2 French fighter pilots die in collision with another fighter plane during training

PARIS (AP) — Two fighter jet pilots were killed when their Rafale fighter plane collided with another and crashed in northeastern France, according to the French military. The pilot of the other jet was able to eject and suffered minor injuries.

The two planes collided on Wednesday during a combat maneuver in the Vosges region near the town of Colombey-les-Belles, the Defense Ministry said late in the day. The pilots killed were an instructor and a trainee on a training mission, it said.

Military and judicial investigations into the causes of the accident are currently underway.

The pilot of one Rafale was found alive soon after the crash, but the gendarmes had to search the forest for several hours before they found the two pilots of the other jet.

FILE – The Dassault Rafale jet performs a demonstration flight during the Paris Air Show in Le Bourget, north of Paris, France, Monday, June 19, 2023. Two fighter jet pilots were killed when their Rafale fighter plane collided with another and crashed in northeastern France on Wednesday, Aug. 14, 2024, according to the French military. The pilot of the other jet was able to eject and suffered minor injuries. (AP Photo/Lewis Joly, File)

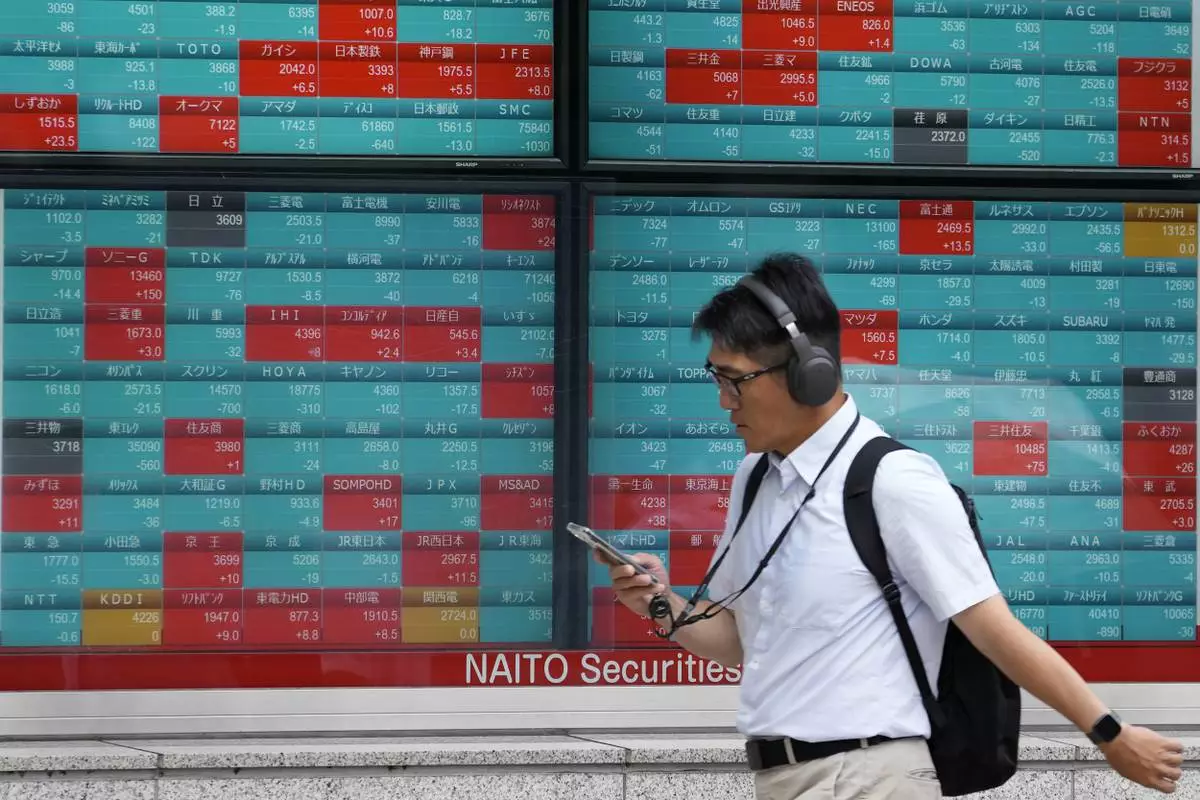

TOKYO (AP) — Global stocks mostly rose Thursday after the latest U.S. inflation report came in almost exactly as economists expected and data on the Japanese economy showed relatively healthy growth.

France’s CAC 40 rose 0.2% to 7,347.04 in early trading, while Germany’s DAX gained 0.4% to 17,962.78. Britain’s FTSE 100 rose less than 0.1% to 8,281.77. U.S. stocks are expected to continue rising, with Dow futures up 0.2% to 40,205.00. S&P 500 futures rose 0.2% to 5,485.75.

Japan’s Nikkei 225 gained 0.8% to close at 36,726.64. Australia’s S&P/ASX 200 rose 0.2% to 7,865.50. Hong Kong’s Hang Seng fluctuated throughout the day and closed little changed, losing less than 0.1% to 17,109.14, while the Shanghai Composite rose 0.9% to 2,877.36. In South Korea, trading was closed for the national holiday, Liberation Day.

Data from Japan’s Cabinet Office showed that the world’s fourth-largest economy grew 3.1 percent year-on-year in the April-June period, recovering from the previous quarter’s contraction.

The annual rate shows how much the economy would have grown or contracted if the quarterly rate had remained the same for a year.

Domestic demand grew by a strong 3.5 percent compared to the previous quarter. The reason for this was healthy private consumption and investments by the private and public sectors. Exports rose by a whopping 5.9 percent.

A major source of uncertainty, centered on currency fluctuations and interest rates, has become the political sector as Japan’s ruling Liberal Democratic Party elects a new leader after Prime Minister Fumio Kishida said he would not run for re-election. The next leader is likely to come from his party, signaling continuity in Japan’s fundamental pro-US and pro-business policies, but there is no clear successor. Some analysts believe a younger candidate would have a better chance of gaining more voter support.

The latest data for China painted a mixed picture: retail sales for July showed an upward trend, while real estate investment and manufacturing were less encouraging.

“The investment decline and weak private sector and household confidence also provide strong arguments for expanding fiscal stimulus. Many market participants would favor demand-side policy support,” said Lynn Song, chief Greater China economist at ING Economics.

According to U.S. government data, consumers paid 2.9 percent more for gasoline, food, housing and other items last month than a year earlier.

The data is likely to prompt the Federal Reserve to cut its benchmark interest rate at its next meeting in September, after keeping rates at levels that were weighing on the economy in the hope of curbing inflation.

In energy trading, US oil rose 22 cents to $77.20 per barrel. Brent oil, the international standard, rose 21 cents to $79.97 per barrel.

In foreign exchange trading, the US dollar rose from 147.22 yen to 147.38 yen. The euro cost 1.1010 dollars, up from 1.1016 dollars previously.

AP business writer Stan Choe contributed. Yuri Kageyama is on X: https://x.com/yurikageyama

FILE – A person walks under the intense sun in front of the Tokyo Stock Exchange building in Tokyo on June 24, 2024. (AP Photo/Eugene Hoshiko, File)

FILE – A person walks past an electronic stock board displaying Japanese stock prices at a securities firm in Tokyo, June 27, 2024. (AP Photo/Shuji Kajiyama, File)