Regions Financial (NYSE:RF)’s upcoming dividend will be higher than last year

Regions Financial Company (NYSE:RF) announced that it will increase its dividend on October 1 to $0.25 from the comparable payment made last year. This brings the annual payment to 4.6% of the share price, which is above what most companies in the industry pay.

Check out our latest analysis for Regions Financial

Regions Financial’s earnings will easily cover the distributions

A high dividend payout over a few years doesn’t mean much if it can’t be sustained.

Regions Financial has paid dividends for at least 10 years, giving it a long history of returning a portion of its profits to shareholders. The company’s payout ratio comes from its most recent earnings report at 54%, meaning Regions Financial could pay its last dividend without putting pressure on its balance sheet.

EPS growth of 25.3% is expected over the next three years. Analysts expect the future payout ratio to be 60% over the same period. This is in a range that makes us comfortable with the sustainability of the dividend.

Regions Financial has a solid track record

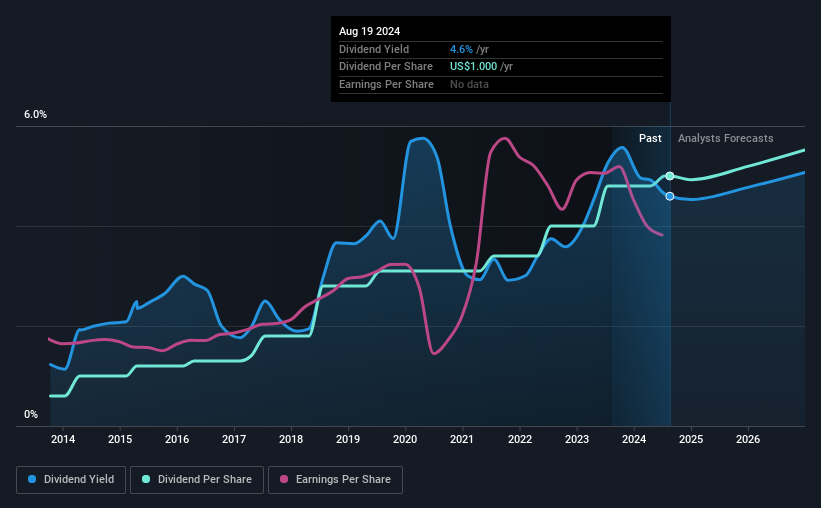

The company has a long history of paying dividends with very little fluctuation. Since 2014, the annual payment at that time was $0.12, compared to the last full-year payment of $1.00. This means that the company has increased its payouts by about 24% annually during that time. It is encouraging to see that there has been strong dividend growth and that there have been no cuts in a long time.

Dividend growth prospects are limited

Investors in the company will be happy to have been receiving dividends for some time. Earnings have grown at about 4.6% per year over the past five years, which isn’t huge, but it’s still better than seeing them shrink. The company has grown at a fairly modest 4.6% per year and is paying out a lot of its profits to shareholders. That’s not bad in itself, but if earnings growth isn’t picking up, we wouldn’t expect dividends to grow either.

We like Regions Financial’s dividend very much

Overall, we think this could be an attractive dividend stock, and it will get even better by paying a higher dividend this year. Earnings easily cover distributions, and the company generates plenty of cash. All in all, this stock meets many of the criteria we look for when selecting a dividend stock.

It is important to note that companies with a consistent dividend policy generate more confidence among investors than those with an irregular one. However, there are other things that investors need to consider when analyzing stock performance. Earnings growth is generally a good sign for the future value of companies’ dividend payments. See if the 16 Regions Financial analysts we track agree with our free Report on analyst estimates for the company. Looking for more high yield dividend ideas? Try our Collection of strong dividend payers.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.