The return trends at Aris Water Solutions (NYSE:ARIS) look promising

What trends should we look for when identifying stocks that can multiply in value over the long term? A common approach is to find a company that Returns on capital employed (ROCE), combined with a growing Crowd of the capital employed. Simply put, these types of companies are compound interest machines, meaning that they continually reinvest their profits at ever-higher returns. Speaking of which, we have seen some big changes in Aris Water Solutions (NYSE:ARIS) returns on capital, so let’s take a look.

Return on Capital Employed (ROCE): What is it?

For those who don’t know, ROCE is a measure of a company’s annual profit before tax (its return) relative to the capital employed in the business. Analysts use this formula to calculate it for Aris Water Solutions:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

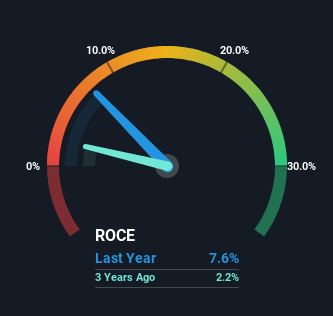

0.076 = $99 million ÷ ($1.4 billion – $95 million) (Based on the last twelve months to June 2024).

So, Aris Water Solutions has a ROCE of 7.6%. Ultimately, this is a low return and is below the industry average for commercial services of 9.6%.

Check out our latest analysis for Aris Water Solutions

In the chart above, we’ve compared Aris Water Solutions’ past ROCE with its past performance, but the future is arguably more important. If you want to know what analysts are predicting for the future, you should check out our free analyst report for Aris Water Solutions.

So how is Aris Water Solutions’ ROCE developing?

We are pleased to see ROCE moving in the right direction, even though it is currently low. Over the last four years, return on capital has increased significantly to 7.6%. Essentially, the company is earning more per dollar of capital invested, and in addition, 45% more capital is now being deployed. So we are very excited about what we are seeing at Aris Water Solutions thanks to its ability to profitably reinvest capital.

The most important things to take away

In summary, it’s great to see that Aris Water Solutions can generate returns by consistently reinvesting capital at increasing rates of return, as these are some of the key ingredients of these sought-after multibaggers. And investors seem to expect more of the same in the future, as the stock has returned shareholders 54% over the last year, so we think it’s worth checking to see if these trends will continue.

If you want to know more about Aris Water Solutions, we discovered: 3 warning signs, and 1 of them is potentially serious.

Although Aris Water Solutions does not have the highest return, check out this free List of companies with solid balance sheets and high returns on equity.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.