77 Bank (TSE:8341) will pay a higher dividend than last year at ¥70.00

The Board of 77 Bank, Ltd. (TSE:8341) has announced that it will pay its dividend of 70.00 yen on December 9. This is a higher payment than the comparable dividend paid last year. Based on this payment, the company’s dividend yield will be 3.4%, which is fairly typical for the industry.

Check out our latest analysis for 77 Bank

77 The bank’s earnings will easily cover the distributions

While a solid dividend yield is nice, it only really helps us if the distribution is sustainable.

77 Bank has established itself as a dividend-paying company, distributing profits to shareholders for over 10 years. Based on 77 Bank’s latest earnings report, the payout ratio is a decent 28%, which means the company can pay its dividend with some room to maneuver.

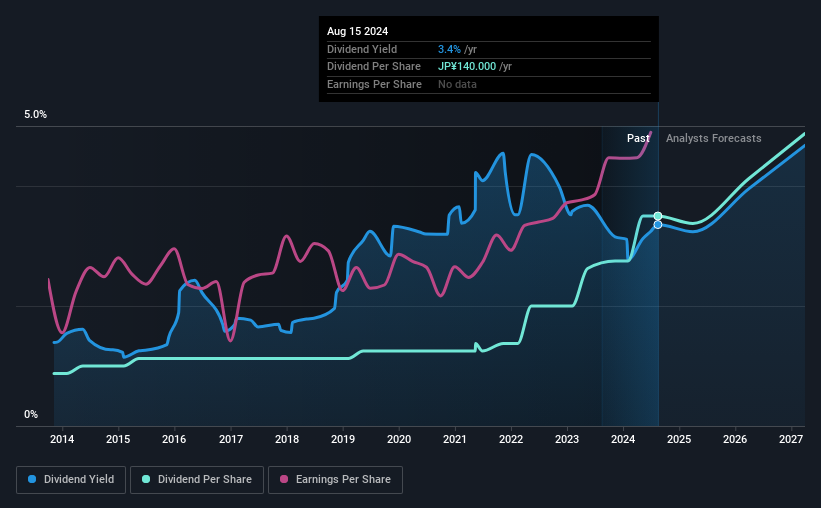

Next year, EPS is expected to grow by 6.4%. If the dividend follows recent trends, we estimate the future payout ratio to be 32%, which is in the range where we are comfortable with the sustainability of the dividend.

77 Bank has a solid track record

The company has a long history of paying dividends with very little fluctuation. Since 2014, the annual payment at that time was 35.00 yen, compared to the last annual payment of 140.00 yen. This means that the company has increased its payouts by about 15% annually during this period. It is pleasing to see that there has been strong dividend growth and that there have been no cuts for a long time.

The dividend is likely to increase

Some investors will be eager to buy some shares of the company given its dividend history. It is encouraging to see that 77 Bank has grown earnings per share at 16% per year over the past five years. A low payout ratio and decent growth suggest that the company is reinvesting well and there is also plenty of room to increase the dividend over time.

We really like 77 Bank’s dividend

In summary, a dividend increase is always positive and we are particularly pleased with its overall sustainability. Distributions are fairly easily covered by profits, which are also converted into cash flows. Taking all these factors into account, we believe this has solid potential as a dividend stock.

Companies with a stable dividend policy are likely to attract more interest from investors than those with a more inconsistent approach. However, there are other things investors need to consider when analyzing stock performance. Is management confident in delivering performance? Check out their shareholdings in 77 Bank in our latest insider ownership analysis. If you are a dividend investor, you should also check out our curated list of high dividend stocks.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.