How the Oxford Group’s multi-million dollar fraud cost investors their marriage, their health and their savings

“Seeing is believing” is a maxim that explains why belief can become conviction, but sometimes the more you look, the less you see. This aptly describes how the Oxford Group International, a conglomerate of several companies, defrauded many Nigerians of millions in 2022 under the guise of investment opportunities.

They posed as a trustworthy company with great milestones and disappeared with investors’ hard-earned money. Three years later, the refrain on investors’ lips is still: “I want my money back.”

For Joseph Ogunleye, a retired engineer from Ado-Ekiti, Ekiti State, Oxford Group seemed like the perfect organization to invest. Before investing his now-retained 2 million naira with Oxford Group, he traveled from Akure, Ondo State, his then residence, to Lagos State in October 2021 to meet with Oxford Group staff. Staff of the firm showed him schools and a petrol station owned by the company. This was enough to convince him that the 1 million naira he had previously invested was in safe hands.

On November 1, 2021, Ogunleye invested another 2 million naira in Oxford Group without waiting for his first investment to mature, expecting to receive 2,647,500 naira on November 1 of the following year, but that decision still haunts him. When the first investment of 1 million naira matured, the company paid him exactly the 1 million naira he had invested in three tranches. It was then that Ogunleye began to admit that the more you have, the less you see.

READ MORE: Accountant invested 11 million in Oxford International Group to pay his tuition fees. He lost his money and his British scholarship

“When my second investment was due, they started telling me banal stories. They called me to ask me not to present the later-dated cheque they had given me to the bank, but I refused,” Ogunleye told FIJ.

“They said they would pay me cash but I refused. I presented the cheque at the bank but it bounced. I wrote an email and called customer service but they gave me flimsy excuses. The 2 million naira means nothing to me because of the naira devaluation but they should pay me my money and stop changing their names.”

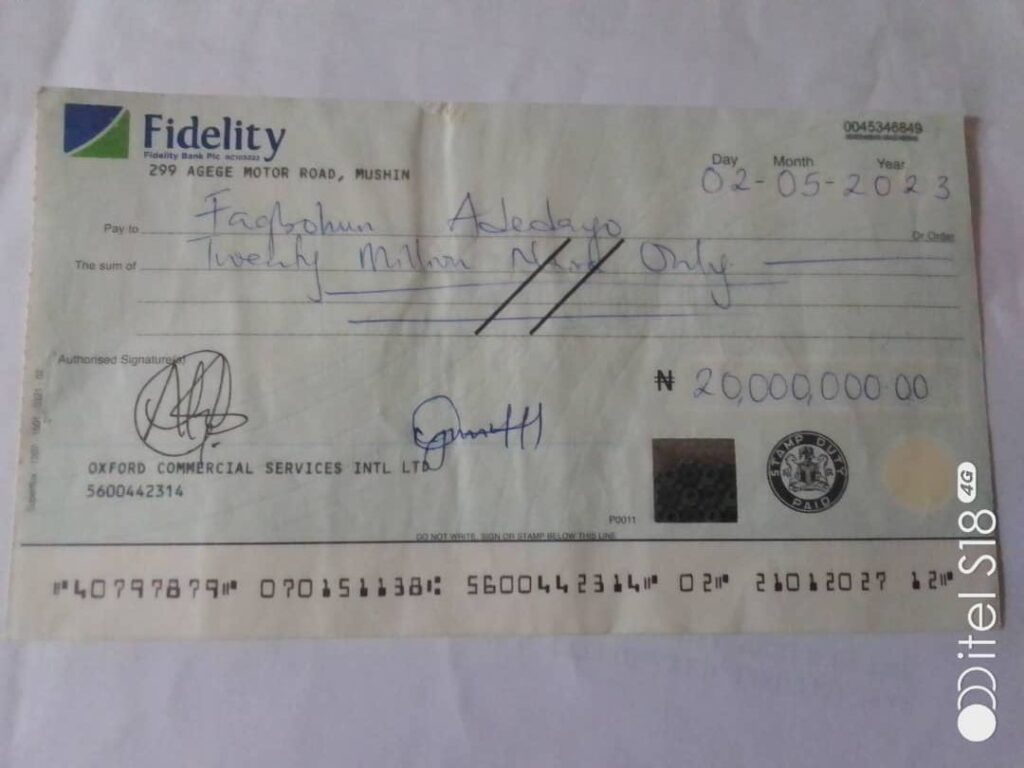

While Ogunleye can still bear the pain Oxford inflicted on him, the situation is grimmer for Adedayo Fagbohun, a retired civil servant in Ibadan. He claims his wife left him after Oxford refused to release his investment capital. Fagbohun, who describes himself as a “depressed man”, told FIJ that Oxford had taken all his savings and investments from his time as a federal government employee for 35 years.

Fagbohun said Adekoya Olugbenga, the then chief auditor of the Oxford Group, who lived in his area, introduced him to Oxford and assured him that he would receive interest on his money. He said Olugbenga made the investment process easy as he did not have to leave Ibadan. According to Fagbohun, Olugbenga gave him all the documents which he signed and then took with him to Lagos.

