After a price jump of 32%, the shares of Far East Smarter Energy Co., Ltd. (SHSE:600869) do not go unnoticed

Far East Smarter Energy Co., Ltd. (SHSE:600869) shareholders are no doubt pleased to see the share price up 32% over the past month, although it is still trying to make up for the ground it recently lost. Unfortunately, last month’s gains barely made up for last year’s losses, with the stock still down 30% in that time.

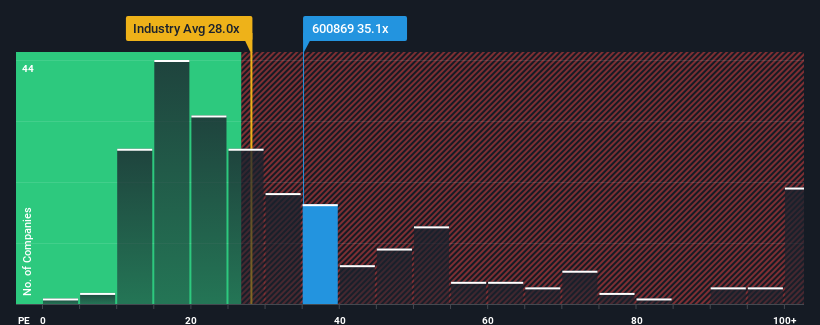

Since the price has risen sharply, Far East Smarter Energy’s price-to-earnings (P/E) ratio of 35.1 might look like a bargain right now compared to the Chinese market, where about half of the companies have P/E ratios below 27 and even P/E ratios below 16 are quite common. However, the P/E ratio might be high for a reason and further research is needed to determine if it is justified.

While the market has seen earnings growth recently, Far East Smarter Energy’s earnings have gone into reverse, which is not good. It could be that many are expecting the dismal earnings performance to rebound significantly, which has prevented the P/E ratio from collapsing. If not, existing shareholders could be extremely nervous about the profitability of the share price.

Check out our latest analysis for Far East Smarter Energy

If you want to know what analysts are predicting for the future, you should check out our free Report on Far East Smarter Energy.

Is there enough growth for smarter energy in the Far East?

A P/E ratio as high as Far East Smarter Energy’s would only be truly comfortable if the company is on track to outperform the market growth.

If we look at the earnings over the last year, we are disheartened to see that the company’s earnings have fallen by 62%. Unfortunately, this has brought the company back to where it was three years ago, when EPS growth was virtually nonexistent during that time. So, it’s fair to say that the company’s earnings growth has been inconsistent lately.

According to the only analyst covering the company, earnings per share are expected to grow 81% per year over the next three years, well above the 24% annual growth rate forecast for the overall market.

With this information, we can see why Far East Smarter Energy is trading at such a high P/E compared to the market. It seems that most investors are anticipating this strong future growth and are willing to pay more for the stock.

What can we learn from Far East Smarter Energy’s P/E ratio?

Far East Smarter Energy’s P/E ratio is rising sharply as shares have risen sharply. We would say that the price-to-earnings ratio is not primarily used as a valuation tool, but rather to gauge current investor sentiment and future expectations.

As we suspected, our study of Far East Smarter Energy’s analyst forecasts found that its above-average earnings outlook is contributing to its high P/E ratio. At this point, investors believe that the potential for earnings deterioration is not large enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other important risk factors that need to be considered and we have found 5 warning signs for Far East Smarter Energy (1 makes us a little uncomfortable!) that you should know before investing here.

If you uncertain about the strength of Far East Smarter Energy’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.