CRFB: Harris’ cost-cutting plan would increase national debt by over $1.7 trillion

Forbes Chairman and Editor-in-Chief Steve Forbes responds to Vice President Kamala Harris’ economic plan and price control proposal in “The Bottom Line.”

An essential component Vice President Kamala HarrisAccording to a budget watchdog, the newly released economic program would add $1.7 trillion to America’s growing national debt.

The plan, dubbed a “cost-cutting agenda for American families,” was released Friday as Harris laid out her platform for her presidential campaign. It calls for expansions of the child tax credit and the earned income tax credit, as well as an extension of health insurance premium subsidies under the Affordable Care Act (also known as ObamaCare), which are set to expire at the end of next year. It also calls for creating a new $25,000 tax credit for first-time homebuyers, expanding tax credits for building affordable housing, establishing a $40 billion Housing Innovation Fund and lowering prescription drug prices through negotiations and increased transparency.

A quick analysis by the bipartisan Committee for a Responsible Federal Budget (CRFB) found that these plans Increase in federal budget deficits by $1.7 trillion over the next decade. That figure would rise to $2 trillion if the temporary housing measures proposed by the Vice President were eventually made permanent.

Harris blames corporate greed for high prices, but some economists disagree

According to the CRFB, Vice President Harris’ plan would increase the budget deficit by $1.7 trillion over the next decade. (Peter Zay/Anadolu via / Getty Images)

The think tank noted that while the fact sheet released by Harris’ campaign team “lacks certain details necessary for a comprehensive analysis of these measures, many of them are similar to proposals in the Biden-Harris administration’s recent budget.”

Based on CRFB’s analysis of Harris campaign disclosures, the cost of new tax credits and spending over fiscal years 2026 through 2035 would total about $1.95 trillion – and would rise to $2.25 trillion if the housing policy were made permanent.

This amount would be partially offset by savings of about $250 billion due to lower prescription drug costs, which would increase the deficit by $1.7 trillion over that period.

TRUMP AND HARRIS SUPPORT TIP TAX REPEAL: WHAT DO THE EXPERTS SAY?

Harris’ overhaul of the child tax credit is likely to be the most expensive part of the policy proposal she released on Friday. (Elizabeth Conley/Houston Chronicle via/Getty Images)

The most expensive Part of the plan would be an expansion of the Child Tax Credit (CTC) by making it fully refundable and increasing the basic exemption from $2,000 to $3,000 or $3,600 for children under six.

This would cost a total of $1.1 trillion compared to extending the CTC and related measures under the Tax Cuts and Jobs Act over ten years. Given the impending expiration of the CTC measures, this amount would rise to $1.8 trillion compared to current legislation.

In addition, the child tax credit for the first year of life would be increased to $6,000, costing an additional $100 billion over the next ten years.

Homebuilders tell Vice President Harris her housing plan must overcome regulatory barriers

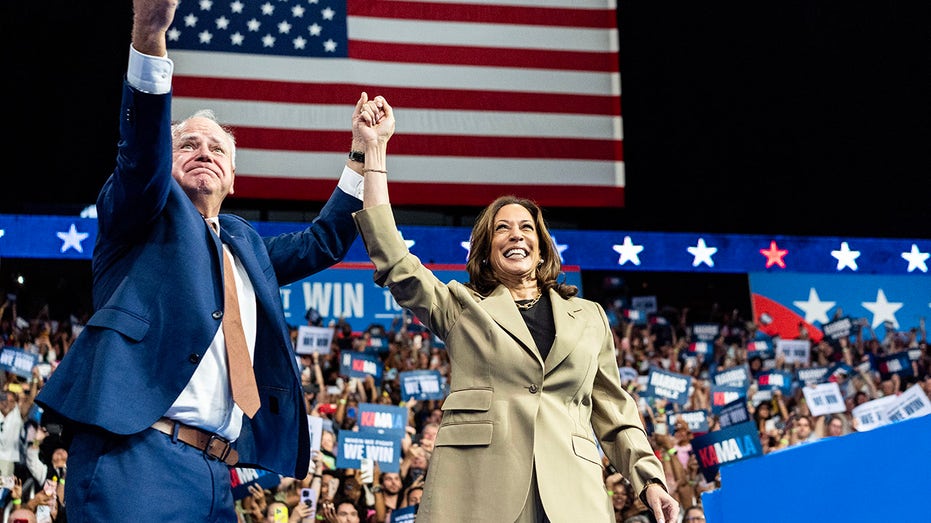

Vice President Harris and her running mate, Minnesota Governor Tim Walz, have signaled that they support the tax increases in Biden-Harris’ budget. (Melina Mara/The Washington Post via / Getty Images)

Expansion of the expansion of the Tax credit for ObamaCare premiums would cost $400 billion over the decade. Increasing the Earned Income Tax Credit for workers without children would cost $150 billion.

The $25,000 loan for first-time home buyerswhich Harris’ plan calls for a four-year plan would cost $100 billion over 10 years. Her campaign assumes four million eligible homebuyers, but CRFB believes that number could be higher and result in additional costs.

The additional affordable housing measures included in her plan would also last for four years and also cost $100 billion over 10 years. However, the CRFB notes that the costs could differ from Harris’ proposal due to details that have not yet been finalized.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

While the proposal released by her campaign did not specify how they would be funded by higher taxes Harris and her vice presidential running mate, Minnesota Governor Tim Walz, have said they want to “fulfill their commitment to fiscal responsibility, including by asking the wealthiest Americans and the largest corporations to pay their fair share – steps that will enable us to make needed investments in the middle class while reducing the deficit and strengthening our fiscal health.”

Harris’ announcement on Friday represents only part of her overall economic agenda. She has also announced that she will publish plans for education, Childcare and long-term care, among other measures.