Young Fast Optoelectronics Co., Ltd. (TWSE:3622) looks interesting and will soon pay a dividend

Some investors rely on dividends to grow their wealth. If you are one of these dividend detectives, you might be interested to know that Young Fast Optoelectronics Co., Ltd. (TWSE:3622) will trade ex-dividend in just four days. The ex-dividend date is usually one business day before the record date, which is the date on which you, as a shareholder, must be on record in the company’s books to receive the dividend. The ex-dividend date is important because any transaction in a share must have been completed before the record date to be eligible for the dividend. In other words, investors can purchase Young Fast Optoelectronics shares before August 28th to be eligible for the dividend, which will be paid on September 20th.

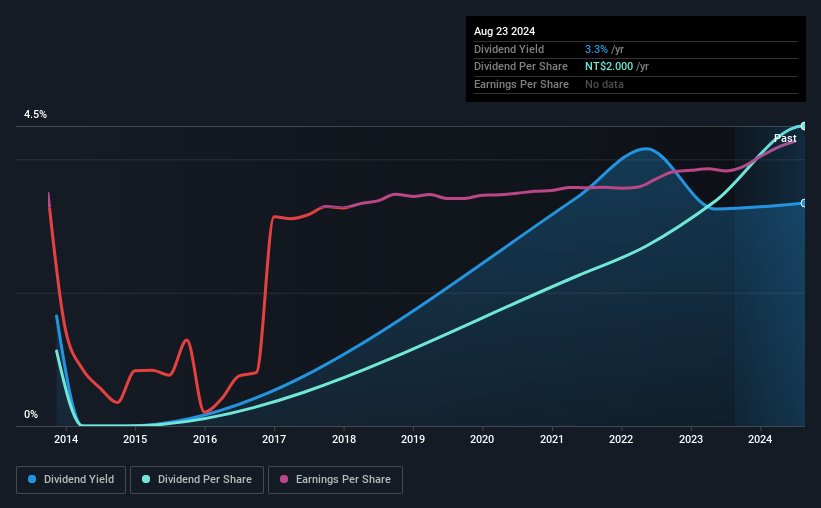

The company’s next dividend payment will be NT$2.00 per share, after the company paid out a total of NT$2.00 to shareholders last year. Calculating last year’s payments shows that Young Fast Optoelectronics has yielded 3.3% on the current share price of NT$59.80. Dividends contribute significantly to investment returns for long-term holders, but only if the dividend is kept paid. Therefore, readers should always check if Young Fast Optoelectronics has been able to increase its dividends, or if the dividend is at risk of being cut.

Check out our latest analysis for Young Fast Optoelectronics

Dividends are usually paid out of company profits, so if a company pays out more than it earns, it is usually at higher risk of a dividend cut. Fortunately, Young Fast Optoelectronics’ payout ratio is modest at just 41% of profits. However, cash flow is usually more important than profits for assessing dividend sustainability, so we should always check if the company generated enough cash to afford the dividend. It paid out 40% of its free cash flow as dividends, a comfortable payout level for most companies.

It’s positive to see that Young Fast Optoelectronics’s dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually indicates a greater margin of safety before the dividend gets cut.

Click here to see how much profit Young Fast Optoelectronics has paid out over the past 12 months.

Have earnings and dividends increased?

Companies with consistently growing earnings per share generally make the best dividend stocks because they usually have an easier time increasing dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That’s why it’s reassuring to see Young Fast Optoelectronics’ earnings have skyrocketed 42% per year over the past five years. Young Fast Optoelectronics is paying out less than half of its earnings and cash flow, while simultaneously growing earnings per share at a rapid pace. This is a very favorable combination that can often result in dividends multiplying over the long term as earnings grow and the company pays out a higher percentage of its earnings.

Many investors judge a company’s dividend performance by looking at how dividend payments have changed over time. Over the past 10 years, Young Fast Optoelectronics has increased its dividend by an average of about 15% per year. Both earnings per share and dividends have risen sharply recently, which is encouraging.

To sum it up

Is Young Fast Optoelectronics worth buying for its dividend? Young Fast Optoelectronics has been growing its earnings per share while reinvesting in the business. Unfortunately, the company has cut the dividend at least once in the last 10 years, but the conservative payout ratio makes the current dividend seem sustainable. Young Fast Optoelectronics looks solid overall on this analysis, and we would definitely consider investigating it further.

With this in mind, an important part of a thorough stock analysis is to be aware of the risks the stock is currently exposed to. Our analysis shows 2 warning signs for Young Fast Optoelectronics and you should be aware of this before you buy stocks.

In general, we would not recommend simply buying the first dividend stock you see. Here is a curated list of interesting stocks with high dividend numbers.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.