With Maybank MAE you can now add multiple M2U accounts on a single device

KUALA LUMPUR, June 27 – Maybank has introduced the Single Device Access feature on its MAE app to make it easier for sole proprietors who need to manage multiple M2U accounts. Previously, users with different business accounts had to set up MAE apps on different devices. With the new feature, sole proprietors can now have up to 5 M2U accounts in a single MAE app on one device.

According to Maybank, the Single Device Access feature will benefit Maybank’s sole proprietorship customers and enable them to view their financial activities across all linked accounts on a single device, eliminating the need to operate multiple devices, saving them time and providing added convenience when banking online.

Maybank’s Head of Community Financial Service Malaysia, Datuk Hamirullah Boorhan, said: “This new feature not only simplifies the banking experience of our sole proprietor customers but also gives them peace of mind by implementing additional security measures including Secure2u and the ‘Kill Switch’ feature. As security remains Maybank’s top priority, each M2U gateway has its own Secure2u for transaction approval, ensuring the highest level of protection. Sole proprietors can then validate transactions seamlessly within the MAE app.”

To use the Single Device Access feature, you must ensure that you update the MAE app to version 0.9.25 or higher. It is available on the Apple App Store, Google Play Store, and Huawei App Gallery.

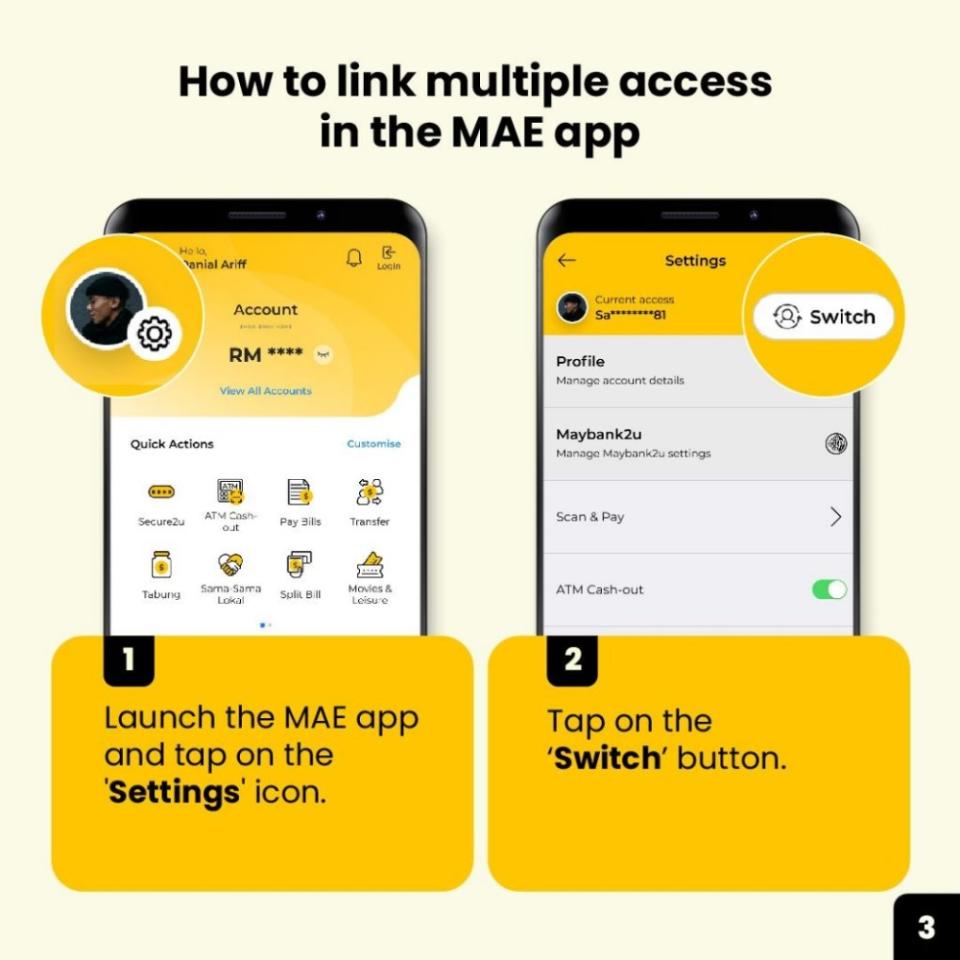

How do I add multiple M2U bank accounts in MAE?

This is how you can add multiple M2U accounts in the MAE app.

Step 1: Launch the MAE app and then tap the Settings icon in the top left corner.

