Are robust financials the reason behind the recent rise in Costco Wholesale Corporation (NASDAQ: COST) stock?

Most readers will already be aware that Costco Wholesale (NASDAQ:COST) shares are up 11% over the past three months. Given that the market rewards strong financials over the long term, we wonder if that’s the case in this case. We’ll be paying particular attention to Costco Wholesale’s return on equity today.

Return on equity (ROE) is a measure of how effectively a company increases its value and manages its investors’ money. In other words, it is a profitability ratio that measures the return on the capital provided by the company’s shareholders.

Check out our latest analysis for Costco Wholesale

How do you calculate return on equity?

ROE can be calculated using the following formula:

Return on equity = Net profit (from continuing operations) ÷ Equity

Based on the above formula, the return on equity for Costco Wholesale is:

33% = $7.2 billion ÷ $22 billion (based on the trailing twelve months ending May 2024).

The “return” is the profit over the last twelve months. This means that for every dollar invested by its shareholders, the company earned a profit of $0.33.

What is the relationship between ROE and earnings growth?

We’ve already established that return on equity (ROE) serves as an efficient measure of a company’s future earnings. Depending on how much of those earnings the company reinvests or “retains” and how effectively it does so, we can judge a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the return on equity and earnings retention, the higher a company’s growth rate will be compared to companies that don’t necessarily have these characteristics.

Costco Wholesale’s earnings growth and return on equity of 33%

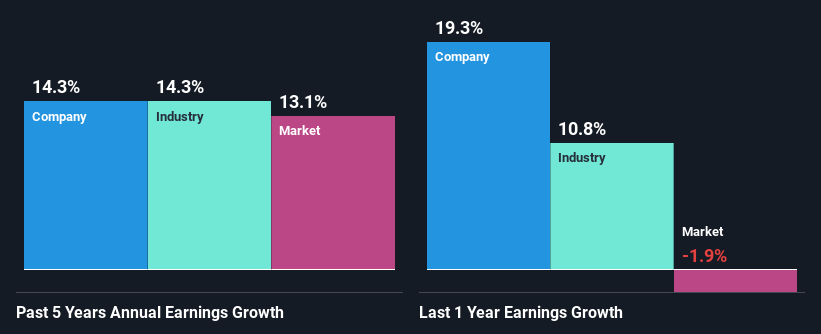

First of all, Costco Wholesale has a pretty high return on equity, which is interesting. In addition, the company’s return on equity is higher than the industry average of 11%, which is quite remarkable. This has likely paved the way for the modest 14% net income growth that Costco Wholesale has seen over the past five years.

We then compared Costco Wholesale’s net income growth to that of the industry and found that the company’s growth was in line with the average industry growth of 14% over the same 5-year period.

The basis for valuing a company depends largely on its earnings growth. The investor should try to determine if the expected earnings growth or decline, whichever may be the case, is built into the price. This will give him an idea of whether the stock is heading for clear blue waters or if it is drifting into swampy waters. What is COST worth today? The intrinsic value infographic in our free research report helps visualize whether COST is currently mispriced by the market.

Does Costco Wholesale use its retained earnings effectively?

Costco Wholesale has a three-year average payout ratio of 26%, meaning the company retains the remaining 74% of its earnings. This suggests the dividend is well covered, and given the company’s decent growth, it looks like management is reinvesting its profits efficiently.

In addition, Costco Wholesale is committed to continuing to share its profits with shareholders, which we infer from its long history of paying dividends for at least ten years. Our latest analyst data shows that the company’s future payout ratio is expected to be around 24% over the next three years. However, projections suggest that Costco Wholesale’s future return on equity will decline to 25%, although the company’s payout ratio is not expected to increase significantly.

Summary

Overall, we think Costco Wholesale’s performance has been quite good. We particularly like that the company is reinvesting heavily in its business at a high rate of return. Unsurprisingly, this has resulted in impressive earnings growth. However, recent industry analyst forecasts show that the company’s earnings growth is expected to slow. Are these analyst expectations based on broader expectations for the industry or on the company’s fundamentals? Click here to go to our analyst forecasts page for the company.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.