Far West sees increase in bond sales in the first half of the year, driven by California

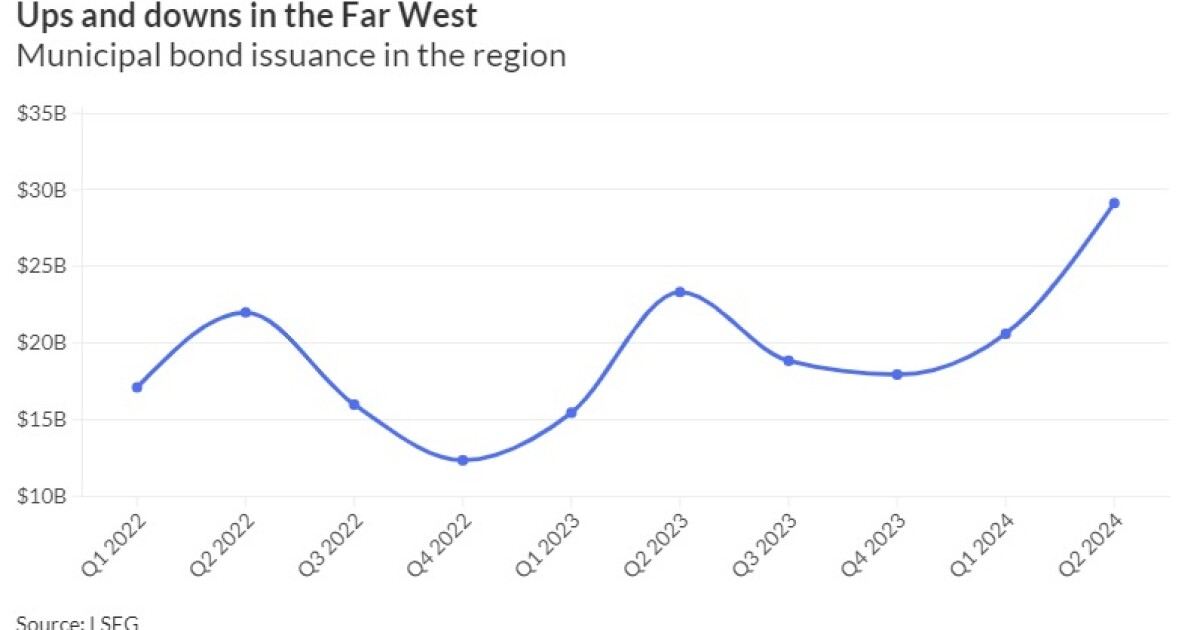

In line with national trends, most far-western states saw double-digit increases in municipal bond issuance during the first half of the year as market conditions for borrowers improved.

According to LSEG Data & Analytics, issuance in the nine-state region totaled $49.7 billion, up 28.3 percent from the same period last year ($38.7 billion). The number of transactions rose from 458 to 507, including nine megadeals valued at over $1 billion.

The increase was due to repayments, which more than doubled to $16.2 billion, while new money transactions fell 3 percent. Financings, which included both repayments and new money, rose 69 percent, according to the data.

The development was uneven across states. There was an increase in five states, most notably Alaska, which rose by 122% to $353 million.

A significant increase in emissions from California, the region’s leading state, gave the Far West an increase compared to the previous year.

Four states – Hawaii, Montana, Oregon and Wyoming – saw a decline in emissions, led by Hawaii, which saw a 53% decline.

Nationwide, bond sales also rose above mid-year levels, increasing more than 32% to $242 billion from $183 billion in the same period in 2023.

Borrowing increased as cities and states took advantage of favorable market conditions compared to the weak issuance and volatile markets of recent years. Some issuers that had postponed projects finally brought them to market. The cessation of pandemic aid may also have played a role. Many issuers also engaged in “election forward” deals to complete deals before November and avoid any uncertainty related to the election.

