Should you be impressed by American States Water Company’s (NYSE:AWR) return on equity (ROE)?

One of the best investments we can make is in our own knowledge and skills. With that in mind, this article will explain how we can use return on equity (ROE) to better understand a company. As part of the learning-by-doing principle, we will look at ROE to gain a better understanding of American States Water Company (NYSE:AWR).

Return on equity (ROE) is a measure of how effectively a company increases its value and manages its investors’ money. Simply put, it is used to assess a company’s profitability relative to its equity.

Check out our latest analysis on water in the American states.

How do you calculate return on equity?

The Formula for return on equity Is:

Return on equity = Net profit (from continuing operations) ÷ Equity

Based on the above formula, the ROE for American States Water is:

13% = $107 million ÷ $833 million (based on the trailing twelve months ending June 2024).

The “return” is the profit over the last twelve months. You can also imagine it like this: for every dollar of equity, the company was able to generate $0.13 in profit.

Does American States Water have a good return on equity?

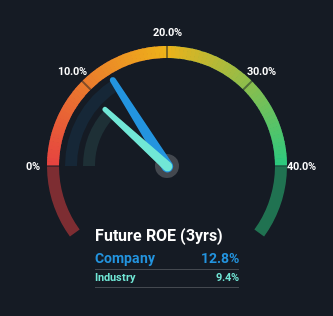

By comparing a company’s return on equity to the industry average, we can quickly gauge how good it is doing. The limitation of this approach is that some companies are very different from others, even within the same industry. As can be seen in the image below, American States Water has a better return on equity than the average (9.4%) in the Water Utilities industry.

That’s what we like to see. However, keep in mind that a high return on equity does not necessarily indicate efficient profit generation. Aside from changes in net income, a high return on equity can also be the result of high debt to equity, which indicates risk. Our risk dashboard should include the two risks we’ve identified for American States Water.

Why you should consider debt when looking at ROE

Most companies need money – from somewhere – to grow their profits. This money can come from issuing stock, retained earnings, or debt. In the first two cases, return on equity will capture this use of capital for growth. In the latter case, the debt required for growth will increase returns but have no impact on equity. Thus, the use of debt can improve return on equity, but in the case of stormy weather, metaphorically speaking, with added risk.

American States Water’s debt and 13% return on equity

American States Water actually takes on a lot of debt to boost returns. Its debt to equity ratio is 1.12. Although the return on equity is quite respectable, the amount of debt the company is currently carrying is not ideal. Debt increases risk and reduces the company’s options in the future, so one generally wants to get good returns from using debt.

Summary

Return on equity is a way to compare the business quality of different companies. A company that can generate a high return on equity without any debt could be considered a high-quality company. If two companies have the same return on equity, I would generally prefer the company with the lower debt.

However, if a company is of high quality, the market will often bid it up at a price that reflects this. The rate at which earnings are expected to grow, relative to the earnings growth expectations reflected in the current price, must also be considered, so you may want to take a look at this data-rich interactive chart of forecasts for the company.

But please note: American States Water may not be the best stock to buySo take a look at the free List of interesting companies with high return on equity and low debt.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.