demand, shipping companies have been slow to push forward with recycling. As they are forced to withdraw ships from normal Red Sea routes in 2024, shipping companies are keeping everything possible running to offset capacity constraints.

“Ship recycling activity has been very low since 2021,” says Rasmussen. BIMCO highlights that only 150 ships with a total capacity of just 240,000 TEU have been recycled since 2021. “In the coming years, recycling could increase significantly and partially or completely decommission the 10 percent of capacity and 20 percent of ships that are currently over 20 years old,” predicts Rasmussen.

So far, however, the average age continues to rise as recycling progresses slowly despite the new influx of new tonnage into the sector. According to BIMCO, the average age of container ships has increased from 13 years at the beginning of 2021 to 13.9 years today.

With recycling still low, they point out that overall fleet capacity has increased by a quarter since 2021. Alphaliner puts the sector at almost 7,100 active vessels and a total capacity of 30.5 million TEU. They estimate that the top 100 shipping companies still have well over 6 million TEU of capacity on their order books, and BIMCO questions how high this will rise.