READ MORE: Oxford International Group fires Lagos banker after ‘stealing’ 3 million naira from her

Fagbohun, now in crisis, invested his entire assets amounting to 20 million Naira on April 29, 2022 and the company issued him a cheque with a later date of March 5, 2023. When he tried to claim his planned investment the following year, the bank informed him that the Oxford account with them was empty.

“Adekoya took me to Panti to report Oxford but they said we had to bring 500,000 naira before they could do anything on my case. I met Oxford’s Chief Security Officer in Lagos for my money but he offered me land. I told him I didn’t want land but my money. Since July 2023, they have not paid me a penny despite telling a lawyer to draw up an agreement that they would pay me 2 million naira monthly,” Fagbohun told FIJ.

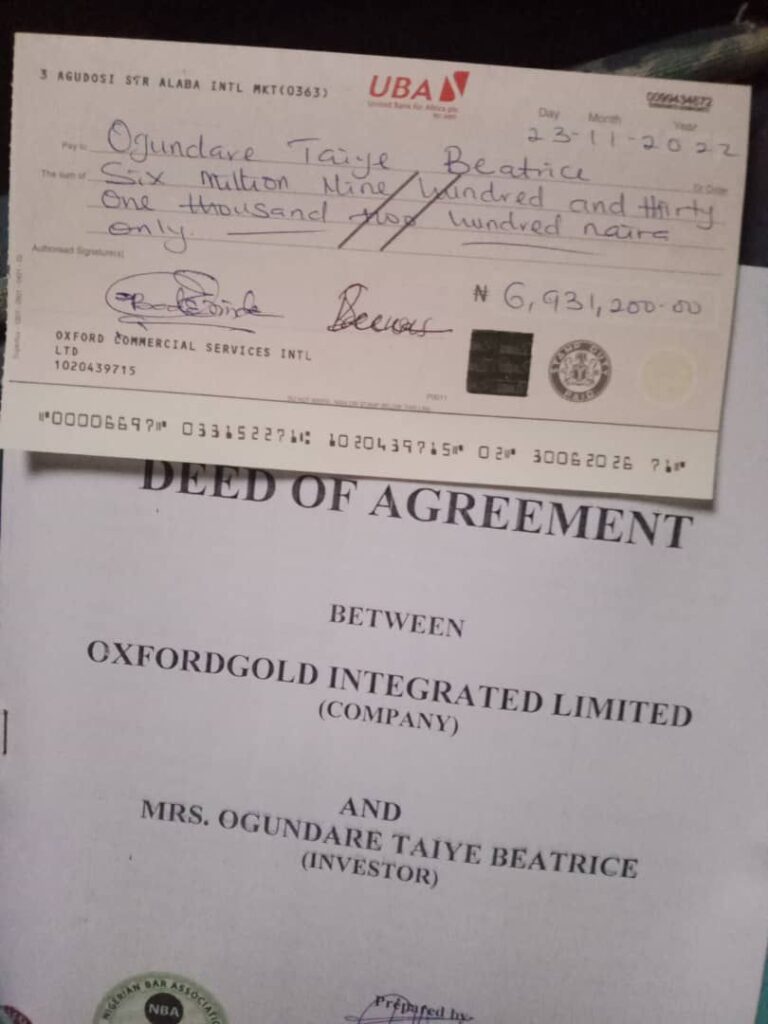

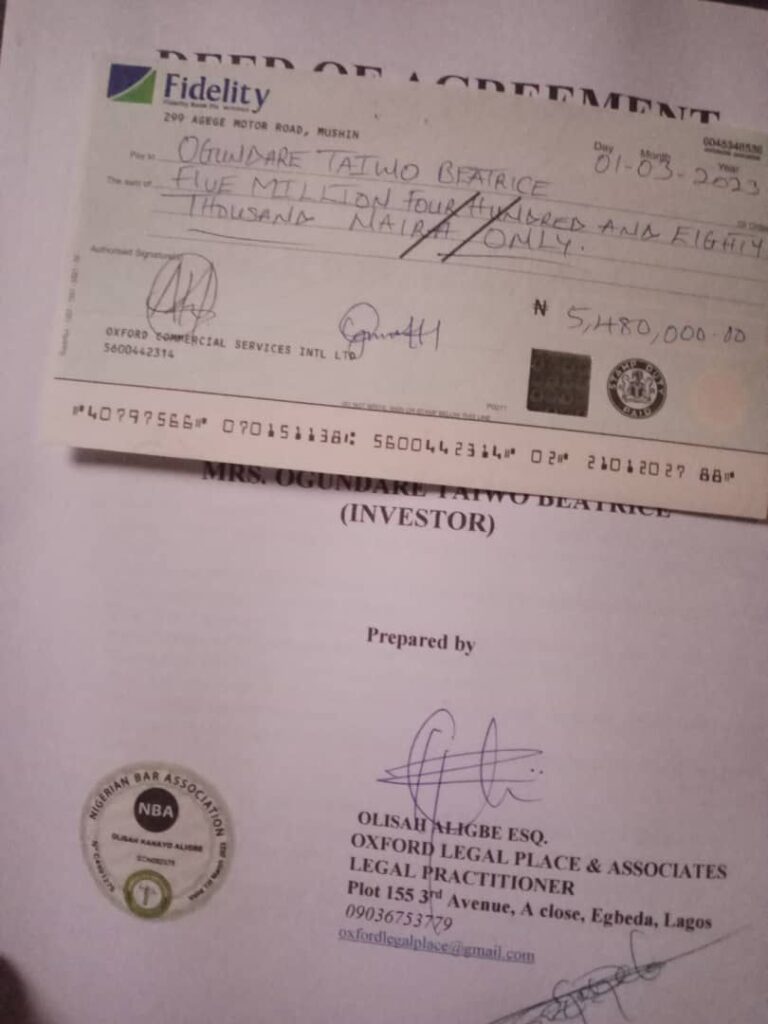

Beatrice Ogundare, an elderly woman from Abuja, has 46 million naira tied up with Oxford Group Internationals, but it is not her money that worries her, but other people’s money that she invested on their behalf. Since the Oxford Group cut ties with her, she has been cursed by several people every day.

The people she was sharing Oxford’s gospel with continued to call and threaten her. One man even reported her to her boss, and her husband almost left her.

Ogundare told FIJ that she fell for the Oxford Group’s deception in March 2021 when a man took her to Mariam Animashaun, one of its managing directors, who immediately gave her interest when she invested 200,000 naira. On the same day, she said, she invested 2.3 million naira and started spreading the gospel of Oxford Group Internationals.

READ MORE: ‘Investor’ lost money to Teniola Adesanya’s Oxford International Group, but was still arrested by police

“After that, I started giving everything I had and started evangelising people. I believed that Mariam would not mislead me as we are from the same area. I told my husband and he said we could invest there. My husband and children invested everything. My colleagues then gave me money and I invested with them,” Ogundare told FIJ.

Ogundare experienced the worst shock of her life when Oxford stalled her in April 2022 when her first investment was due.

This continued until the last investment was due in 2023. Animashaun didn’t want to tell her that Oxford had a problem with the Security Exchange Commission (SEC) until she found out for herself. But it was too late, as Animashaun stopped taking her calls.

“A mother-in-law who gave me 10 million naira needs her money so badly that I can’t think about mine. Another investor who came to them through me reported me to the Economic and Financial Crimes Commission (EFCC) but the anti-corruption agency found me to be a victim. It almost cost me my job and my marriage. I need my money back,” she said.

