Select Water Solutions insiders sold $638,000 worth of shares, suggesting caution

Choose Water Solutions, Inc. (NYSE:WTTR) shareholders may have reason to be concerned as several insiders have been selling their shares over the past year. When evaluating insider transactions, it is usually more useful to know if insiders are buying than if they are selling, as the latter is open to many interpretations. However, if several insiders are selling shares over a period of time, shareholders should take notice as this could potentially be a warning sign.

While we would never suggest that investors should base their decisions solely on the activities of a company’s management, we think it is perfectly logical to keep an eye on the activities of insiders.

Check out our latest analysis for Select Water Solutions

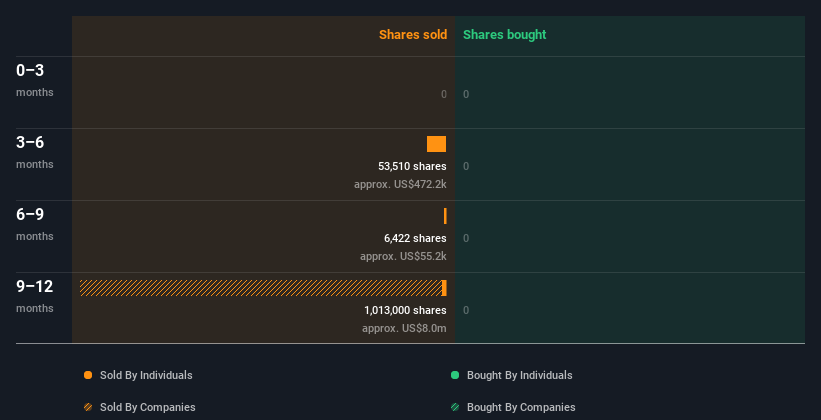

Selected insider transactions of Water Solutions in the last year

Over the last year, we could see that the largest insider sale was by Executive VP & CFO Christopher George, who sold $199,000 worth of shares at a price of about $8.63 per share. This means that an insider wanted to sell some shares even when the share price was below the current price of $11.50. When an insider sells below the current price, it suggests they thought that lower price was fair. This makes us wonder what they think of the (higher) recent valuation. While insider sales are sometimes discouraging, they are only a weak signal. This single sale only represented 8.3% of Christopher George’s stake.

In the last year, Select Water Solutions insiders have not purchased any company shares. Below is a visual representation of insider transactions (by companies and individuals) over the last 12 months. If you want to know exactly who sold, for how much and when, just click on the graphic below!

If you are like me, you will not don’t want to miss this free List of small-cap stocks that are not only bought by insiders but are also attractively valued.

Insider ownership

Looking at the total insider ownership in a company can help you assess whether they are well aligned with common shareholders. High levels of insider ownership often mean that company management is more mindful of shareholder interests. It appears that Select Water Solutions insiders own 4.3% of the company, worth about US$59 million. This level of insider ownership is good, but not particularly remarkable. It certainly suggests a reasonable level of alignment.

What could the insider transactions at Select Water Solutions tell us?

The fact that no insiders traded Select Water Solutions shares in the last quarter doesn’t mean much. Our analysis of Select Water Solutions’ insider transactions makes us cautious. But it’s good to see that insiders own shares in the company. While it’s good to know what’s happening with insider ownership and transactions, we make sure to also consider the risks associated with a stock before making an investment decision. To help with this, we found: 2 warning signs that you should check out to get a better idea of Select Water Solutions.

Naturally Select Water Solutions may not be the best stock to buy. You may want to see this free Collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulator. Currently, we only consider open market transactions and private disposals of direct holdings, but not derivative transactions or indirect holdings.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.