BYD Auto’s rapid growth in the ASEAN-5 region: reasons and challenges

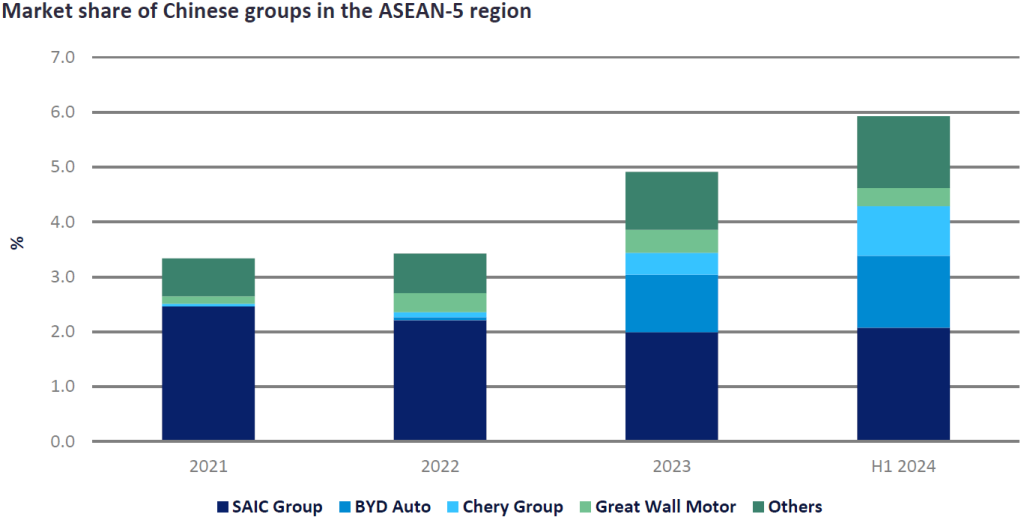

Chinese brands accounted for 3.4% of ASEAN light vehicle (LV) sales in 2021-22. This share increased to 4.9% in 2023 and 5.9% in H1 2024. SAIC Group was the largest of the Chinese groups in the region. Although SAIC expanded its model range and presence in all ASEAN-5 markets, the group’s market share declined from 2.5% in 2021 to 2.1% in H1 2024, mainly due to weak sales in the Thai market.

Looking closer, BYD Auto and Chery Group have been the two main growth drivers for Chinese brands in the region in recent years. Together, the two groups’ market share was only 0.1% in 2022. However, BYD Auto’s share increased to 1.0% in 2023 and 1.3% in the first half of 2024, while Chery Group’s share improved to 0.4% in 2023 and 0.9% in the first half of 2024.

The increasing market success of BYD Auto and Chery Group is attributed to their entry into new markets and acquisition of market share from existing players. BYD Auto started operations in Thailand in 2022 and expanded to Malaysia and the Philippines in 2023, followed by Indonesia and Vietnam in 2024. In 2019, Chery Group started operations in the Philippines, followed by Malaysia and Indonesia in 2023 and Thailand and Vietnam in 2024.

With only one brand in all ASEAN-5 markets, BYD Auto has seen faster sales and market share growth than Chery Auto, even though Chery Auto has four sub-brands: Chery, OMODA, Jaecoo and Jetour, each positioned differently in different markets. Interestingly, Jetour and Chery are not present in the Thai market, but all Chery Group sub-brands are active in Indonesia. Jetour is positioned as the most cost-effective brand, while Jaecoo is positioned as a premium brand compared to Chery and OMODA.

The main differences between BYD Auto and Chery Group are as follows:

BYD started its operations exclusively with battery electric vehicle (BEV) models, while Chery Group focused mainly on non-BEV models. Although the BEV market is significantly smaller than the non-BEV segment, Chery Auto has to compete against established players, especially dominant Japanese brands. In contrast, BYD Auto is operating in a new market where Japanese manufacturers are not yet present. In addition, BEV sales have been boosted by demand from early adopters and government incentives such as Thailand’s cash subsidy program and import duty exemption for BEVs in Malaysia.

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain a competitive advantage.

Company profile – free sample

Your download email will arrive shortly

We are confident in the unique quality of our company profiles, but we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by filling out the form below.

By GlobalData

In addition, the segmentation of BYD Auto and Chery Group is different. BYD launched with three models in different segments: Dolphin Sub-Compact Car, Atto 3 Compact SUV and Seal Midsize Car. Chery Group, on the other hand, mainly focuses on the SUV segment in different sizes: Sub-Compact, Compact and Midsize, with only one Mini BEV car in the Philippines. This could lead to Chery Group’s SUVs cannibalizing each other, while BYD’s models do not have this problem.

In addition, each BYD model targets key segments. For example, BYD Thailand has positioned the Dolphin to compete in Thailand’s largest passenger car segment, the sub-compact car or eco car. The Atto 3 targets the fast-growing compact SUV segment, while the Seal competes directly with Tesla’s Model 3.

In Indonesia, BYD immediately launched the M6 MPV to gain market share in the MPV segment, which is the largest segment in Indonesia. This shows that BYD Auto understands customer needs and behavior in each market. In addition, all BYD models are competitively priced compared to non-BEV models in the same segment.

In a Article from earlier this yearI mentioned that Chinese brands that specialize exclusively in BEVs will face obstacles in the medium term. Although demand for BEVs will continue to grow, they will not become the leading powertrain type in the market. Moreover, the number of players is now growing faster than demand. BYD Auto seems to understand this limitation and the problems of buyers who cannot get used to owning BEVs, such as charging stations and range. This prompted BYD to launch the Sealion plug-in hybrid electric vehicle (PHEV) in Thailand and the Philippines in the third quarter of 2024. The model is also scheduled to debut in other ASEAN-5 markets next year. Therefore, BYD Auto has the potential to become one of the top ten best-selling brands in the region after entering the non-BEV segment. Currently, BYD is the sixteenth Best-selling brand in ASEAN in H1 2024.

However, BYD faces several challenges:

- BYD Thailand has reduced the price of the 2023 model year Atto 3 from THB 1.2 million to THB 860,000 in an effort to reduce inventory and increase sales. This price-cutting strategy could impact brand image, resale value and willingness to purchase as it could negatively impact future buyers who want to resell the vehicle as a down payment on a new one.

- After-sales service is yet to prove itself. After launching the Sealion PHEV in Thailand, the company has yet to disclose maintenance costs and details, which are crucial to vehicle ownership.

- The durability of the products, an important factor for the dominant Japanese brands, remains questionable.

- We also expect competing automakers to change their strategies to compete with the fast-growing BYD Auto – not just Japanese brands, but also other Chinese companies.

Titikorn Lertsirirungsun, Senior Manager, Southeast Asia Forecast, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center..