Like other investors, Comfort Oyedijo, a woman from Lagos, was convinced by the Oxford Group’s flashy real estate portfolio, which it flaunted to build credibility. Now she knows that all that glitters is not gold and that the investment costs 30 million naira and seven and a half plots of land that are yet to be allocated.

READ MORE: UPDATED: 8 new names in FIJ’s investment fraud list

Between 2021 and 2022, she has paid for five more plots of land but has not received any of them yet. In June 2021, she invested 5 million naira in Oxford, and by November 2021, she had invested another 30 million naira and received none of them.

“Oxford demanded 5% for documentation and 30,000 naira per plot for allocation, which I paid in full. They also promised me two and a half plots but they gave me nothing,” Oyedijo told FIJ.

“In June 2022, Oxford started stalling me when my money was due. I couldn’t even finance my son’s wedding. They struggled to give me 5 million naira out of the 35 million naira I had invested and since then they have not released my remaining 30 million naira. I estimate they owe me 88.5 million naira in today’s naira value but I want my 30 million naira back.”

When FIJ called Teniola Adesanya, chairman of the Oxford International Group, his connection was not connected. Eight days later, he had still not responded to a text message sent to his phone.

ALSO READ: Instagram hair influencer Tessy Oluchi defrauded investors of millions – and even asked them to pay more!

THE CHAIRMAN OF THE OXFORD GROUP HUNTS FOR OXFORD INVESTORS

Olamilekan Akinduro, a Lagos-based accountant whose funds are still held by the Oxford Group, joined forces with other disgruntled investors to form a group aimed at recovering their funds. Adesanya was not happy with this action. He approached the police, accusing Akinduro of inciting violence against him.

In a separate conversation with FIJ this year, Akinduro mentioned that he had been in touch with other frustrated Oxford Group investors and they were planning to find a way to get their money back.

Akinduro later informed FIJ that members of the group of aggrieved investors pooled money with which he and another investor travelled to Abuja, where they presented their case to Benjamin Kalu, the Deputy Speaker of the House of Representatives.

On August 10, the Special Investigation Unit (SIU) of the Nigeria Police Force (NPF) arrested Akinduro is said to have mobilised the Oxford International Group investors group to demand their overdue payments, but authorities claimed he formed the group to incite violence against Adesanya.