Step 2: On your MAE settings page, tap the Switch button in the top right corner.

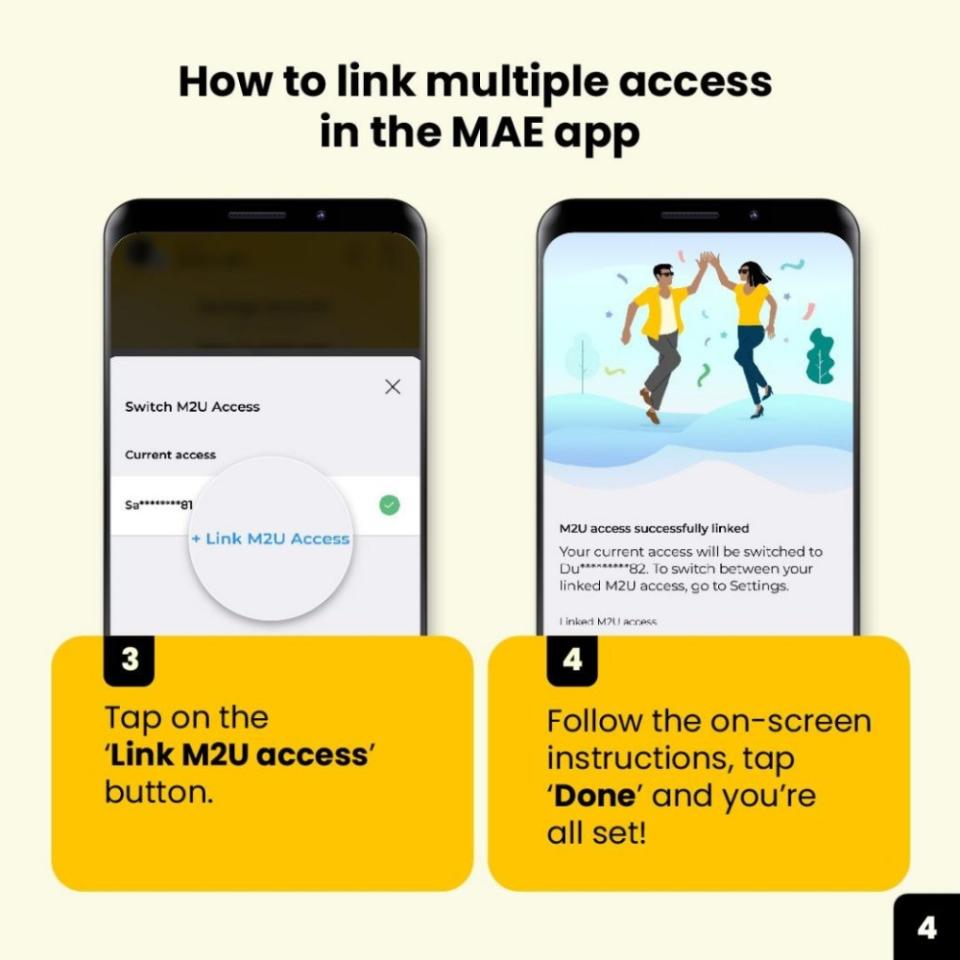

Step 3: On the Manage M2U Access page, tap Link M2U Access at the bottom of the screen

Step 4: Follow the on-screen instructions and tap Done.

What you should know about Maybank’s Single Device Access on MAE

As mentioned earlier, you can set up up to 5 accounts in a single MAE app. This can include 1 individual and 4 sole proprietorship accounts, or 5 sole proprietorship accounts in a single app.

You can only add accounts with access that belong to you. This means you cannot add an M2U access that is not registered in your name. In addition, each M2U access can only be actively linked to one device at a time. If you try to link your M2U access to a different device, you will be logged out of your current device.

Once linked, you will be asked to enable Secure2U for each M2U access, which can be done at the ATM. Secure2U is MAE’s security verification method that replaces SMS-based OTP, and each account has its own Secure2U facility. This ensures that only you can authorize transactions, as approval can only be done on your registered device. If you are adding multiple accounts, it is recommended that you enable Secure2U at once to save time.

As part of Maybank’s security measures, a 12-hour cooling-off period applies. This is only required when registering for the first time or when switching between devices.

According to the FAQ, you can use almost all functions of the MAE app as usual. However, you cannot carry out the following transactions:

-

• Receive group tab invitations

-

• Receive split bill requests

-

• Send or receive money requests using the Send and Request feature

To learn more, you can visit Maybank’s website. – SoyaCincau