Entrust (TSE:7191) will pay a higher dividend than last year at ¥12.50

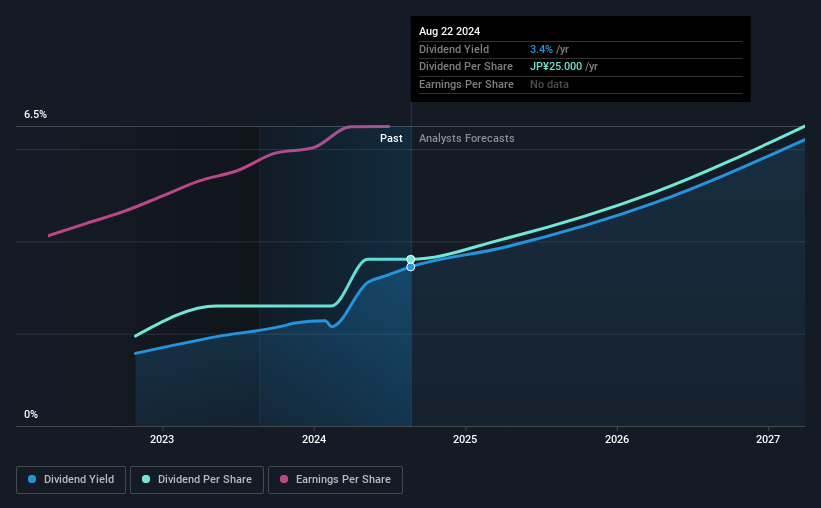

Entrust Inc. (TSE:7191) has announced that it will increase its dividend to 12.50 yen compared to last year’s payout on December 4. Based on this payment, the company’s dividend yield will be 3.4%, which is fairly typical for the industry.

Check out our latest analysis for Entrust

Entrust’s earnings easily cover distributions

We want a dividend to remain consistent over the long term, so it’s important to check whether it’s sustainable. Before this announcement, Entrust was paying a whopping 378% in dividends, but this only represented 33% of its total profit. Such a high payout ratio could put pressure on the dividend and force the company to cut it in the future if it hits tough times.

Next year, EPS is expected to grow by 11.5%. If the dividend stays on this path, the payout ratio could be 35% next year, which we believe can be quite sustainable going forward.

Entrust continues to build on its track record

Looking back, the dividend has been stable, but the company has not been paying a dividend for very long, so we cannot be sure that the dividend will remain stable in all economic environments. The annual payment over the last 2 years was ¥13.50 in 2022, and the payment in the last fiscal year was ¥25.00. This represents a compound annual growth rate (CAGR) of approximately 36% per year over that period. The dividend has grown quickly, but with such a short payment history, we cannot be sure if the payment can continue to grow in the long term, so caution may be warranted.

The dividend has growth potential

Investors in the company will be happy to have been receiving dividends for some time. It is encouraging to see that Entrust has been able to grow its earnings per share by 9.5% per year over the past five years. A low payout ratio and decent growth suggest that the company is reinvesting well and there is also plenty of room to increase the dividend over time.

Our thoughts on Entrust’s dividend

Overall, this is probably not a great dividend stock, even if the dividend is currently being increased. Given the lack of cash flows, it is hard to imagine the company being able to maintain a dividend payment. Overall, we do not believe this company has what it takes to be a good dividend stock.

Investors generally prefer companies with a consistent, stable dividend policy over those with irregular dividend policies. However, despite the importance of dividend payments, they are not the only factors our readers should consider when evaluating a company. For example, we have selected the following: 1 warning signal for Entrust investors should consider. Is Entrust not quite the opportunity you have been looking for? Check out our Selection of the highest dividend stocks.

Valuation is complex, but we are here to simplify it.

Discover whether Entrust could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.