“The bond business is running like clockwork,” said Justin Cooper, head of finance at Orrick, Herrington & Sutcliffe LLP. The market has begun to recover from the abrupt end of a decade of low interest rates, he said.

“Now everyone is reset with new starting points,” Cooper said. “We understand that money now costs money – and bonds cost less than other money, so everyone is back in business.”

Bonds classified by LSEG for the education sector were the top sector in the Far West at $13.8 billion, up 32 percent from the same period last year. Healthcare issuances rose a whopping 1,333 percent to total $3.8 billion from 25 transactions, compared to $272 million from 11 transactions last year. The California Health Facilities Financing Authority was the fifth-largest borrower during the period at $2.1 billion.

The volume in the transport sector doubled to 7.3 billion dollars.

As usual, California topped the region, with issuers there selling $36.1 billion worth of securities in the first six months of 2024, up 32% year over year and more than any other state in the first half of the year.

California accounted for eight of the region’s top 10 borrowers, led by the state government, which took on $4 billion in debt in the first half of the year. The Los Angeles United School District was the region’s third-largest issuer in the first half of the year, just behind

LAUSD was one of the few large issuers that took advantage of the market situation to redeem its BABs through extraordinary redemption provisions, a move that was not without controversy among investors who were reluctant to sell the securities.

The third largest issuer in the region, the Regents of the University of California, repaid BABs worth $1.09 billion in early March, after which

The condition of

Looking ahead, the Golden State is expected to continue its credit trend. The state will end the second half of the year with a

In November, voters will consider statewide borrowing proposals, including $10 billion for schools and $10 billion for climate and environmental projects, as well as dozens of local initiatives.

Another measure, Proposition 5, could indirectly increase future issuance by local governments by reducing the vote required to approve housing and infrastructure bonds from two-thirds to 55 percent.

Last week,

Spreads in California have widened slightly over the course of the year, said Cooper Howard, director and bond strategist at Schwab.

“That’s partly because of the budget problems they’re having right now,” he said. The state is struggling to balance a budget deficit.

Schwab’s overall assessment nationally is that credit quality has peaked but is not deteriorating significantly, Howard said.

“California is one of the outliers,” he said. “Of course, there are budget deficits and rainy day reserves, and things are not great. So we expect the pace of modernization to slow down a little bit from here.”

Issuers in Washington sold $7.59 billion in bonds, making the region the second-largest source of bonds in the first half of the year. Volume was up 70 percent from the same period last year, but the increase was largely due to the state’s decision to hold its annual summer sale in June instead of July, Aaron Sherman said. Communications Director for State Treasurer Mike Pellicciotti.

The deal increased the state’s total bond and equity securities volume by about 8 percent, Sherman said.

“This is due to slightly higher borrowing in the capital and transport budgets and slightly lower issuance of refinancing,” he said.

In the area of underwriting, there was a sharp increase of 41% in negotiated deals compared to the same period last year, with a notional value of $41.7 billion and 413 deals. Competitive deals fell by 2.4% to a total of $7.3 billion and 70 deals. Private placements fell by 57% to a total of $726 million.

BofA Securities ranked first among the region’s leading book-running managers. LSEG ranked the firm at $9.2 billion in notional value, followed by JP Morgan Securities at $6.1 billion. Morgan Stanley came in third at $5.3 billion, followed by Wells Fargo at $4.6 billion. Jefferies ranked fifth at $4.17 billion, closely followed by RBC Capital Markets at $4.14 billion.

Among financial advisors, PFM Financial Advisors ranked first with a face value of $12 billion, followed by Public Resources Advisory Group with $10.6 billion. KNN Public Finance ranked third, followed by Piper Sandler and Montague DeRose & Associates.

Orrick Herrington & Sutcliffe remained comfortably at the top of the Far West Bond Counsel rankings with $15.2 billion in face value. Stradling Yocca Carlson & Rauth came in second with $5.9 billion. Hawkins Delafield & Wood took third place.